Best Growth Stocks To Buy

Companies that have significant growth prospects for profitability and returns can add tangible upside to your portfolio. Hock Lian Seng Holdings and Dyna-Mac Holdings are examples of many potential outperformers that analysts are bullish on. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

Hock Lian Seng Holdings Limited (SGX:J2T)

Hock Lian Seng Holdings Limited, an investment holding company, primarily provides civil engineering services to public and private sectors in Singapore. Hock Lian Seng Holdings was established in 1969 and with the stock’s market cap sitting at SGD SGD220.20M, it comes under the small-cap stocks category.

Thinking of investing in J2T? Other fundamental factors you should also consider can be found here.

Dyna-Mac Holdings Limited (SGX:NO4)

Dyna-Mac Holdings Limited, an investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading (FPSO) and floating storage offloading (FSO) topside modules for the oil and gas industries. Formed in 1990, and now run by Tze Lim, the company size now stands at 621 people and with the stock’s market cap sitting at SGD SGD127.90M, it comes under the small-cap group.

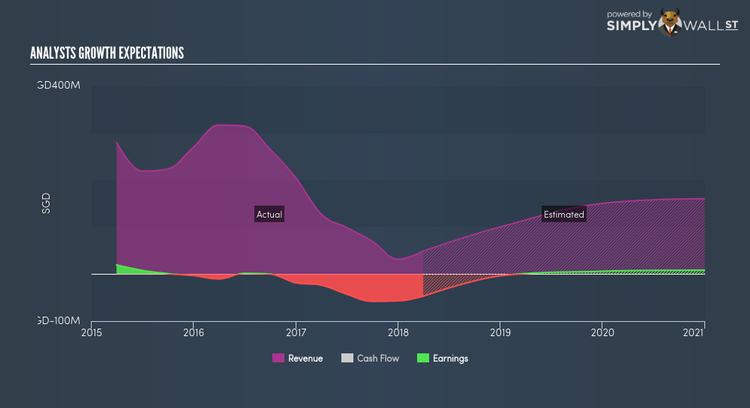

NO4 is expected to deliver a triple-digit high earnings growth over the next couple of years, bolstered by a significant revenue which is expected to more than double. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 6.04%. NO4 ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? I recommend researching its fundamentals here.

Roxy-Pacific Holdings Limited (SGX:E8Z)

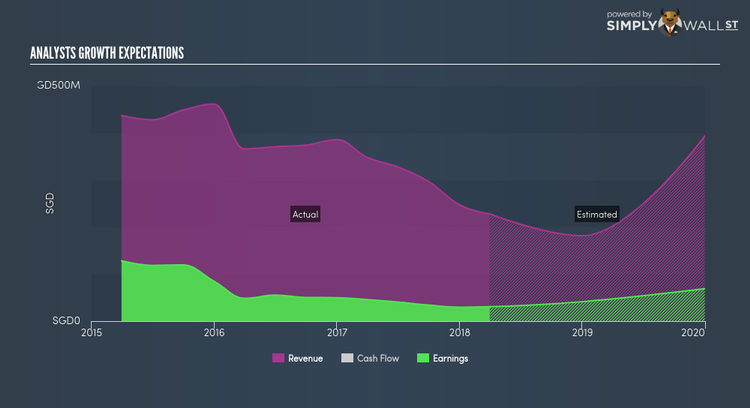

Roxy-Pacific Holdings Limited, an investment holding company, operates in the property and hospitality businesses in the Asia-Pacific. Formed in 1967, and headed by CEO Hong Teo, the company provides employment to 278 people and with the stock’s market cap sitting at SGD SGD647.96M, it comes under the small-cap stocks category.

A potential addition to your portfolio? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance