Better Buy: Kinder Morgan, Inc. vs. Enterprise Products Partners L.P.

If you are looking to invest in the midstream energy space, then the names of industry giants Enterprise Products Partners L.P. (NYSE: EPD) and Kinder Morgan, Inc. (NYSE: KMI) are likely to be very familiar. Although there are some notable similarities between the two, there are also some very big differences as well -- and in a head to head match up, one comes out ahead of the other. Here's why.

1. Reach and scale

When it comes to the midstream space, few can match Enterprise Products Partners for size and diversification. It owns everything from pipelines to processing facilities, and even a fleet of boats. Its assets span across North America, helping to move products within the region and aiding in the export of oil and natural gas products to the rest of the world. With a $60 billion market cap it is actually one of the largest energy companies in the United States.

Image source: Getty Images

One of the few that can match up with Enterprise, however, is Kinder Morgan. It too has a broad portfolio of assets, from pipelines to storage reaching across the continent. And while its market cap is notably smaller at around $40 billion, it is easily one of the most important players in the North American midstream sector. When it comes to reach and scale, these two midstream players are basically on equal footing.

2. Corporate structure

This one ends up being a wash, with the "better" option more dependent on the needs and wants of individual investors. Enterprise is structured as a master limited partnership. It's a complex structure that allows Enterprise to avoid corporate level taxation and pass as much income as possible on to unit holders. Part of this involves treating limited partners as if they were owners of the business, allowing them to benefit from things like depreciation. This, in turn, means that a portion of the income bypasses current taxation, and is instead treated as a return on capital, which lowers an investor's cost basis. This increases capital gains taxes when a limited partnership is sold.

It might be a good idea to consult a tax specialist if you plan to own a partnership, because it can get confusing (especially the K-1 form that comes at tax time). And these securities don't play well with tax advantaged accounts, meaning partnerships are best owned outside of them. All in all, owning a limited partnership like Enterprise requires a bit more work, but the benefit is a high level of tax advantaged income.

Kinder Morgan is structured as a normal corporation. There's no particular tax issues involved, dividends are treated just like any other ordinary dividend, and you can own it in a tax advantaged account. If you are investing inside an IRA or prefer simplicity, Kinder Morgan is the better option. However, in the end, the choice really depends on the investor.

3. Yield

At first glance, Enterprise's 6.3% yield wins hands down -- after all, Kinder Morgan's yield is just 4.4%. But there's more to this story. Kinder Morgan is in the middle of a multi-year process of increasing its dividend from $0.50 per share per year to $1.25 per share. It plans to hit the $1.25 per share figure in 2020. Using that number and today's stock price pushes the company's yield up to 6.7%, and that makes it look like a new winner.

However, Enterprise should continue to increase its distribution over that span as well, though at a much slower rate. Assuming a 3% distribution growth in 2019 and 5% in 2020 (more on this below), the two companies' yields would end up being roughly the same if you used Enterprise's current unit price to calculate yield.

If you are looking to generate income today, Enterprise is the better choice. However, if you are willing to look out a couple of years, it's more of a wash.

4. Distribution history

Enterprise has increased its distribution for 21 consecutive years. Kinder Morgan cut its distribution by 75% in 2016. Before giving Enterprise the easy win, there's a little bit more to understand about Kinder Morgan's dividend cut.

When oil prices cratered in mid-2014, midstream stocks also took a hit. That made it more difficult for companies like Kinder Morgan to raise cash in the capital markets. When faced with the option of supporting the dividend or funding growth investments, management chose to put cash toward growth investments. It was likely the best option for the company, but it clearly took a heavy toll on income investors, who were expecting the dividend to keep heading higher over time.

That expectation, meanwhile, was completely reasonable -- just a few months before the cut, Kinder Morgan was projecting a dividend hike of as much as 10% in 2016. There's a reasonable trust issue here for income investors to keep in the back of their minds.

5. Distribution growth

This is a harder one to pin down because of the rapid dividend growth currently taking place at Kinder Morgan. For the next couple of years, that company's dividend growth will trounce what is expected at Enterprise. After that, however, it's likely that its growth will be more similar to Enterprise's -- both will likely be in the mid-single digit range, with Kinder probably up in the mid- to high-single digit area. That's partially a Kinder Morgan issue, but also partially an Enterprise issue.

That's because Enterprise's distribution growth was lowered to the low single digits in 2018, with similar growth projected for 2019. The goal of this move is to increase the partnership's ability to self-fund more of its growth spending, which will make it a more desirable long-term investment as it will reduce the need to issue new units. Once this transition is done, which should be in 2020, distribution growth should pick back up to the historic mid-single digit range.

EPD Dividend Per Share (Quarterly) data by YCharts

All in all, when you consider the distribution history Enterprise probably ekes out the win here. Slow and steady is much better than higher growth punctuated by a dividend cut.

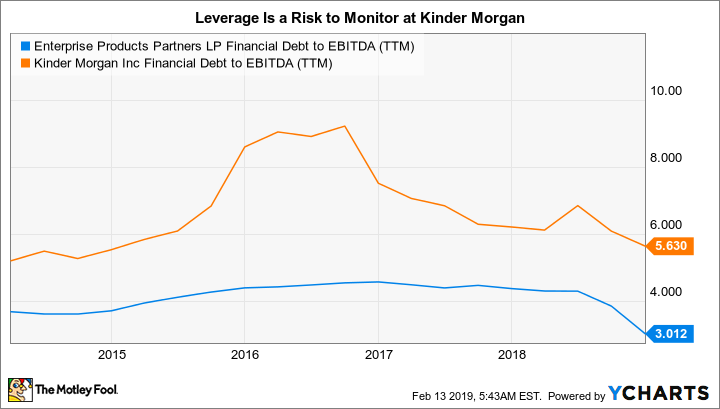

6. Leverage

One of the reasons why Kinder Morgan cut its dividend was that it has historically made greater use of leverage than Enterprise. That limited its options when times got tough. Although it has brought leverage down since the cut, management still uses debt more aggressively than Enterprise. To put some numbers on that, Kinder Morgan's debt to EBITDA ratio is around 5.6 times, down from over 9 times when it cut the dividend. Enterprise's debt to EBITDA ratio is roughly 3 times, which sits at the low end of the midstream sector.

EPD Financial Debt to EBITDA (TTM) data by YCharts

If you are looking for a conservatively financed midstream investment, then Enterprise wins. That said, Kinder's use of leverage is a key factor behind the expectation that it will increase its dividend at a slightly faster clip in 2021 and beyond. That's not a small issue, but the point still goes to Enterprise when you take into consideration distribution history.

The final call

When you dig down a little into the similarities and differences between Enterprise Products Partners and Kinder Morgan, the tally comes out with slow and steady Enterprise in the lead. Of the six points looked at here, each was either a push, or Enterprise was the clear winner. So if you are considering Kinder Morgan and Enterprise for your midstream exposure, err on the side of caution and go with Enterprise. The slow and steady midstream giant probably won't excite you, but that's really just another reason to own it.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance