Best Low P/E Stocks to Buy in July

Stocks that trade at low earnings multiples typically do so because the market doesn't expect much in terms of growth from them. However, finding sturdy companies in this category that are capable of surpassing these low expectations and rewarding shareholders with returned income can be a great way to limit your downside risk while still notching strong returns.

Here's a look at three stocks that have attractive price-to-earnings ratios, offer substantial dividend payouts, and have the potential to benefit from some huge trends: General Motors (NYSE: GM), AT&T (NYSE: T), and Western Digital (NASDAQ: WDC).

Image source: Getty Images.

1. General Motors

With the cyclical nature of the auto industry in mind, it would be a mistake to take GM's 6.3 forward earnings multiple as a face-value buy signal. On the other hand, it is a metric that casts the stock in an attractive light when recent performance, growth initiatives shaping the company, and its appealing returned-income profile are taken into account. GM stock also comes with a chunky 3.8% dividend yield at current prices.

If business accelerates as management expects in the year's second and third quarters, the company's earnings should actually increase this year. There's some promising news on that front with GM's U.S. auto sales up 4.6% year over year in the second quarter. The company also expects that new launches in its truck lines and growth in markets like China and South Korea will help deliver earnings growth in the 2019 fiscal year.

Some investors also appear to have trepidation about the potentially disruptive impact that self-driving cars could have on the auto space. Mass-market deployment of Level 4 and Level 5 autonomous vehicles will likely change the game, and companies that fail to adequately prepare for the shift will face consequences.

However, GM looks well-positioned in the space as it plans to launch a self-driving ride-hailing service by 2019. And, the economics seem to support rides-as-a-service being an advantageous development for industry leaders. The as-a-service model has already been hugely beneficial for the software industry, and while the maintenance costs for cars are likely to be higher, GM's estimate that an autonomous-ride-share car could generate hundreds of thousands in revenue points to big opportunity.

In spite of competitive pressures and recent escalations in trade tensions between the U.S. and China, GM looks to have better growth prospects than its valuation implies.

2. AT&T

AT&T shareholders have had to be content with the company's admittedly generous dividend payouts over the last decade. Its share price has remained fairly flat over the last decade while the S&P 500 index has climbed roughly 115% over the stretch.

Much of the poor stock performance comes down to increasing competition in the mobile wireless space and paying a steep price to acquire DirecTV right before subscription declines accelerated due to cord-cutting trends. Recently, the telecom's stock has gotten a haircut amid investor concerns that the roughly $180 billion in debt it carries following the Time Warner acquisition could mean that a dividend cut is in the cards. Those concerns intensified following news that the telecom giant intends to purchase advertising and analytics company AppNexus at a price around $2 billion.

So, there's been no shortage of reasons for the lack of enthusiasm surrounding AT&T stock. The flip side is that shares trade at roughly 9.5 times this year's expected earnings, come with a sizable 6.1% dividend yield, and the company expects to generate $21 billion in free cash flow (FCF) this year. That would put the cost of covering its payout at a still-reasonable 70% of this year's FCF.

The business also enjoys an entrenched market position, is backed by strong brands, and appears to have growth opportunities in 5G network technology and synergies created by the Time Warner acquisition. For income-seeking investors, I think AT&T is worth adding to your portfolio this month.

3. Western Digital

As with GM, the cyclical nature of the Western Digital's business presents something of a caveat when valuing the stock against short-term earnings expectations. The company's profits will fluctuate based on product-refresh cycles, heavy investment periods, and swings in pricing strength for its offerings.

On the consumer side of things, Western Digital should continue to benefit from growth in the solid-state drive and NAND flash memory markets. The general trend is that the pricing power per terabyte is declining, and that will almost certainly continue, but the good news for Western Digital is its production costs are also on a downtrend.

The amount of data to be stored is rising as video becomes an increasingly widespread medium and emerging product categories like smart cars and Internet-of-Things devices gain traction. The company expects to start rolling out a microwave-assisted hard drive in 2019, with storage up to 40 terabytes. There's increasing need for storage in the enterprise market as businesses move to support these technologies and ramp up their cloud processing and data analytics offerings.

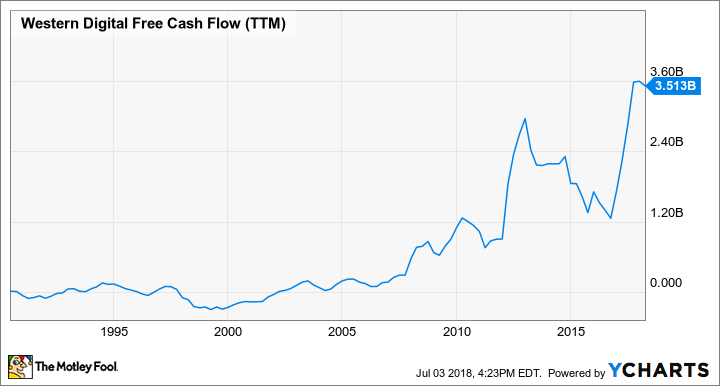

Still, Western Digital stock boasts a solid 2.6% yield and trades at less than six times this year's expected earnings. The company's payout growth has stalled since 2016, but with the cost of distributing its dividend representing just 17% of trailing free cash flow, the company could likely maintain its returned-income distribution even if business shifts to a down period.

WDC Free Cash Flow (TTM) data by YCharts

While some consumer storage business is migrating to the internet and the company faces tough competition from Samsung and others, there are still drivers of demand for Western Digital. The storage stock looks like a cheap buy this July.

More From The Motley Fool

Keith Noonan owns shares of AT&T.; The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance