BioMarin (BMRN) Q4 Earnings Miss, Sales Beat, Stock Down

BioMarin Pharmaceutical BMRN reported adjusted earnings of 36 cents per share for fourth-quarter 2022, missing the Zacks Consensus Estimate of 39 cents. Earnings were significantly higher than 3 cents in the year-ago quarter, driven by higher revenues, which offset the impact of higher marketing costs.

Total revenues were $537.5 million in the reported quarter, up 19% year over year. Revenues beat the Zacks Consensus Estimate and our estimate of $534.0 million and $533.7 million, respectively.

Quarter in Detail

Product revenues (including Aldurazyme) were $525.5 million in the quarter, up 20.7% year over year. Product revenues from BioMarin's marketed brands (excluding Aldurazyme) were up 18% year over year to $487.9 million on higher revenues from the new drug, Voxzogo, which offset lower sales of Kuvan. Royalty and other revenues were $12.0 million in the quarter, down 17.4%.

Vimizim sales declined 3% year over year to $152.1 million. Naglazyme sales were up 21% to $100.5 million. Higher Naglazyme sales upside can be attributed to the favorable timing of large government orders in some countries in Europe and the Middle East during the quarter. While Naglazyme sales beat our expectations of $92.6 million, Vimizim sales missed our model estimate of $164.6 million.

Brineura generated sales of $42.6 million in the quarter, up 14% year over year. The drug’s sales beat our model estimate of $39.1 million for the quarter.

New drug Voxzogo, approved in 2021 for achondroplasia, generated sales worth $66.8 million in the fourth quarter compared with $48.3 million in the previous quarter. Higher sales of Voxzogo were driven by continued global market expansion and rapid patient uptake. As of Sep 30, an estimated 1,264 children were being treated with Voxzogo from 32 active markets. The Voxzogo sales figure was almost in line with our model estimate of $67.0 million.

In the phenylketonuria (PKU) franchise, Kuvan revenues declined 22% to $53.6 million due to generic competition, as the drug lost U.S. market exclusivity in late 2020. BioMarin is now in the third year of U.S. generic competition for Kuvan and expects new generic competitors in Europe.

Palynziq injection sales grossed $72.3 million in the quarter, up 13% year over year driven by new patient starts.

Product revenues from Aldurazyme totaled $37.6 million, up 85%.

BioMarin has a collaboration agreement with Sanofi’s SNY subsidiary, Genzyme for Aldurazyme. Sanofi, through Genzyme, is BioMarin's sole customer for Aldurazyme. The Sanofi subsidiary is also responsible for marketing and selling Aldurazyme to third parties.

2023 Guidance

In 2023, BioMarin expects to record total revenues in the range of $2.375-$2.5 billion, implying an increase of around 15% at the midpoint. The revenue guidance, however, fell slightly short of the Zacks Consensus Estimate of $2.55 billion.

Shares of BioMarin declined 3.24% in after-market trading on Feb 27 in response to the mixed results and probably due to the soft revenue guidance.

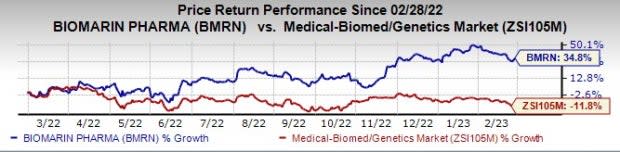

In the past year, the stock has risen 34.8% against the industry’s decline of 11.8%.

Image Source: Zacks Investment Research

BioMarin expects revenues in the range of $1.7 billion to $1.85 billion from its Enzyme products, which include Aldurazyme, Vimizim, Naglazyme, Brineura and Palynziq. The total revenue guidance includes an assumed contribution from Kuvan of about $125 million globally. BioMarin, on the conference call, specified that Kuvan is no longer a source of growth for the company and management is lowering focus on the drug.

Voxzogo revenues are expected to be in the range of $330 million to $380 million, representing over 100% growth from the midpoint compared to the 2022 figure. BioMarin expects Voxzogo sales to gain from continued market penetration, new market launches and approval for younger age groups. At present, only 6% of the total addressable patient population is being treated with Voxzogo, per BioMarin.

BioMarin expects Roctavian sales in the range of $100 million to $200 million in 2023.

Roctavian, a gene therapy for treating adults with severe hemophilia, was granted conditional approval by the European Commission in August 2022. The Roctavian product launch is underway in Europe.

In the United States, BioMarin refiled its biologics license application (BLA) with the FDA for Roctavian in September 2022. The BLA has been accepted for review and an FDA decision is expected by March 2023-end. However, BioMarin management expects the FDA to extend this review by another three months following the submission of three-year follow-up safety and efficacy data from the ongoing phase III study, GENEr8-1 study on Roctavian.

The Roctavian guidance assumes a launch in the United States in 2023.

The gross margin is expected to be between 77.5% and 79%. The company expects R&D expenses to be in the range of 30%-32% of revenues in 2023 while SGA expenses are expected to be between 36% and 38%.

BioMarin expects adjusted earnings per share to be in the range of $1.80 to $2.05.

Pipeline Updates

In January 2023, the European Medicines Agency (“EMA”) validated BioMarin’s Type II Variation application, seeking label expansion for Voxzogo (vosoritide) injection to treat children aged under two years with achondroplasia. BioMarin has also submitted a supplemental new drug application (sNDA) to the FDA for the same patient population. Regulatory decisions in Europe and the United States are expected in the second half of 2023.

Another gene therapy candidate in BioMarin’s pipeline is BMN 331 for the treatment of hereditary angioedema. A phase I/II HAERMONY study on BMN 331 is ongoing and patient dosing in the study continues. In January, BioMarin announced data from the first participant treated with the 6e13vg/kg dose of BMN 331. In the study, the patient demonstrated levels of C1-Inhibitor, an acute-phase protein that circulates in the blood, that were approaching the therapeutically relevant range.

Zacks Rank & Stocks to Consider

BioMarin currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the drug sector include eFFECTOR Therapeutics EFTR and ADMA Biologics, Inc. ADMA. While eFFECTOR Therapeutics sports a Zacks Rank of 1 (Strong Buy), ADMA Biologics has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for eFFECTOR Therapeutics for 2023have narrowed from 96 cents to 88 cents in the past 60 days.

Earnings of eFFECTOR Therapeutics beat estimates in all of the trailing four quarters. The average earnings surprise for EFTR is 104.56%. EFTR stock has declined 89.6% in the past year. eFFECTOR Therapeutics is expected to report its fourth-quarter results next month.

In the past 60 days, the consensus estimate for ADMA Biologics’ 2023 loss per share has narrowed from 20 cents to 19 cents. Shares of ADMA Biologics have increased by 116.2%.

ADMA’s earnings beat estimates in three of the trailing four quarters, delivering an average earnings surprise of 1.81%. ADMA Biologics is expected to report its fourth-quarter results next month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

eFFECTOR Therapeutics, Inc. (EFTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance