BioMarin (BMRN) Up After FDA Scraps AdCom Meet for BLA Filing

Shares of BioMarin Pharmaceutical Inc. BMRN increased 7.3% on Nov 23 on investors’ optimism about the FDA’s decision to not hold an advisory committee (AdCom) meeting to review the company’s biologics license application (BLA) seeking approval for Roctavian (valoctocogene roxaparvovec or valrox) gene therapy.

The BLA, currently under FDA’s review, seeks approval for Roctavianas a treatment for adult patients with severe hemophilia A. FDA’s final decision is expected by Mar 31, 2023. If approved, Roctavian would become the first gene therapy for treating severe hemophilia A in the United States.

The FDA’s latest decision to waive holding an AdCom meeting also indicates that the additional data submitted by BMRN satisfies its earlier concerns. The FDA had initially announced that an AdCom meeting would be held but did not specify a date.

BioMarin also remains on track to host the scheduled manufacturing inspection by the FDA in the coming weeks of one of its gene therapy manufacturing facilities in California.

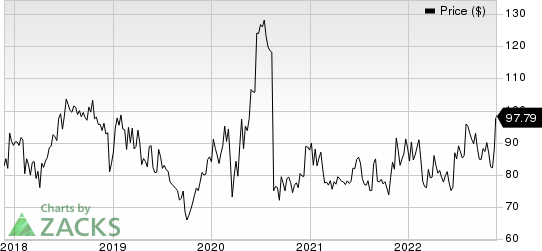

Shares of BioMarin have risen 10.7% in the year-to-date period against the industry’s 19.6% fall.

Image Source: Zacks Investment Research

A one-time infusion, Roctavian is designed to enable the body to produce Factor VIII independently. The patients are also not required to be administered continued hemophilia prophylaxis, which in other marketed therapies is required.

In the United States, BioMarin previously submitted a BLA in 2019 for valrox to address hemophilia A. The FDA issued a complete response letter (CRL) to the BLA ahead of the PDUFA date in August 2020. This was due to the regulatory agency’s dissatisfaction with the available data. Management resubmitted its BLA for Roctavian in September 2022, supported by two-year follow-up safety and efficacy data from the phase III GENEr8-1 study.

In August 2022, the European Commission granted conditional approval to Roctavian for treating adults with severe hemophilia A.

BioMarin Pharmaceutical Inc. Price

BioMarin Pharmaceutical Inc. price | BioMarin Pharmaceutical Inc. Quote

Zacks Rank & Stocks to Consider

BioMarin currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector include Angion Biomedica ANGN, Celularity CELU and Vertex Pharmaceuticals VRTX. While Celularity sports a Zacks Rank #1 (Strong Buy), Angion Biomedica and Vertex Pharmaceuticals carry a Zacks Rank #2 (Buy).

In the past 60 days, estimates for Angion Biomedica’s 2022 loss per share have narrowed from $1.64 to $1.54. During the same period, the loss estimates per share for 2023 have narrowed from $1.54 to $1.48. Shares of Angion Biomedica have plunged 70.7% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 66.42%, on average. In the last reported quarter, ANGN delivered an earnings surprise of 41.67%.

In the past 60 days, estimates for Celularity’s 2022 loss per share have narrowed from 84 cents to 44 cents. During the same period, the loss estimates per share for 2023 have narrowed from $1.04 to 97 cents. Shares of Celularity have plunged 67.6% in the year-to-date period.

Earnings of Celularity beat estimates in three of the last four quarters and missed the mark once, witnessing a surprise of 51.01% on average. In the last reported quarter, Celularity delivered an earnings surprise of 111.54%.

Vertex’s stock has risen 44.0% this year so far. While Vertex’s earnings estimates for 2022 have risen from $14.21 to $14.61 per share in the past 30 days, estimates for 2023 have increased from $15.12 to $15.60 per share during the same period.

Vertex beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 3.16%. In the last reported quarter, Vertex reported an earnings surprise of 8.67%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

Celularity, Inc. (CELU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance