Big Tech Earnings Preview: Time to Buy Amazon or Alphabet Stock?

The outlook for technology companies will become clearer soon, as big tech companies Alphabet GOOGL, Amazon AMZN, and Apple AAPL are all set to report earnings on Thursday, February 2.

Investors are on edge for better-than-expected guidance after Microsoft’s MSFT outlook was underwhelming despite the company beating its fiscal second-quarter earnings expectations last week.

Let’s see what’s in store for Alphabet and Amazon specifically heading into their quarterly reports this week.

Momentum

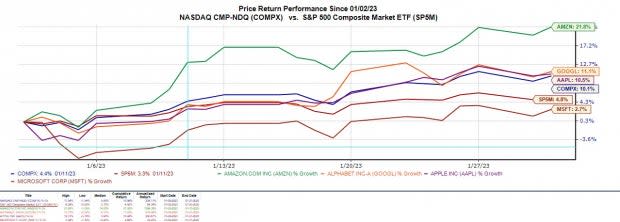

As we begin the new year, tech stocks are off to their best start in over 20 years with the Nasdaq up +10% in January. Amazon stock has stood out, up +21% with Microsoft lagging the big tech pack at +3%.

After a brutal 2022 for tech stocks, recent rallies were supported by December CPI numbers suggesting inflation is beginning to ease. This largely reflects why investors are hoping that Microsoft’s big tech peers can offer better guidance and keep the momentum going in the broader technology sector.

Image Source: Zacks Investment Research

Amazon Quarterly Estimates

Amazon’s fiscal fourth-quarter earnings are expected at $0.15 per share, which would be a -89% decrease from Q4 2021. This is indicative of a tougher operating environment as Q4 sales are expected to be up 6% year over year to $145.37 billion despite Amazon's large budget toward its growing streaming service with the company also expected to continue cutting its labor force.

Amazon would round out fiscal 2022 with EPS at -$0.14 per share compared to earnings of $3.24 a share in 2021. However, fiscal 2023 earnings are projected to climb back into the black at $1.58 per share although estimate revisions have trended down over the quarter.

Total sales for fiscal 2022 would be up 8% at $510.15 billion and are expected to jump another 9% in FY23. More impressive, fiscal 2023 sales projections of $556.57 billion would be a 98% increase from pre-pandemic levels with 2019 sales at $280.52 billion although this is modestly slower than the company's growth in the past.

Image Source: Zacks Investment Research

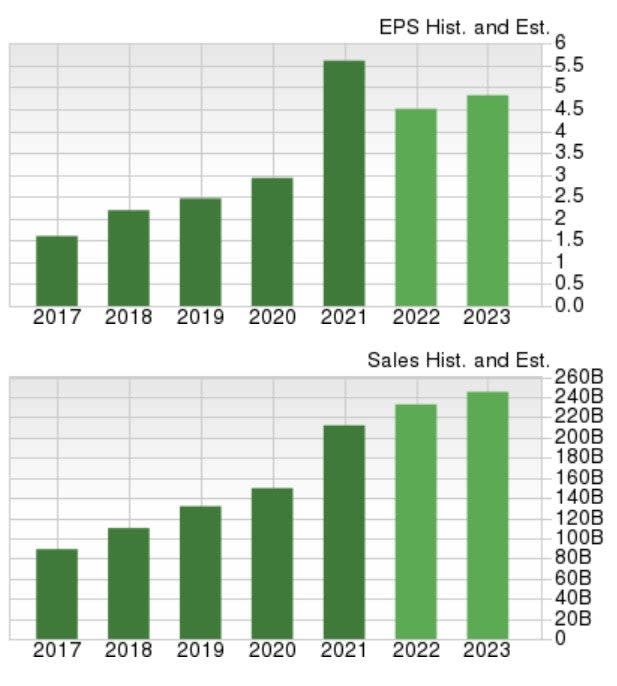

Alphabet Quarterly Estimates

Pivoting to Alphabet, Q4 earnings are expected at $1.17 per share, which would be a -23% drop from Q4 2021. Sales for the quarter are projected to be $63.15 billion, an 2% YoY increase from the prior year quarter.

This would round out Alphabet’s fiscal 2022 with EPS declining -17% to $4.65 per share compared to earnings of $5.61 a share in 2021. Fiscal 2023 earnings are forecasted to rise 8% to $5.05 a share although estimates have slightly declined over the quarter.

Total sales for FY22 would be $233.98 billion, up 10% YoY with FY23 sales forecasted to rise another 7%. Plus, with 2019 sales at $161.85 billion FY23 sales projections of $249.70 billion would represent 54% growth.

Image Source: Zacks Investment Research

Cloud Growth

Along with overall top and bottom-line growth, Wall Street will be monitoring the cloud growth for both Alphabet and Amazon as leaders in the space along with Microsoft’s Azure cloud services.

During the third quarter, Google cloud grew 36% YoY to $6.86 billion topping revenue expectations as shown in the chart below but also produced a larger operating loss at -$699 million compared to -$644 million in the prior year quarter.

Continued expansion of cloud services is very lucrative but managing operating costs will be important, with this especially true for Alphabet’s Google cloud as the segment is still on the path to profitability.

Image Source: Zacks Investment Research

As for Amazon, its AWS cloud service grew 27% during Q3 to $20.53 billion. Operating income for AWS was up 13% to $5.52 billion last quarter, compared to $4.85 billion in Q3 2021.

However, Amazon lowered its Q4 revenue guidance on slowing e-commerce sales and declining AWS growth and analysts will be scoping the expansion in its cloud service as the quarterly growth rate has been closer to 40% in the past.

For now, AWS is still the largest cloud service provider estimated to have 34% of the market share followed by Microsoft’s Azure at 22%, and Google Cloud at 9.5%.

Image Source: Zacks Investment Research

Historical Performance & Valuation

Over the last year, Alphabet stock is down -29% Vs. Amazon’s -32% with both underperforming the S&P 500’s -13% and the Nasdaq’s -20%. With that being said, Amazon’s +677% and Alphabet’s +403% in the last decade have still impressively outperformed the broader indexes.

Image Source: Zacks Investment Research

Still well off of their 52-week highs after last year’s selloff, investors are hoping strong Q4 reports will get Alphabet and Amazon stocks back on track to continue their stellar performances.

Trading at $97 per share and 19.1X forward earnings Alphabet stock is intriguing relative to its past valuation. Shares of GOOGL trade 48% below the decade-high of 37X and at a 28% discount to the median of 26.5X.

Similarly, Amazon also looks attractive from a historical perspective. Shares of AMZN are trading around $102 a share and 58.2X forward earnings. Amazon trades well below its extreme decade-long high of 8,055X and at a 55% discount to the median of 130.1X.

Bottom Line

Going into their Q4 earnings report both Amazon and Alphabet stock land a Zacks Rank #3 (Hold). These tech giants certainly trade attractively relative to their past but more near-term upside will largely depend upon the guidance and outlook they offer during the quarterly reports.

At the moment, holding on to Amazon and Alphabet stock at their current levels could still be rewarding long term given their tremendous businesses with much of the risk from slowing growth in correlation with broader economic challenges appearing to already be priced into the stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance