Bitcoin drops sharply after record high rally

Bitcoin (BTC-USD), the world’s largest cryptoasset, fell as much as 13% on Thursday after surging for the past few months.

Markets analysts say fears over tighter regulation and profit-taking following a strong rally are the main drivers for the fall on Thursday.

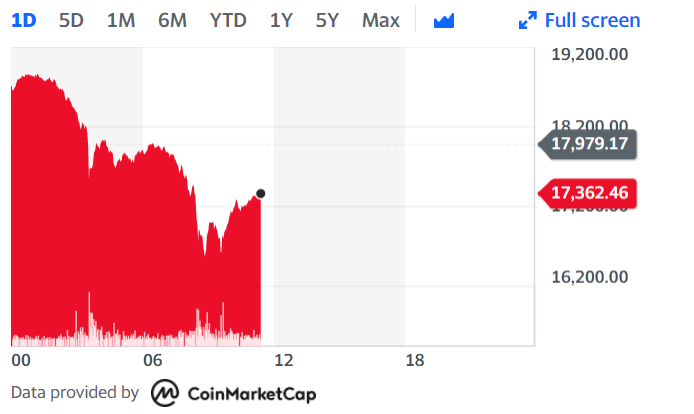

Bitcoin was trading lower 3.4% at around 11.30am in London, sitting at approximately $17,360 (£13,017).

The currency could be heading towards its worst day since the COVID-19 pandemic spread globally in March.

Bitcoin had hit a new all-time high of just over $19,500 on Wednesday, coming close to exceeding its 2017 peak of almost $20,000.

“With many US investors likely to be off on Friday as well [following Thursday’s Thanksgiving holiday], the slight weakness in stocks and the plunge in Bitcoin can, at least partially, be attributed to profit-taking,” said Fawad Razaqzada, market analyst at ThinkMarkets.com.

“This is especially the case for Bitcoin as the crypto neared its previous all-time high of just under $20K. Clearly some holders from 2017 probably saw this as the perfect opportunity to take profit, while others also feared that the current economic situation does not justify Bitcoin breaking past $20K, even if the long term outlook continues to remain bullish because of mainstream acceptance and limited supply. A correction was therefore almost inevitable and is probably not a bad thing for the health of the long-term rally.”

READ MORE: Muted gains in Europe extend global market rally

Just less than a week ago, market analysts said the price of Bitcoin was being supported by its image as a safe haven asset and recent institutional backing from the likes of Square and PayPal.

Cryptocurrencies remain among the best-performing assets in 2020 and could continue rising. This is despite the US government’s rumored plans to track down the owners of the self-hosted cryptocurrency and introduce data collection requirements.

“We believe that the current [drop] is the opportunity for those investors who have missed the rally or for those who want to add more into their position,” said Naeem Aslam, chief market analyst at AvaTrade. “In terms of pullback, the price can easily retrace all the way to $15,982. Traders should keep an eye on the 50-day SMA [simple moving average] on the daily time frame and as long as the price continues to trade above this level, there isn’t much to worry.”

WATCH: What is driving Bitcoin’s recent rally to record highs?

Yahoo Finance

Yahoo Finance