Blizzard warning — What you need to know in markets on Tuesday

It’s going to snow on Tuesday.

As of 5:00 p.m. ET, the National Weather Service was forecasting 12-24 inches of snow in New York City and had issued a blizzard warning for most of the region stretching from just north of Philadelphia through southeastern Maine.

As a result of the storm, markets should be a bit quieter on Tuesday.

There will be some economic data out, with the headline report from the National Federation of Independent Business, which will release its small business optimism index in the morning. This report has been among the most consistently bullish since Donald Trump’s election as the president’s focus on cutting regulation has been seen as an immediate and positive development from smaller business owners.

Elsewhere in economic data, the February reading on import prices is also due out in the morning.

On Monday, markets were little-changed as investors await the latest policy announcement from the Federal Reserve — due out on Wednesday afternoon — though market pricing has, for almost two weeks now, been indicating a 0.25% rate hike is all but a formality.

As Neil Dutta, an economist at Renaissance Macro, said in a note on Monday, “The FOMC meeting already happened.”

Trumpcare, scored

On Monday, the nonpartisan Congressional Budget Office released its report on the American Health Care Act, the Obamacare repeal bill proposed by House Republicans.

The headline numbers are, of course, going to get most of the play.

Twenty-four million more Americans — a projected 52 million vs. 28 million — will be uninsured by 2026 than had been forecast under Obamacare. In the next two years, premiums are expected to rise 15%-20%. In 2020, these will begin falling.

Additionally, the deficit would be decreased by $337 billion over the next ten years, which as my colleague Ethan Wolff-Mann points out would come largely from cutting Medicaid and subsidies for those buying insurance on the individual market.

The spin on this is likely to be three-fold — opponents won’t like uninsured numbers rising, proponents will like the deficit falling, and those in the middle will note this bill is just the first in a series of changes that will be needed.

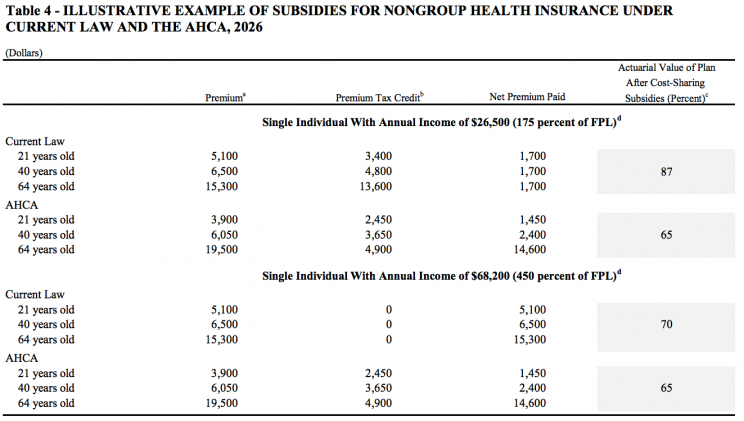

And that final point is made clear in a table near the bottom of the CBO’s report. This table shows that in 2026, 62-year-old Americans with an annual individual income of $26,500 would face healthcare premiums totaling $14,600 per year. Certainly, this is not feasible.

How this bill proceeds through Congress remains to be seen, though the prospects appear dim.

In initial comments following the CBO’s report, Health and Human Services Secretary Tom Price said Monday following the CBO report’s release that the administration disagrees “strenuously” with the report. House Speaker Paul Ryan (R-WI) said Monday, “This report confirms that the American Health Care Act will lower premiums and improve access to quality, affordable care.”

But the initial discord among lawmakers following the CBO’s report belies the real trouble that a flubbed healthcare package presents for Republicans.

As Max Nisen, a columnist at Bloomberg Gadly, noted on Twitter on Monday, an underrated part of this report is that for the next two years, premiums will still increase. Higher costs, along with underserved insurance exchanges, are often fingered as the reasons that Republicans insist Obamacare is “collapsing under its own weight.”

Speaker Ryan’s statement on Monday added that the bill scored by the CBO on Monday is the first of a “three-pronged approach” to addressing healthcare and stressed a focus on thinking long-term about reforming healthcare in the U.S. This is a process, and potentially a long and slow one.

Over the last few years, business leaders have increased calls for a focus on “long term” thinking over “short-termism.” It’s unclear how well this message has been received.

This is, however, exactly the kind of message that Ryan and others are trying not only to get across to colleagues in the Senate and the President himself, but voters. And while the seemingly interminable 2016 election cycle ended just over four months ago, in a year we’ll be talking about midterms.

And at least as the CBO sees it, voters will still be facing higher costs.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance