Brexit vote has cost each UK household £600 a year - and we've not even left yet

UK households are each about £600 a year worse off following the Brexit vote – and we haven’t even left the EU yet.

An influential economic forecasting group says it is “almost certain” the leave vote has damaged living standards and hit the growth potential of the economy.

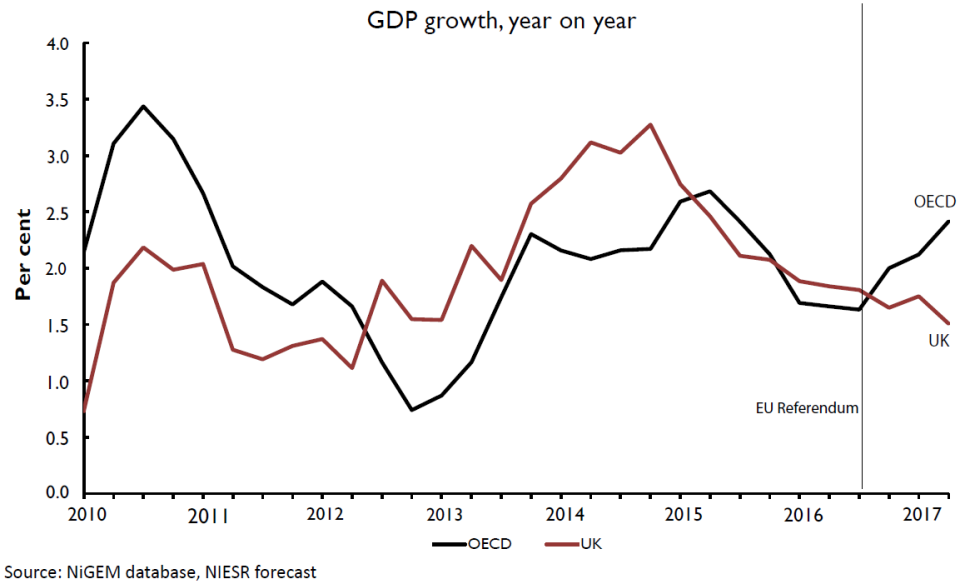

The National Institute of Economic and Social Research (NIESR) said the fall in the value of sterling since the vote in June 2016 has held back the UK economy, even as growth in the rest of the world has accelerated.

MORE: Nationwide says Brexit exodus could hit rents

Dr Garry Young, a director at the think-tank, said: “It is almost certain that the relative deterioration in the UK economy and the accompanying fall in living standards over the past year are a consequence of the vote by the British people to leave the European Union.

“Had sterling not depreciated and the economy continued to grow at its previous rate, as would have been likely with an improving global backdrop, real household disposable income per head might have been more than 2% higher than now, worth over £600 per annum to the average household.”

The NIESR revised down GDP growth to 1.6% this year, down from NIESR’s previous estimate for growth of 1.7%. In contrast, global GDP is expected to grow by 3.5% this year.

MORE: Revealed: How much the UK pays the EU per person every day

Dr Young added: “Evidence suggests that continuing uncertainty about Brexit and the possibility of an adverse change in trading arrangements in the future is bearing down on investment and productivity now.”

He also warned that there was little confidence the comparative ‘soft Brexit’ scenario outlined by prime minister Theresa May in her Florence speech in September.

The PM proposed a transition period of two years after Britain leaves the European Union in 2019 where current trading arrangements would, in effect, remain.

MORE: Banks need Brexit transition deal by end of year, warns FCA chief

But Dr Young said: “We do not have any great confidence that this will be the path to Brexit that will be followed.

“There are many possible alternatives, including the extreme possibility of a disorderly cliff-edge Brexit where the UK leaves the EU with no deal in place and no legal basis for many current activities to continue.”

Yahoo Finance

Yahoo Finance