Investor Central

Investor CentralBlumont Group Ltd - Does it already have indirect control over Merlin Diamonds Ltd?

28/3/2014 – Blumont Group Ltd is offering to take over ASX-listed Merlin Diamonds Ltd for S$60.9 mln.

Blumont's proposal comes a year after SGX-listed Innopac Holdings Ltd announced a controversial takeover of Merlin Diamonds for S$76 mln.

At that time, Merlin Diamonds Ltd was controlled by Mr Joseph Gutnick who swapped sides during Innopac's takeover offer.

However, Innopac didn't succeed as it couldn't get acceptances of at least 90% shareholders of Merlin Diamonds.

But Joseph Gutnick is still the single largest shareholder of Innopac Holdings Ltd with a 10.37% stake (source:Reuters Knowledge).

According to its February 28 announcement, Blumont Group is offering 5.7 new shares for every 2 shares held in Merlin Diamonds Ltd.

For the takeover to succeed, Blumont Group Ltd has announced a much lower threshold of acceptances from 50.1% shareholders of Merlin Diamonds.

And those who followed our coverage of Innopac Holdings Ltd's takeover of Merlin Diamonds last year would know that Blumont Group won't struggle to achieve acceptances from 50.1% shareholders of Merlin Diamonds.

That's because the controlling shareholders of Merlin Diamonds are already related to Blumont Group.

Investor Central. Asian insights for global investors. We ask the tough questions of Asian companies which global investors need answers to.

1. Does it already have indirect control over Merlin Diamonds Ltd?

According to Reuters Knowledge, and based on a total of 225,480,396 shares on February 27, the biggest shareholders of Merlin Diamonds are:

Newton Centre Development Ltd (a 10.64% stake), Gary Tan Boon Kiat (9.76%), Lim Kuan Yew (9.58%), Blumont Group (5.91%), Goh Hin Calm (5.77%), Edwin Sugiarto (4%), Vernon Khoo Tiam Hock (4%) and ISR Investments Ltd (1.5%).

Together, that adds up to a 51.16% stake in Merlin Diamonds Ltd.

Having witnessed the rise and fall of the network of closely related SGX-listed companies, it wouldn't be a surprise to know that the leading shareholders of Merlin Diamonds are already related/connected to Blumont Group.

Lee Chai Huat is a director and controlling shareholder of Merlin Diamonds' largest shareholder Newton Centre Development Ltd.

Here is a map of the relationship between Blumont Group and Lee Chai Huat who is indirectly the largest shareholder of Merlin Diamonds Ltd:

Gary Tan Boon Kiat - the second largest shareholder of Merlin Diamonds - is also a shareholder of Blumont Group Ltd (map).

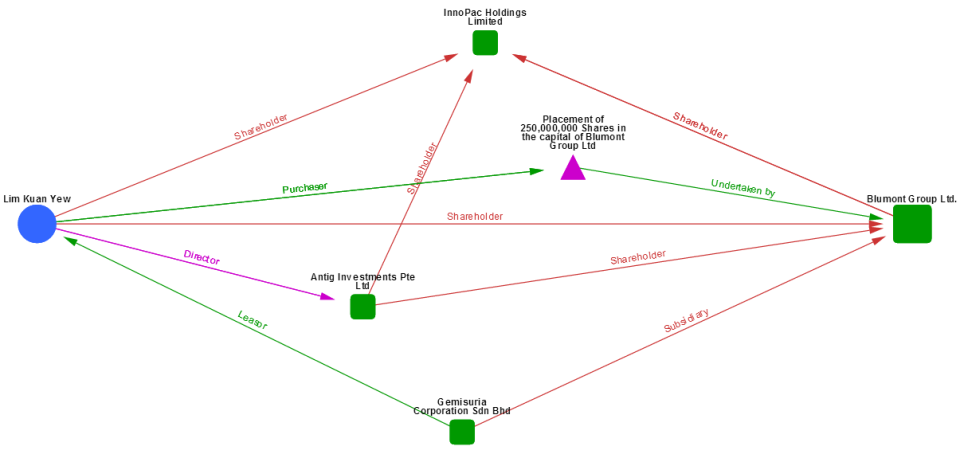

The following map reveals the relationship of Lim Kuan Yew - the third largest shareholder of Merlin Diamonds - and Blumont Group:

Goh Hin Calm - a 5.77% shareholder of Merlin Diamonds - is also closely related to Blumont Group, as shown in this map:

Edwin Sugiarto - a 4% shareholder of Merlin Diamonds - is also a shareholder of Blumont Group (map).

Vernon Khoo Tiam Hock - a 4% shareholder of Merlin Diamonds - is a shareholder of Kuantan Floor Mills Bhd which is controlled by Blumont Group's Executive Chairman Neo Kim Hock (map 1, map 2).

ISR Investments Ltd - a 1.5% shareholder of Merlin Diamonds - counts Blumont Group's Executive Chairman Neo Kim Hock as its director (source).

Finally, Blumont Group acquired a 5.91% stake in Merlin Diamonds on February 17.

That's shortly before it announced a takeover offer on February 28.

Therefore, with at least 51.16% shares of Merlin Diamonds under its direct and indirect control, Blumont Group is in a comfortable position to successfully complete the takeover.

But so far, we haven’t been able to find any disclosure by Blumont Group about its indirect control over Merlin Diamonds Ltd.

2. Is Blumont Group coming to the rescue of investors stuck with Merlin Diamonds' shares?

Newton Centre Development Ltd, Gary Tan Boon Kiat, Lim Kuan Yew, Goh Hin Calm, Edwin Sugiarto, Vernon Khoo Tiam Hock and ISR Investments Ltd bought shares of Merlin Diamonds around the same time as Innopac Holdings Ltd announced its takeover offer early last year.

Months after the failed takeover of Merlin Diamonds by Innopac Holdings, it still remains a mystery why a group of closely-related persons/entities jointly bought a controlling stake in Merlin Diamonds.

Perhaps they have been caught on the wrong side of the trade as Innopac failed to complete the takeover.

But with Blumont Group's attractive takeover offer which values Merlin Diamonds at 15.18 Australian cents per share compared with the then market price of 8.7 cents, all those who were stuck at higher levels can recover at least part of their investments at A$0.20 to A$0.22 per share (Legend International Ltd sold a 37% stake in Merlin Diamonds for A$12.5 mln).

Since the announcement on February 28, Merlin Diamonds' share price has already rallied about 50%.

Therefore that gives them an opportunity to sell their shares in Merlin Diamonds at an even higher price.

Otherwise, in the takeover offer, they can convert their shares in Merlin Diamonds into new shares of Blumont Group and sell it on the SGX.

Blumont Group has proposed to acquire Merlin Diamonds for 3.5 times its net tangible value.

(Total number of questions in the full story: 8)

We have sent these questions to the company (info@blumontgroup.com) its IR agency (karenting@august.com.sg, wrisney@august.com.sg) and Mr Gutnick's office to invite them for an on-camera interview, and/or seek their written response.

So far, we have not had a reply (which is why you are seeing this message).

While our purpose is to ask the questions which the man on the street would ask, and to help the everyday investor make informed investments, please note that:

Our articles and presentations ('our contents') are not investment advice nor should they be construed as investment advice or any recommendation of any kind; nor meant to cast allegations or insinuations of any kind against any individuals or entities. Before acting on the material in our contents, you should either seek independent advice tailored to your particular circumstances and intentions or rely on your own judgement.

Our articles and presentations express our observations, opinions and theoretical analysis based on the facts that we have gathered or have been provided to us. While we endeavour to ensure that our contents are accurate and are presented in good faith, we cannot and do not warrant the accuracy, adequacy or completeness of the material or that the material is suitable for its intended use; and we disclaim any such warranties express or implied that may be presumed by any party; neither do we take responsibility for the views of companies or other stakeholders or observers or sources quoted or hyperlinked in our contents. While every precaution has been taken in the preparation of our contents, we (and our principals) shall not be liable for any losses or damage or inconveniences due allegedly to errors or omissions in any facts or due allegedly to reliance on our contents in any way whatsoever; nor for any damage to any computer hardware, date information or materials allegedly caused by our contents.

All expressions of opinion and observations in our contents are subject to change without notice and we do not undertake a duty to update and supplement our contents or the information contained herein in the event we obtain any further or more complete information.

©2014 Investor Central® - a service of Hong Bao Media

Yahoo Finance

Yahoo Finance