Biotech Stock Roundup: PTGX Gains on Study Data, BMRN Faces Setback & More

The biotech sector was in focus with key pipeline and regulatory updates. Among these, BMRN was down on regulatory updates.

Recap of the Week’s Most Important Stories:

Update From Exelixis: Exelixis EXEL announced the failure of the late-stage CONTACT-03 study. CONTACT-03 evaluated Cabometyx (cabozantinib) in combination with Tecentriq (atezolizumab) versus cabozantinib alone in patients with locally advanced or metastatic clear cell or non-clear cell (papillary or unclassified only) renal cell carcinoma (RCC) who progressed during or after immune checkpoint inhibitor therapy (either combination or monotherapy). RCC is a type of kidney cancer, and Cabometyx (cabozantinib) is approved for advanced RCC and previously treated hepatocellular carcinoma (HCC).

Patients were randomized 1:1 between the experimental arm of cabozantinib in combination with atezolizumab and the control arm of cabozantinib alone. The CONTACT-03 study did not meet its primary endpoint of progression-free survival (PFS). Exelixis has collaborated with Roche to evaluate the combination of cabozantnib and Tecentriq, broadening its exploration of cabozantnib combinations with immune checkpoint inhibitors (ICIs). Tecentriq is an ICI.

Protagonist Gains on Study Results: Protagonist Therapeutics, Inc. PTGX surged after the company announced positive top-line results from FRONTIER 1 study of the oral IL-23 receptor antagonist JNJ-2113 (formerly PN-235) in psoriasis in collaboration with Janssen Biotech, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson. The randomized, multicenter, double-blind, placebo-controlled study FRONTIER 1 phase IIb trial (NCT05223868) is evaluating the efficacy and safety of JNJ-2113 in patients with moderate-to-severe plaque psoriasis. It evaluated three once-daily dosages and two twice-daily dosages of JNJ-2113 taken orally.

The primary endpoint of the study is the proportion of patients achieving PASI-75 at 16 weeks. Data from the study showed that JNJ-2113 achieved the study's primary efficacy endpoint with a statistically significant greater proportion of patients who received JNJ-2113 achieving PASI-75 (a 75% improvement in skin lesions as measured by the Psoriasis Area and Severity Index) responses compared to placebo at week 16 in all five treatment groups.

Protagonist expects that JNJ-2113 will progress into a phase III registrational study in plaque psoriasis on the strength of these data. If JNJ-2113 advances into a phase III study and the study meets its primary goal, Protagonist is entitled to get milestone payments of $50 million and $115 million, respectively. In total, Protagonist remains eligible for up to $855 million in various milestone payments and tiered royalties based on worldwide net drug sales.

BridgeBio Soars on Dwarfism Study Data: Shares of commercial-stage biopharmaceutical company BridgeBio Pharma, Inc. BBIO jumped after it announced positive results from PROPEL2, a mi-stage study evaluating infigratinib in children with achondroplasia, the most common form of dwarfism. Study results showed that in the highest dose level (cohort 5, 0.25 mg/kg once daily), the mean change from baseline in annualized height velocity (AHV) at six months was +3.03 cm/year for the first 10 children with at least six months of follow-up in cohort 5. The two remaining children who have not yet had six months of follow-up have a mean change from baseline in AHV of +8.8 cm/year based on three months' data.

Of the children, 80% at six months were responders, as defined by an increase from baseline AHV of at least 25%. The mean change from baseline in AHV of responders was 3.81 cm/year. As a result of treatment, the median absolute AHV reached 7.6 cm/year, which is beyond the 99th percentile of growth for children living with achondroplasia. Infigratinib demonstrated clear dose-responsiveness as a single daily oral therapy and was well-tolerated with no adverse events assessed as treatment-related in cohort 5. Based on the positive phase II results, BridgeBio has started to enroll children for a pivotal phase III study. BridgeBio expects to initiate the development of infigratinib for hypochondroplasia, a skeletal dysplasia closely related to achondroplasia.

Updates From BioMarin: BioMarin Pharmaceutical Inc. BMRN announced that the FDA has accepted the company's supplemental new drug application (sNDA) for Voxzogo (vosoritide) for injection to expand treatment in the United States to include children with achondroplasia under the age of 5. The FDA has set a target action date of Oct 21, 2023.

The company also announced that it has received a notice from the regulatory body informing it that the agency has extended the review of the company's biologics license application (BLA) for Roctavian (valoctocogene roxaparvovec) gene therapy for adults with severe hemophilia A. The final decision from the regulatory agency is now expected by the end of June 2023. This extension period was due to the submission of three-year follow-up safety and efficacy data from the late-stage GENEr8-1 study supporting the BLA filing for Roctavian, which the FDA deemed as a major amendment to the earlier filed data.

BioMarin currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Setback For Incyte: Incyte INCY announced that it will discontinue the late-stage LIMBER-304 study following the results of a pre-planned interim analysis conducted by an independent data monitoring committee (IDMC). LIMBER-304 is a randomized, double-blind study evaluating the efficacy and safety of parsaclisib plus Jakafi (ruxolitinib) versus placebo plus ruxolitinib in adult (age ≥18 years) patients living with myelofibrosis (MF) who have an inadequate response to ruxolitinib monotherapy.

The IDMC advised that the study is unlikely to meet its primary endpoint and hence Incyte decided to discontinue the study. The primary endpoint of LIMBER-304 was the proportion of patients who achieved a targeted reduction in spleen volume as measured by magnetic resonance imaging or computed tomography.

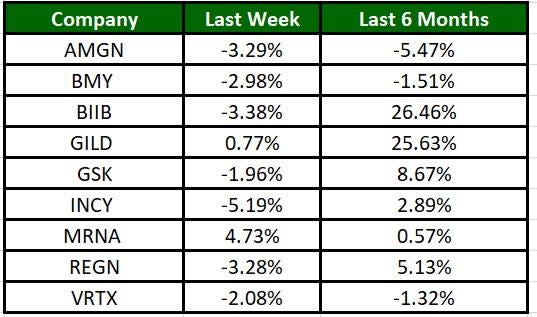

Performance

The Nasdaq Biotechnology Index has lost 1.77% in the past five trading sessions. Among the biotech giants, Incyte has lost 5.19% during the period. Over the past six months, shares of Biogen have soared 26.46%. (See the last biotech stock roundup here: Biotech Stock Roundup: MRNA Q4 Earnings, REGN’s Updates, CYTK Receives Setback)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for other updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Protagonist Therapeutics, Inc. (PTGX) : Free Stock Analysis Report

BridgeBio Pharma, Inc. (BBIO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance