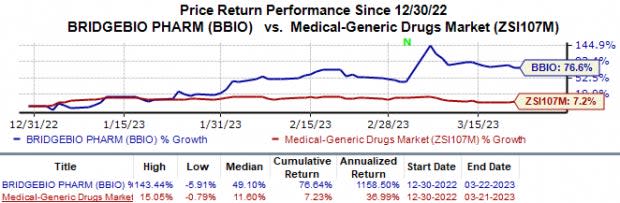

BridgeBio Pharma (BBIO) Surges 77% YTD: Here's Why

Shares of BridgeBio Pharma BBIO have risen 77.0% in the year-to-date period against the industry’s 7.2% decline.

Image Source: Zacks Investment Research

This jump in price is attributable to the recently announced positive results from cohort 5 of the phase II PROPEL2 study, which evaluated infigratinib in children with achondroplasia, the most common form of dwarfism.

Data from cohort 5 of the PROPEL2 study showed that in the highest dose level (0.25 mg/kg once daily), the mean increase from baseline in annualized height velocity (AHV) at six months was +3.03 cm/year for the first 10 children with at least six months of follow-up. In fact, 80% of the children at six months were responders, as defined by an increase from baseline AHV of at least 25%. The mean change from baseline in AHV of responders was 3.81 cm/year. As a result of treatment, the median absolute AHV reached 7.6 cm/year, which is beyond the 99th percentile of growth for children living with achondroplasia.

The remaining two children who have not yet had six months of follow-up have a mean change from baseline in AHV of +8.8 cm/year, based on three months' data.

Overall, treatment with infigratinib demonstrated clear dose-responsiveness as a single daily oral therapy and was well tolerated, with no adverse events reported in the cohort. Based on these results, BridgeBio has started to enroll children for a pivotal phase III study. In addition, management also expects to start developing infigratinib in hypochondroplasia, a skeletal dysplasia closely related to achondroplasia.

These results were a substantial improvement to rival BioMarin’s BMRN Voxzogo, which was approved by the FDA under the accelerated pathway in 2021 to treat achondroplasia in children aged five years and older. Initial six-month data from a clinical study demonstrated that treatment with BioMarin’s Voxzogo resulted in a +2.01 cm/year improvement in AHV in a similar test. At 52 weeks, the change from baseline in AHV was +1.40 cm/year for Voxzogo-treated patients compared to -0.17 cm/year for patients who were administered placebo.

Voxzogo is currently the only treatment approved for achondroplasia. The drug is also approved in Europe for use in children with achondroplasia aged two years and older. In 2022, BioMarin recorded $169 million from Voxzogo as net product revenue.

BridgeBio has two approved products in its portfolio, Nulibry (for molybdenum cofactor deficiency Type A) and Truseltiq (for bile duct cancer), which were approved in 2020. The company is yet to generate significant revenues from the sale of these products. Successful development and potential approval for infigratinib will help the drug cater to an untapped market for growth.

Currently, BridgeBio has more than 30 programs in its pipeline and multiple ongoing clinical studies. Apart from infigratinib, the company’s pipeline includes acoramidis for treating symptomatic transthyretin amyloidosis (ATTR), encaleret for autosomal dominant hypocalcemia type 1 (ADH1), BBP-418 for limb-girdle muscular dystrophy type 2i (LGMD2I) and BBP-631 for congenital adrenal hyperplasia (CAH).

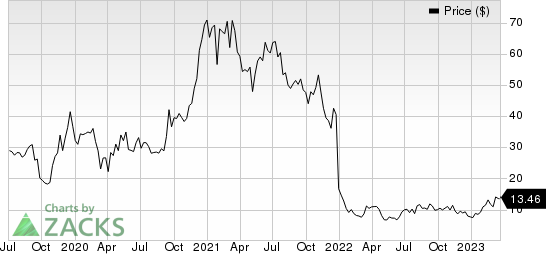

BridgeBio Pharma, Inc. Price

BridgeBio Pharma, Inc. price | BridgeBio Pharma, Inc. Quote

Zacks Rank & Stocks to Consider

BridgeBio currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Adaptive Biotechnologies Corporation ADPT and AVITA Medical RCEL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Adaptive Biotechnologies’ 2023 loss per share have narrowed from $1.20 to $1.15 in the past 30 days. During the same period, the loss per share estimates for 2024 narrowed from 99 cents to 94 cents. Shares of Adaptive Biotechnologies have risen 9.3% year-to-date.

Earnings of Adaptive Biotechnologies beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 10.75%. In the last reported quarter, ADPT delivered an earnings surprise of 24.32%.

In the past 30 days, estimates for AVITA Medical’s 2023 loss per share have narrowed from $1.26 to 99 cents. During the same period, the loss per share estimates for 2024 narrowed from 92 cents to 79 cents. In the year so far, shares of AVITA Medical have surged 104.4%.

Earnings of AVITA Medical beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 22.16%, on average. In the last reported quarter, AVITA Medical’s earnings beat estimates by 34.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

BridgeBio Pharma, Inc. (BBIO) : Free Stock Analysis Report

Avita Medical Inc. (RCEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance