Boston Scientific (BSX) Q4 Earnings Beat, Margins Decline

Boston Scientific Corporation BSX posted adjusted earnings per share (EPS) of 46 cents in the fourth quarter of 2019, up 17.9% from the year-ago quarter. The same also exceeded the Zacks Consensus Estimate by 4.5% as well. Moreover, the figure surpassed the company’s guided range of 42-45 cents. The adjustments take into consideration certain litigation charges related to the company’s Channel Medsystems, Inc. purchase issue among others.

Reported EPS in the fourth quarter was $2.83, substantially above the year-ago earnings of 27 cents per share.

For the full year, adjusted EPS was $1.58, reflecting a 7.5% improvement from the year-earlier period. The figure also came a penny ahead of the Zacks Consensus Estimate, reaching the upper end of the company’s guided range of $1.55-$1.58.

Revenues in the fourth quarter rose 13.4% year over year reportedly, up 14.1% on an operational basis (at constant exchange rate or CER) and up 7.3% on an organic basis (adjusted for foreign currency fluctuations and certain recent acquisitions) to $2.91 billion. However, the number missed the Zacks Consensus Estimate of $2.92 billion by a close margin.

Full-year revenues of $10.74 billion were up 9.3% year over year on a reported basis (up 11.1% on an operational basis and up 7.3% on an organic basis). Here too, revenues marginally lagged the Zacks Consensus Estimate of $10.75 billion.

Q4 Revenues in Detail

In the fourth quarter, the company achieved 13.4% growth in the United States on a reported basis (same operationally); 7.2% improvement in the Europe, Middle East and Africa region (up 9.7%); 11.3% growth in the Asia Pacific zone (up 11.5%); 0.6% rise in Latin America and Canada (up 2.9%) and 14.1% increase in the emerging markets (up 16.2%).

Segmental Analysis

Boston Scientific currently has three global reportable segments: Cardiovascular, Rhythm and Neuro plus MedSurg.

The company generates maximum revenues from Cardiovascular. Sales from its subsegments, namely Interventional Cardiology and Peripheral Interventions were $748 million (up 12.8% year over year organically) and $403 million (up 3.6%), respectively, in the fourth quarter.

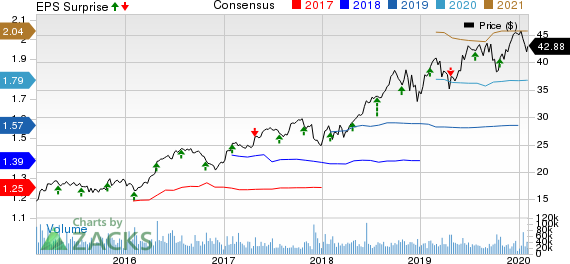

Boston Scientific Corporation Price, Consensus and EPS Surprise

Boston Scientific Corporation price-consensus-eps-surprise-chart | Boston Scientific Corporation Quote

Boston Scientific's Rhythm and Neuro business comprises Cardiac Rhythm Management (CRM), Electrophysiology and Neuromodulation. CRM reflected a 2.6% year-over-year fall in organic sales to $473 million in the reported quarter.

Electrophysiology sales inched up 3.7% year over year, organically, to $84 million. Neuromodulation sales grew 7.8% year over year on an organic basis to $261 million.

Other segments like Endoscopy plus Urology and Pelvic Health (under the MedSurg broader group) recorded sales of $499 million (up 9.6% organically) and $379 million (up 11.7%), respectively.

Margins

Gross margin in the fourth quarter contracted 83 basis points (bps) year over year to 70.7% due to a 16.7% rise in the cost of products sold.

Adjusted operating margin declined 48 bps to 21.9% in the reported quarter. Selling, general and administrative expenses increased 14.6% to $1.09 billion while research and development expenses rose 7.3% to $309 million. Meanwhile, royalty expenses of $17 million fell 5.6% year over year.

Guidance

Boston Scientific projects full-year 2020 revenue growth in the 10-12% range on a reported basis. Organically (adjusted for foreign currency fluctuations, certain recent acquisitions and divestitures), revenues are projected in the band of 6.5-8.5%. The Zacks Consensus Estimate for 2020 revenues is pegged at $12.08 billion.

The company expects its 2020 adjusted EPS in the $1.74-$1.79 bracket. The Zacks Consensus Estimate is pegged at $1.79.

The company also provided its first-quarter 2020 financial outlook. It envisions revenue growth in the range of 10-12% on a reported basis and at 5-7% on an organic basis. Adjusted EPS is anticipated within 37-40 cents. The consensus mark for EPS stands at 41 cents while the same for revenues is pegged at $2.85 billion.

Our Take

Boston Scientific delivered better-than-expected earnings for the fourth quarter. Although revenues missed the mark, organic growth across all major business lines and geographies was encouraging.

The company has been leaving no stone unturned to strengthen its core businesses and invest in the new technologies as well as the global markets. This, in turn, accounts for its sales uptick across most geographies during the quarter under review.

We are also optimistic about the company’s receipt of the FDA 510(k) clearance and the Breakthrough Device Designation as well as the CE Mark for the EXALT Model D Duodenoscope. The company already initiated its limited market release. As a major breakthrough, Boston Scientific received the Japanese Pharmaceuticals and Medical Devices Agency (PMDA) approval and a positive reimbursement in Japan for the LOTUS Edge Aortic Valve System. Further, it received an FDA approval for the INGEVITY+ active fixation pacing lead for use with pacemakers and defibrillators and a CE Mark for the POLARx Cryoablation System (indicated for treating patients with paroxysmal atrial fibrillation).

On the flip side, escalating costs and expenses are putting pressure on the company’s margins.

Zacks Rank and Stocks to Consider

Currently, Boston Scientific carries a Zacks Rank #3 (Hold). Some better-ranked stocks having already reported solid results this earning season are Stryker Corporation SYK, Accuray Incorporated ARAY and ResMed Inc. RMD.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Revenues of $4.13 billion also surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, comparing favorably with the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million trumped the Zacks Consensus Estimate by 0.3% as well. The company sports a Zacks Rank #1.

ResMed has a Zacks Rank of 2 and it reported second-quarter fiscal 2020 adjusted EPS of $1.21, topping the Zacks Consensus Estimate by 19.8%. Additionally, its revenues of $736.2 million outshined the consensus mark by 1.5%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance