Bitcoin Spurs 5th Consecutive Week of Outflows at Crypto Investment Funds: CoinShares

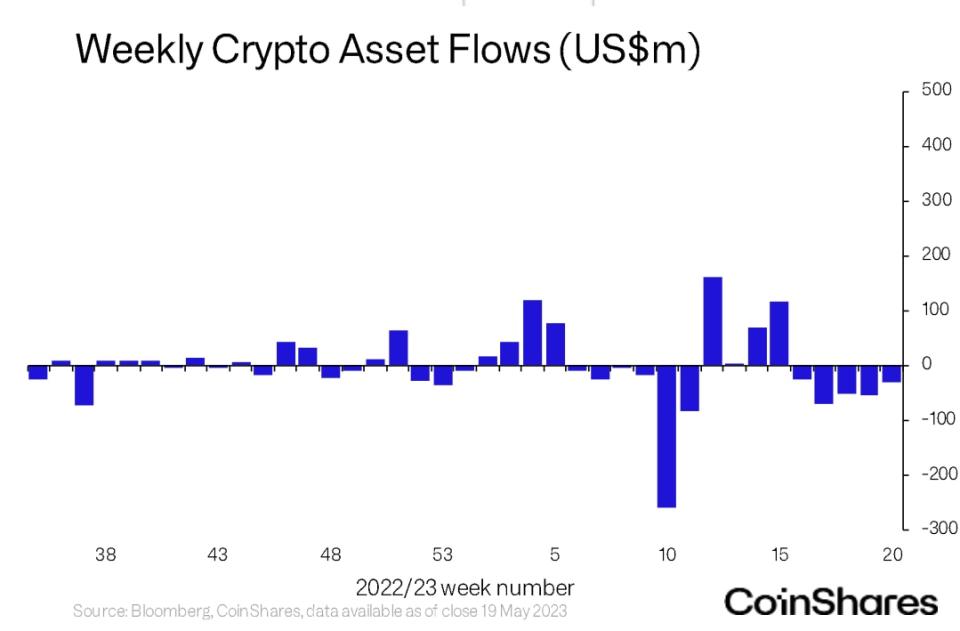

Digital asset investment products have witnessed outflows for the fifth consecutive week as bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, has traded down in May.

Outflows last week came to $32 million, pushing the total during the streak to $232 million, according to a report from CoinShares. Investors withdrew $33 million from bitcoin products alone last week, meaning BTC funds yet again dominated the outflow – as they have throughout the five-week period.

Bitcoin has soared this year, surpassing $30,000 in April for the first time since mid-2022. But it’s struggled since then and now trades below $27,000.

“It is unclear why there is such coordinated negative sentiment for both long and short investment products,” CoinShares said, noting that even products that short BTC saw an outflow of $1.3 million last week.

Altcoins bucked the trend and witnessed inflows, with the exception of ether (ETH) which saw $1 million of outflows. Avalanche (AVAX) and litecoin (LTC) saw inflows of $0.7 million and $0.3 million last week.

Yahoo Finance

Yahoo Finance