Bitcoin Sees Red as the Bears Fight Back

Bitcoin rose by 5.09% on Tuesday, following Monday’s 3.71% rise, to end the day at $7,411.59.

The gains were not as significant as elsewhere, with some of the majors making double digit moves on the day, but closing out at $7,000 levels for a 2nd consecutive day was key for the Bitcoin bulls at the start of the quarter.

An intraday high $7,506.84 broke through the first major resistance level of $7,197.1 and 2nd resistance Level of $7,325.07, supporting a move through to the day’s 38.2% FIB Retracement Level of $7,481.8, affirming a short-term reversal of Bitcoin’s bearish trend at Sunday’s swing lo $6,427.16.

Adding to the view that Bitcoin bottomed out at Sunday’s swing lo $6,427.16, was Bitcoin managing to avoid testing the day’s first major support level of $6,860.56, with Bitcoin finding plenty of support at the $7,000 psychological level, with a day’s low $7,001.29.

While there was no material news to shift sentiment through the first part of the week, regulators and governments busy rolling out new crypto regulations, the general view that new regs will likely be more focused on KYC and AML policies, together with anti-fraud regulations for initial coin offerings, eased concerns of certain key jurisdictions possibly looking to ban cryptocurrency trading altogether.

Get Into Cryptocurrency Trading Today

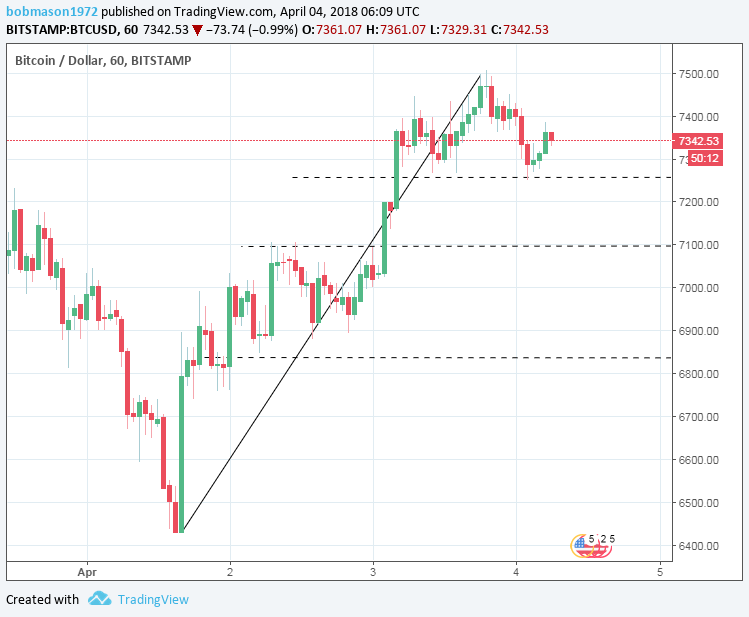

At the time of writing, Bitcoin was down 0.99% to $7,342.53, as investors locked in profits in the early hours of the morning, pulling Bitcoin down to a morning low $7,251 to test buyer appetite at the day’s 23.6% FIB Retracement Level of $7,252.

Following the bearish trend reversal at Sunday’s swing lo $6,427.17, Bitcoin managed to avoid testing the day’s first major support level of $7,106.3, the morning’s trend reflecting a more positive sentiment across the cryptomarket at the start of the 2nd quarter.

For the day ahead, a move through to the morning’s $7,430 high would support a run at the day’s first major resistance level of $7,612, a move through the first major resistance level considered to be a key move this week to further reaffirm the short-term bullish trend formed on Sunday.

Failure to break back through to $7,600 levels would likely test investor sentiment in the late afternoon that could lead to a more significant pullback to the day’s first major support level and possibly test support at $7,000.

In spite of the early, losses, the support at the day’s 23.6% FIB Retracement Level suggests a recovery in the 2nd half of the day, though the news wires will need to remain silent.

Looking across at the Cboe Bitcoin Futures, the April contract was down $125 to $7,360, providing little direction for Bitcoin investors, with early slides across the broader market having eased by the late morning, NEO the worst performer this morning, down 3.46%, closely followed by NEM’s XEM, down 3.43%.

Buy & Sell Cryptocurrency Instantly

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance