Block Out the Noise and Buy These Stocks Now to Hold for the Long Haul

Tesla’s report finally helped shake the stock market awake a bit on Thursday. Still, despite the EV giant’s 10% drop, the Nasdaq only fell by around 0.8% and the benchmark slipped 0.6% on low volumes, with buyers stepping in later in the session.

The tech-heavy Nasdaq has moved about sideways since the end of January, with the S&P 500 up slightly. Both the Nasdaq and the S&P 500 remain solidly above their 50-day moving average and well above their 200-days as Wall Street waits for Microsoft, Amazon, Apple, and countless other market movers, and possibly the next few inflation readings, before it’s ready to make a bigger move in either direction.

Many are worried a significant drawdown is in order even if the big tech names provide solid reports given some increasingly bloated valuations. And the overall lackluster response to the start of first quarter earnings season could also signal that Wall Street is far more concerned about the Fed’s moves in the coming months than it is about earnings—unless they are brutal or stellar.

Some market participants are getting nervous about how calm things appear that moment. The VIX did spike back higher Thursday, but it remains very near its fresh 52-week lows. All of this might have some investors staying on the sidelines. But remaining exposed to the market is one of the best strategies for long-term investors.

Today, we dig into a few stocks that have crushed the market over the past 20 years that are sitting at appealing valuation levels. Both companies also operate businesses that should grow over the long haul.

Analog Devices, Inc. (ADI)

Analog Devices is on a mission to challenge Texas Instruments and others for supremacy in the analog semiconductor space. These types of chips aren’t as flashy as some of their peers, but analog chips continue to play vital roles in countless devices that other chips cannot handle. ADI will keep growing for years as its offerings help push forward automation, electrification, EVs, data centers, advanced connectivity, and beyond.

ADI, which has been around for over 50 years, boasts around 125K customers around the world. ADI topped our Q1 FY23 estimates in mid-February and provided upbeat guidance despite a slowing economy and chip industry headwinds. Analog Devices is coming off two massive years of big double-digit sales and EPS expansion, including 64% sales growth in FY22. Despite the difficult-to-compete-against stretch, ADI is projected to post solid growth in FY23 and FY24.

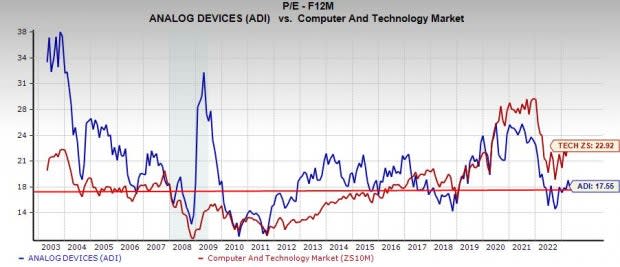

Image Source: Zacks Investment Research

ADI’s positive EPS revisions help it grab a Zacks Rank #2 (Buy) right now and it has topped our quarterly estimates for over three years running. Analog Devices has a strong balance sheet that’s helped boost its dividend payment by 12% annualized over the last five years.

ADI has easily topped the Zacks Tech sector over the last decade, up 335% vs. 211%, including a 19% climb in the trailing 12 months to blow away Tech’s -6% drop and the Zacks Semi market’s 10% pop to help it hit fresh highs along the way. ADI is also up 465% in the past 20 years vs. the benchmark's 350%.

Image Source: Zacks Investment Research

Analog Devices still trades 15% below its average Zacks price target. On top of all that, ADI trades at a 23% discount to the Tech sector and 50% below its own 20-year highs at 17.5X forward 12-month earnings. ADI is trading at a roughly 10% discount to its own 10-year median and around its Covid selloff lows.

Public Storage (PSA)

Public Storage is one of the largest owners, operators, and developers of self-storage facilities, with nearly 3,000 facilities in the U.S. and almost two million customers. PSA is a REIT and its business has been gaining serious momentum for years as Americans continue to buy more and more stuff, big and small.

Image Source: Zacks Investment Research

Public Storage grew its revenue at a steadily impressive pace over the last 20-plus years, including 22% sales growth in 2022 (+15% comps) and 17% in 2021. Zacks estimates call for PSA to post another 8% revenue growth in FY23 and 6% in FY24 to boost its adjusted FFO (which are essentially earnings for REITs) by 6% during both years. PSA’s bottom-line revisions have stagnated recently to help it grab a Zacks Rank #3 (Hold).

PSA is trying to make a big splash in the self-storage space and expand its reach in a market mostly controlled by local and regional players by making an unsolicited offer to buy Life Storage, Inc. (LSI) in an all-stock deal. LSI has rejected the deal, but investors should pay attention to possible updates when Public Storage reports on May 3. PSA also flexed its financial firepower when it lifted its dividend by 50% back in February to help it yield 4.2% at the moment.

Image Source: Zacks Investment Research

PSA shares have surged 800% over the last 20 years to crush the Zacks Real Estate market and the S&P 500’s 350%. Public Storage shares are closer to neck-and-neck with the benchmark over the past five years, with PSA still down around 30% from its April 2022 peaks.

The downturn, coupled with its solid earnings outlook, has PSA trading 20% below its 10-year median and 40% off its highs at 16.9X forward 12-month earnings. Some investors might want to wait for PSA to report or wait for it to rebound above some key moving averages. But the best time to buy a strong stock is often when it seems no one else does.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance