Beijing police detain man over Internet stock suicide rumour

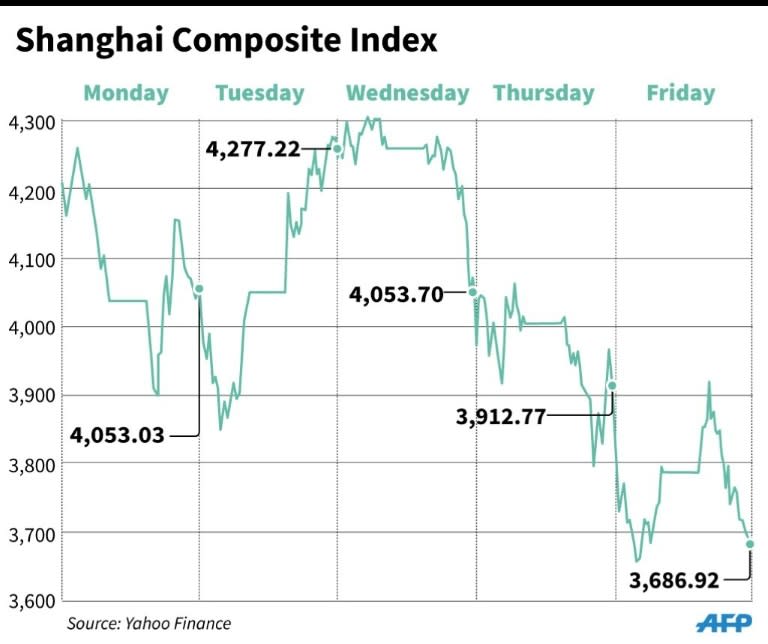

Police in Beijing have detained a man for allegedly spreading a rumour online that a person jumped to their death in the city's financial district due to China's precarious stock markets, police said Sunday, underscoring growing jitters amid a three-week long sell-off. The 29-year-old man detained was identified by the surname Tian, and is a manager at a technology and science company in Beijing, police said in a post on their official microblog. Police said Tian's alleged posting of the rumour took place Friday and called on Internet users to obey laws and regulations, not to believe and spread rumours, and to cooperate with police. The state-run Xinhua news agency reported that Tian allegedly posted the rumours with video clips and screenshots Friday afternoon. The post, which is said to have gone viral, "provoked emotional responses among stock investors who suffered losses over the past weeks", Xinhua said. Xinhua added that a police investigation showed that the video in question had been shot on Friday morning in the eastern Chinese province of Jiangsu where a man had jumped to his death. Local police there were investigating that case, Xinhua said. The original post was unavailable Sunday on China's tightly controlled social media, where authorities are quick to delete controversial material. China's benchmark stock market has plummeted over the past three weeks. On Friday the Shanghai Composite Index closed down 5.77 percent to end at 3,686.92 points. Since peaking on June 12 Shanghai has dropped nearly 29 percent, which Bloomberg News said was its biggest three-week fall since November 1992, wiping out $2.8 trillion from Chinese market capitalisations. Experts fear it could turn into a full-brown crash introducing even more uncertainty into global markets as Europe teeters on the edge of a potential eurozone exit by Greece, where voters were casting ballots in a key referendum on Sunday. The Shanghai market had swelled by 150 percent in the last 12 months and experts had expected a sharp correction, though the rate at which it has occurred is unnerving many. The market regulator announced on Friday it would limit initial public offerings -- which disrupt the rest of the market -- in an attempt to curb plunging share prices. And on Saturday, China's 21 largest brokerage firms announced that they would invest more than $19 billion in the country's stock markets to curb the declines. The brokers will spend at least 120 billion yuan ($19.3 billion) on so-called "blue chip" exchange traded funds, the Securities Association of China said in a statement after an emergency meeting in Beijing.

Yahoo Finance

Yahoo Finance