BoJ keeps economic outlook despite Japan recession

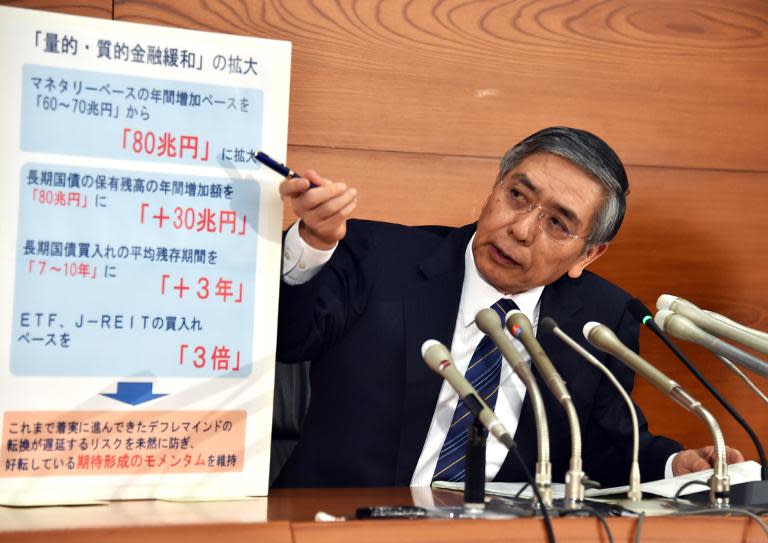

The Bank of Japan on Wednesday kept its upbeat economic view despite data showing the country had slipped into recession, which prompted Premier Shinzo Abe to delay a scheduled tax hike and call a snap election. Following a two-day meeting, the BoJ stood pat on monetary policy -- after expanding its already huge stimulus package last month -- as markets eyed governor Haruhiko Kuroda's reaction to Tokyo's announcements. But Kuroda -- Prime Minister Abe's hand picked central bank chief -- said little about the issue at a post-meeting press briefing, despite earlier calls for Tokyo to press on with tax rises aimed at generating fresh revenue to trim an enormous national debt. "I'm not going to comment on a decision made by the government," Kuroda told reporters. "But, generally speaking, it's important to maintain confidence in Japan's finances. I still expect the government will implement measures" to pay down the debt. He also dismissed suggestions that the BoJ's move to expand its vast easing plan was based on the assumption Tokyo would lift the country's taxes next year. "I never thought we should have waited more before expanding our monetary easing," Kuroda said. Tokyo's decision -- and Abe's call on Tuesday for a snap election ahead of a party leadership vote next year -- came after a sales levy hike in April slammed the brakes on growth just as the deflation-plagued economy appeared to be turning a corner. The perennially optimistic Kuroda echoed a BoJ statement earlier Wednesday which said the world's number three economy was still on track for a recovery. - Snap election, tax hike delay - Despite its bullish view, however, the central bank was more cautious on inflation expectations, saying that they "appear to be rising on the whole from a somewhat longer-term perspective". "While board members noted that some weakness on the production side remained, they upgraded their views on exports, housing investment and private consumption," said Marcel Thieliant from Capital Economics. "However, the BoJ now expects inflation to remain at current levels of 1.0 percent for the time being, rather than to pick up as in previous statements." Thieliant added that "the statement suggests additional stimulus in the near-term is not on the cards." Tsuyoshi Ueno, a senior economist at NLI Research Institute, was surprised at the bank's upbeat tone. "The growth data have been negative for two quarters in a row, which shows that the economy is in a bad state," he said. "It seems a bit strange that the central bank kept its view that Japan's economy is recovering." In forex markets, the yen weakened further with the dollar at a seven-year high of 117.38 yen after the announcement, up from 116.83 yen in New York. The BoJ's decision means it will keep trying to pump cash into the banking system at an annual pace of 80 trillion yen ($682 billion), a scheme designed to stimulate the economy. Last month, the bank surprised markets by announcing it would expand asset purchases by as much as 20 trillion yen annually to the current level, sending the yen into freefall. It also slashed its economic growth forecast by half and trimmed consumer price expectations as a much-touted 2.0 percent inflation target looked increasingly out of reach. The GDP data on Monday showed Japan's economy shrank 0.4 percent, or at an annualised rate of 1.6 percent, in the July-September quarter, dealing a huge blow to Abe's bid to turn around years of tepid growth, dubbed Abenomics. The reading was well below market expectations for a 0.5 percent expansion, and comes after Japan suffered a 1.9 percent contraction in the April-June quarter -- or 7.3 percent at an annualised rate -- as consumers and firms capped their spending.

Yahoo Finance

Yahoo Finance