BioMarin (BMRN) Q1 Earnings Top, Voxzogo Drives Sales

BioMarin Pharmaceutical BMRN reported first-quarter 2023 adjusted earnings per share of 60 cents, beating the Zacks Consensus Estimate of 43 cents and our model estimates of 41 cents.

The company had reported adjusted earnings of 52 cents per share in the year-ago quarter. Higher earnings were driven by an increase in revenues, which offset the impact of higher marketing costs for Roctavian’s launch.

Total revenues were $596.4 million in the reported quarter, up 15% year over year. This improvement was driven by the global uptake of Voxzogo. The top line beat the Zacks Consensus Estimate and our estimate of $572.53 million and $569.3 million, respectively.

In the year-to-date period, the stock fell 10.1% compared with the industry’s decline of 6.9%.

Image Source: Zacks Investment Research

Quarter in Detail

Product revenues (including Aldurazyme) totaled $586.4 million, up 16% year over year. The same from BioMarin's marketed brands (excluding Aldurazyme) increased 15% year over year to $552 million on higher revenues from the new drug, Voxzogo. This offset lower sales from Kuvan. Royalty and other revenues totaled $10.0 million, down 28% from the year-ago quarter's figure.

Vimizim sales rose 3% year over year to $189.2 million. Naglazyme sales were down 4% to $123 million. Vimizim and Naglazyme sales beat our model estimates of $178.2 million and $121.5 million, respectively.

Brineura generated sales of $39.1 million, up 8% year over year. The figure missed our model estimates of $42.1 million for the first quarter.

New drug Voxzogo, approved in 2021 for achondroplasia, generated sales of $87.8 million compared with $66.8 million in the previous quarter. Sales were up 346% from that recorded in the year-ago quarter. Higher sales of Voxzogo were driven by continued global market expansion and rapid patient uptake in Japan and Brazil.

As of Mar 31, an estimated 1,500 children were being treated with Voxzogo from 35 active markets.

In the phenylketonuria (PKU) franchise, Kuvan revenues declined 15% to $50.5 million due to generic competition. The drug lost U.S. market exclusivity in late 2020. BioMarin is now in the third year of U.S. generic competition for Kuvan and expects new generic competitors in Europe.

Palynziq injection sales grossed $62.4 million in the quarter, up 14% year over year driven by new patient starts.

Product revenues from Aldurazyme totaled $34.4 million, up 41% from that recorded in the prior-year quarter.

BioMarin has signed a collaboration agreement with Sanofi’s SNY subsidiary, Genzyme, for Aldurazyme. Sanofi, through Genzyme, is BMRN’s sole customer for Aldurazyme. The Sanofi subsidiary is also responsible for marketing and selling Aldurazyme to third parties.

2023 Sales View Up

Despite ongoing economic challenges like currency fluctuations, BioMarin slightly raised its previously issued Voxzogo sales guidance from a range of $330-$380 million to $380-$430 billion. It did so on the back of robust demand for the drug in Europe and the United States.

The company now expects Roctavian sales in the range of $50-$150 million (previously $100-$200 million). This is due to an extension in the PDUFA target action date.

Pipeline Update

Earlier in March, FDA delayed the review of the biologics license application for Roctavian, a gene therapy for severe hemophilia A in adults. The agency requested additional data from the ongoing phase III GENEr8-1 study. The submission was considered a major amendment that resulted in a new PDUFA target action date of Jun 30, 2023.

This year, BioMarin plans to initiate an expanded study evaluating BMN 255, an orally bioavailable small molecule for patients with chronic liver disease and hyperoxaluria.

The company continues dosing in the phase I/II HAERMONY study to evaluate BMN 331, an investigational AAV5-mediated gene therapy for people living with hereditary angioedema.

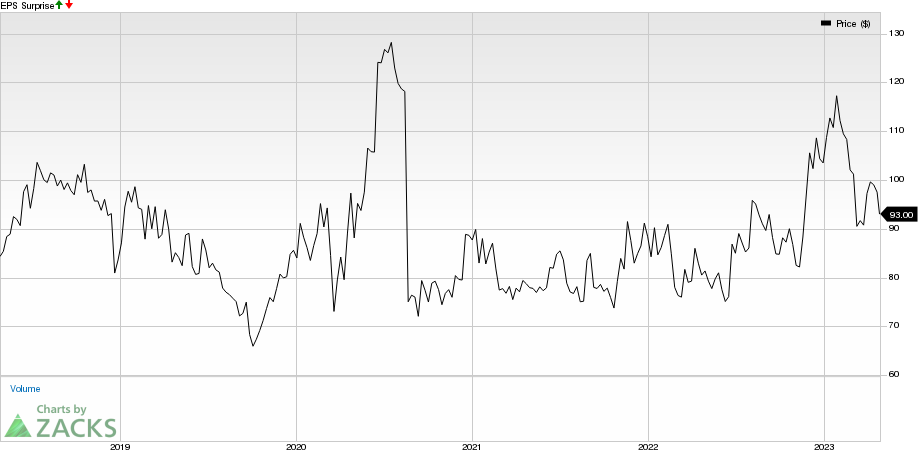

BioMarin Pharmaceutical Inc. Price and EPS Surprise

BioMarin Pharmaceutical Inc. price-eps-surprise | BioMarin Pharmaceutical Inc. Quote

Zacks Rank & Stocks to Consider

Currently, BioMarin has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the overall healthcare sector are Ligand Pharmaceuticals LGND and Ocuphire Pharma OCUP, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ligand Pharmaceuticals' earnings per share has moved up from $3.30 to $4.16 for 2023 and from $3.10 to $4.58 for 2024 in the past 60 days. The stock has risen 16.1% in the year-to-date period.

Ligand Pharmaceuticals’ earnings missed estimates in three of the trailing four quarters and beat the same once, the average negative surprise being 10.07%. In the last reported quarter, LGND’s earnings beat estimates by 10.57%.

The loss per share estimate for Ocuphire Pharma has narrowed from 29 cents to 24 cents for 2023 and from 86 cents to 81 cents for 2024 in the past 60 days. The stock has risen 47.3% in the year-to-date period.

Ocuphire Pharma’s earnings beat estimates in three of the trailing four quarters and missed the same once, the average surprise being 23.85%. In the last reported quarter, OCUP’s earnings beat estimates by 42.35%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance