Bitcoin-Tether Pair Is Most Liquid on Binance Even as TUSD Pair Sees Higher Volume

Join the most important conversation in crypto and web3! Secure your seat today

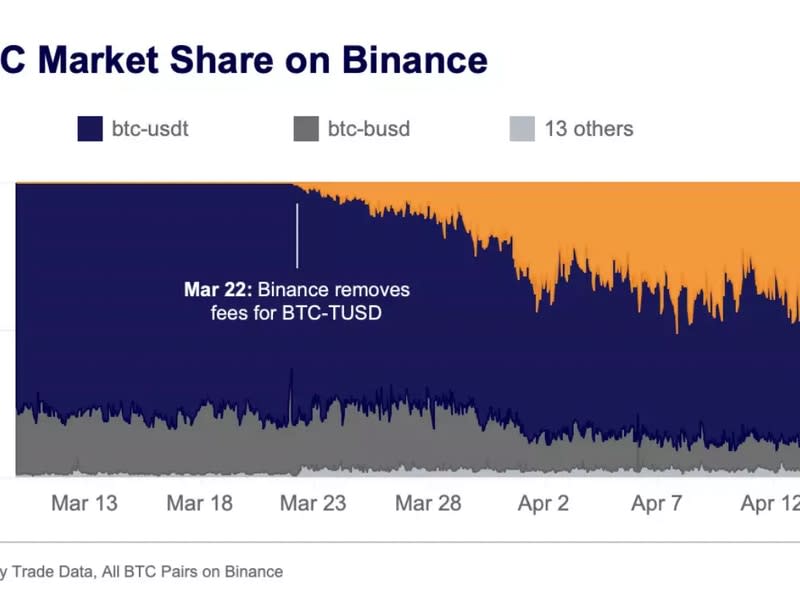

Trading volume on Binance of bitcoin (BTC) denominated in ArchBlock's dollar-pegged stablecoin trueUSD (TUSD) has surged over the past four weeks after the crypto exchange introduced zero trading fees in the pair on March 23 while simultaneously reintroducing fees for all other pairs.

Still, the trade denominated in tether (USDT), the largest dollar-pegged stablecoin by market value, remains the most liquid, allowing large orders to execute with relatively less impact on the cryptocurrency's price than the TUSD trade.

"Market depth data on Binance shows us that BTC-USDT is still king from a liquidity standpoint, with market makers evidently more comfortable with exposure to Tether over TUSD," Conor Ryder, a research analyst at Paris-based crypto data provider Kaiko, said in a market update last week.

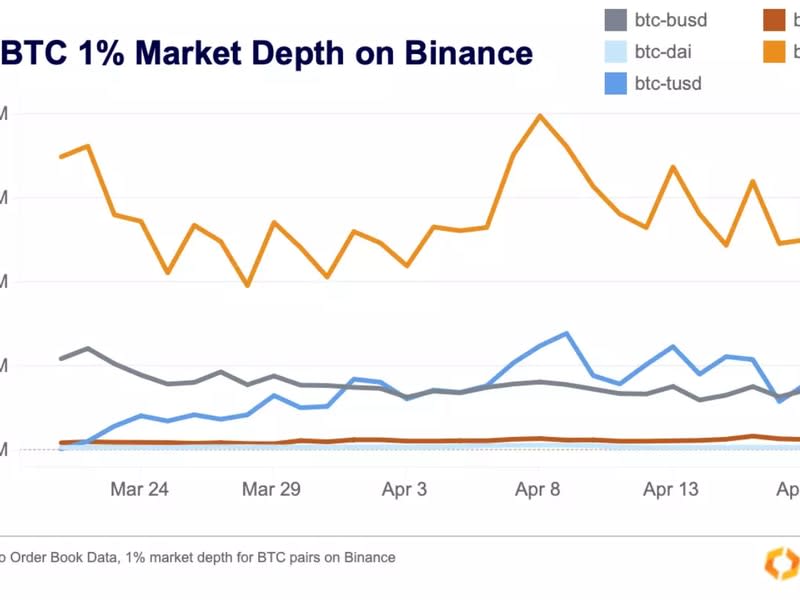

Liquidity conditions are commonly assessed with the help of a metric called market depth – a collection of buy and sell offers within 1% or 2% of the mid-price or the average of the bid and the ask/offer prices.

The more significant the depth, the more liquid an asset is said to be and the less the slippage. Slippage is the difference between the expected price at which a trade is placed and the actual price at which the transaction is executed. Slippage usually occurs when there is low market liquidity or high volatility.

The chart shows liquidity in BTC/USDT was $30 million at the 1% depth last week or 200% greater than $10 million in BTC/TUSD. In other words, traders might be better off executing large orders in the BTC/USDT pairs than the BTC/TUSD pair.

TUSD's market depth has improved sharply from practically zero to $10 million in a month, surpassing BUSD to become the second-most liquid pair on Binance.

The BTC-TUSD pair accounted for 50% of the total bitcoin market volume on Binance last week.

"For as long as zero-fee trading lasts on BTC-TUSD, TUSD needs to be considered a top stablecoin in crypto, whether people like it or not. Similar to how Binance favored BUSD, TUSD is the benefactor of increased volumes now, even if the reasons why Binance granted TUSD this gift are unclear," Ryder said.

Yahoo Finance

Yahoo Finance