Better Buy: Brookfield Infrastructure Partners vs. Kinder Morgan

Brookfield Infrastructure Partners (NYSE: BIP) offers investors a sizable 4.8% distribution yield backed by a portfolio of fee-generating assets. Kinder Morgan (NYSE: KMI) has a roughly 4% yield, also supported largely by fee-generating infrastructure assets. But there are huge differences when you dig into the details here. Here are four reasons why these two income investments aren't created equal.

1. Size matters

Kinder Morgan's $45 billion market cap easily tops Brookfield Infrastructure's nearly $16 billion. However, there's another factor to take into consideration here: Brookfield Infrastructure is a limited partnership run by general partner Brookfield Asset Management (NYSE: BAM), an over-100-year-old Canadian asset manager focused on infrastructure assets. Brookfield Asset Management's market cap is $45 billion. So while Brookfield Infrastructure is the smaller entity, it has the backing of a much bigger industry player. What would normally be an easy win for Kinder Morgan here really turns into a wash.

Image source: Getty Images

Further backing that is another fact: Brookfield Asset Management has been investing in infrastructure assets since day one, so the company running Brookfield Infrastructure has a century of history behind it. That isn't meant to diminish Kinder Morgan's business or its employees' capabilities. However, Kinder Morgan was born out of Enron's collapse in the late 1990s. That story simply doesn't have the same cachet.

2. Long, long arms

Kinder Morgan is focused on midstream energy assets, including things like pipelines, ports, terminals, and processing facilities. Although the majority of its portfolio is located in the United States, its reach extends north into Canada and south into Mexico. It is easily one of the largest and most diversified midstream companies in North America, competing toe to toe with industry bellwethers like Enterprise Products Partners.

Brookfield Infrastructure has a much different portfolio. About 40% of adjusted EBITDA (pulling out corporate expenses) comes from the partnership's utility assets. These are regulated utilities and unregulated power assets backed by long-term contracts. A little over 35% of adjusted EBITDA is tied to transportation assets, including toll roads, railroads, and ports. Roughly 17.5% comes from energy assets like the midstream pipelines Kinder Morgan owns. And the remainder of adjusted EBITDA is derived from a relatively new division that invests in data infrastructure assets like storage facilities. Brookfield Infrastructure's portfolio is far more diversified than Kinder Morgan.

However, there's a little more to discuss here than just the types of assets. Brookfield Infrastructure's portfolio is also far more diverse geographically. Its reach extends through North and South America, Europe, and Asia. If you are looking for broad exposure to global infrastructure assets, Brookfield Infrastructure wins hands-down. However, if you are looking for a way to invest in the ramp up of growth in the North American energy industry, then Kinder Morgan would have the edge here. Which company wins here is a little dependent on your goals, but when it comes to diversification, Brookfield Infrastructure wins.

3. The balancing act

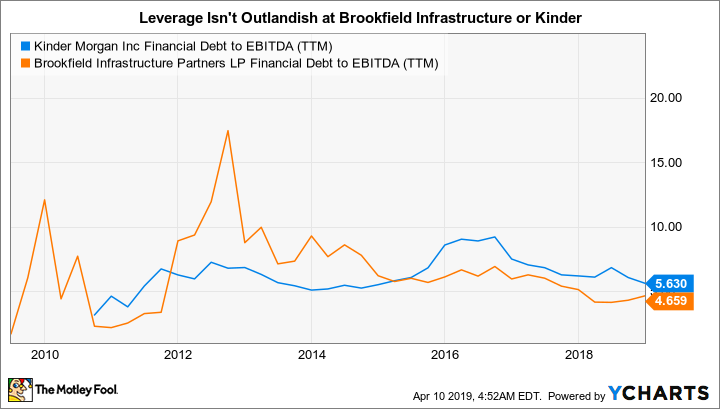

For investors looking at income investments, it's always important to consider balance sheet strength. Although not the only way to evaluate this this, debt-to-EBITDA is a quick way to highlight the leverage employed by each of these infrastructure plays. Kinder Morgan's debt-to-EBITDA ratio is around 5.6. Brookfield Infrastructure's is roughly 4.6. Both have less leverage than they used to.

KMI Financial Debt to EBITDA (TTM) data by YCharts

Although Brookfield Infrastructure's lower debt-to-EBITDA ratio could easily make it the winner here, this one is probably best viewed as a wash. A big part of growth for infrastructure players comes from either buying large assets or building large assets, so debt-to-EBITDA is likely to wax and wane over time. While the numbers here are reasonable today, one deal at either entity could raise the ante.

4. Returning value to investors

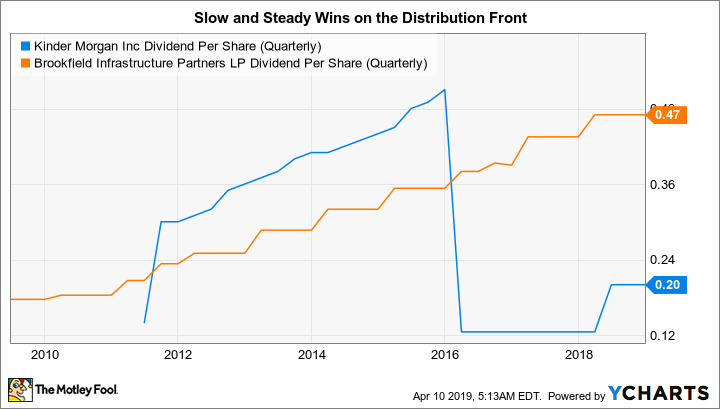

The way infrastructure plays tend to reward investors is via cash distributions. There are really two stories here for Kinder Morgan. In 2016 the company cut its distribution by a massive 75% to free up cash to invest in its capital growth plans. It was the right move for the company, driven by what was then a heavily leveraged balance sheet, but was clearly a painful hit for income investors. The worst part was that just a couple of months prior to the cut management was telling investors to expect a dividend increase of as much as 10% in 2016.

That said, the midstream company has trimmed debt, and growth investments have started to bear fruit. The company started to increase the dividend again in 2018, and has plans for big increases over the next couple of years. All in, the dividend is set to go from $0.50 per share per year in 2017 to a run rate of $1.25 per share in 2020. So there's big dividend growth plans here, but they come from a low base driven by a dividend cut.

KMI Dividend Per Share (Quarterly) data by YCharts

Brookfield Infrastructure Partners' history isn't nearly as exciting. It has increased its distribution each year for 12 consecutive years. The 10-year annualized growth rate is roughly 12%, but the partnership's target is to grow the distribution between 5% and 9% a year. Although Kinder's dividend growth is likely to be more significant in the near term, after 2020 the rate will probably fall back into the range that Brookfield Infrastructure targets. Add in the dividend cut at Kinder Morgan and Brookfield Infrastructure gets the nod here, particularly for more conservative types.

Before leaving this point, however, there's one more factor to consider: Kinder Morgan owns roughly 70% of Kinder Morgan Canada (NASDAQOTH: KMLGF), and that company sold a large asset recently. Instead of leaving the cash at Kinder Morgan Canada where it could have been reinvested in the business, Kinder Morgan pushed through a massive special dividend so it could get its hands on the cash. Once again, probably the right move for Kinder Morgan -- but it's not clear whether or not Kinder Morgan Canada shareholders are better off following this move. When you examine this situation it looks like Kinder Morgan does what's best for Kinder Morgan, with shareholders perhaps taking a back seat. Despite the dividend growth plans, trust still remains an issue at Kinder Morgan.

Boring is likely to be better here

Of this pair, Kinder Morgan is the better way to gain access to the huge growth expected in North American energy markets. That, however, is really the only place in which it is truly better than Brookfield Infrastructure Partners. With regard to scale they are comparable (when you consider Brookfield Asset Management's role). Leverage is roughly similar, too. However, Brookfield Infrastructure offers far greater diversification and a global reach. And when it comes to returning value to investors, Brookfield Infrastructure's history is far better. Add it all up, and most income-focused investors will likely be better off with Brookfield Infrastructure Partners.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Brookfield Asset Management and Kinder Morgan. The Motley Fool recommends Brookfield Infrastructure Partners and Enterprise Products Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance