Best Income Stocks to Buy for June 1st

Here are three stocks with buy rank and strong income characteristics for investors to consider today, June 1st:

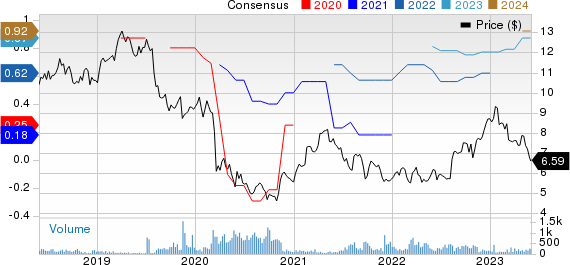

PennantPark Floating Rate Capital Ltd. PFLT: This closed-end, externally managed and non-diversified investment company which generate current income and capital appreciation by investing primarily in floating rate loans and other investments made to the United States middle-market companies, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.2% over the last 60 days.

PennantPark Floating Rate Capital Ltd. Price and Consensus

PennantPark Floating Rate Capital Ltd. price-consensus-chart | PennantPark Floating Rate Capital Ltd. Quote

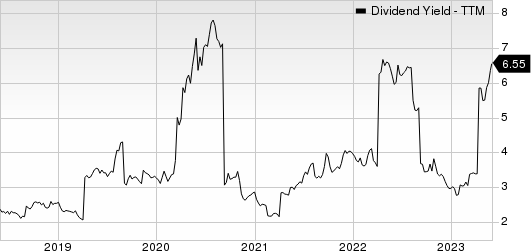

This Zacks Rank #1 company has a dividend yield of 11.4%, compared with the industry average of 3.0%.

PennantPark Floating Rate Capital Ltd. Dividend Yield (TTM)

PennantPark Floating Rate Capital Ltd. dividend-yield-ttm | PennantPark Floating Rate Capital Ltd. Quote

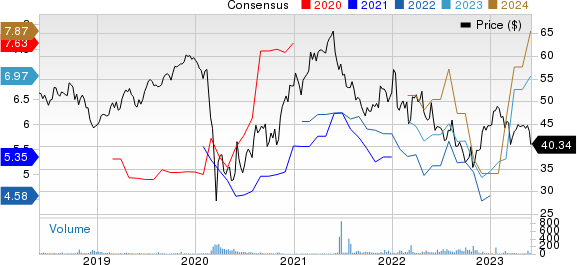

Swire Pacific Limited SWRAY: This company which is one of Hong Kong's leading listed companies, with diversified interests in five operating divisions: Property, Aviation, Beverages, Marine Services and Trading & Industrial, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.1% over the last 60 days.

Swire Pacific Ltd. Price and Consensus

Swire Pacific Ltd. price-consensus-chart | Swire Pacific Ltd. Quote

This Zacks Rank #1 company has a dividend yield of 6.5%, compared with the industry average of 0.0%.

Swire Pacific Ltd. Dividend Yield (TTM)

Swire Pacific Ltd. dividend-yield-ttm | Swire Pacific Ltd. Quote

Ageas AGESY: This international insurance company which has chosen to concentrate its business activities in Europe and Asia, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.0% over the last 60 days.

Ageas SA Price and Consensus

Ageas SA price-consensus-chart | Ageas SA Quote

This Zacks Rank #1 company has a dividend yield of 2.8%, compared with the industry average of 2.3%.

Ageas SA Dividend Yield (TTM)

Ageas SA dividend-yield-ttm | Ageas SA Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ageas SA (AGESY) : Free Stock Analysis Report

PennantPark Floating Rate Capital Ltd. (PFLT) : Free Stock Analysis Report

Swire Pacific Ltd. (SWRAY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance