Blackstone (BX) Q4 Earnings Beat Estimates, Stock Up 1.8%

Blackstone’s BX fourth-quarter 2019 distributable earnings of 72 cents per share surpassed the Zacks Consensus Estimate of 68 cents. Moreover, the figure reflects an increase of 26.3% from the prior-year quarter.

Shares of Blackstone gained 1.8% in pre-market trading, indicating that investors have taken the results in their stride. However, the full day’s trading will depict a better picture of the actual price performance.

Results benefited from growth in revenues and assets under management (AUM). However, higher expenses hurt results to some extent.

Net income attributable to Blackstone was $483.1 million against net loss of $10.9 million recorded in the year-ago quarter.

For 2019, distributable earnings of $2.31 per share surpassed the Zacks Consensus Estimate of $2.26. Moreover, the figure reflects rise of 6.5% from the prior year. Net income attributable to Blackstone was $2.05 billion, up from $1.54 billion a year ago.

Revenues & AUM Improve, Expenses Rise

Total segment revenues for the reported quarter were $1.79 billion, up 30.5% year over year. The top line surpassed the Zacks Consensus Estimate of $1.60 billion. Total revenues (GAAP basis) increased significantly year over year to $2.09 billion.

Total segment revenues for 2019 were $5.58 billion, up 7.2% year over year. The top line surpassed the Zacks Consensus Estimate of $5.37 billion.

Total quarterly expenses (GAAP basis) increased significantly year over year to $1.11 billion due to a rise in all expense components.

Fee-earning AUM grew 19.1% year over year to $408.07 billion. Total AUM amounted to $571.12 billion as of Dec 31, 2019, up 20.9% year over year. The rise in total AUM was largely driven by $26 billion of inflows.

As of Dec 31, 2019, Blackstone had $5.3 billion in total cash, cash equivalents and corporate treasury investments, and $11.5 billion in cash and net investments.

Share Repurchase Update

The company repurchased 1.5 million shares in the reported quarter.

Our Viewpoint

Blackstone delivered a solid performance in the fourth quarter. Growth in AUM, driven by inflows, is expected to aid its top line in the near term. Moreover, the company is well-positioned to capitalize on the changing investment landscape by making long-term investments and augmenting fund-raising abilities. However, lower chances of sustainability of its capital-deployment activities remain a major near-term concern.

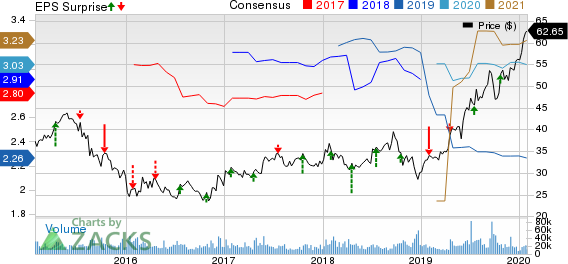

Blackstone Group Inc/The Price, Consensus and EPS Surprise

Blackstone Group Inc/The price-consensus-eps-surprise-chart | Blackstone Group Inc/The Quote

Currently, Blackstone carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Release Date of Other Investment Managers

BlackRock, Inc.’s BLK fourth-quarter 2019 adjusted earnings of $8.34 per share surpassed the Zacks Consensus Estimate of $7.67. Moreover, the figure was 37.2% higher than the year-ago quarter’s number.

Cohen & Steers’ CNS fourth-quarter 2019 adjusted earnings of 74 cents per share surpassed the Zacks Consensus Estimate of 67 cents. Also, the bottom line was 32.1% higher than the year-ago quarter figure.

Affiliated Managers Group, Inc. AMG is slated to announce results on Feb 3.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Blackstone Group Inc/The (BX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance