Is a Beat in Store for American Tower (AMT) in Q1 Earnings?

American Tower Corporation AMT is scheduled to release first-quarter 2023 results before the opening bell on Apr 26. While the quarterly results are expected to reflect year-over-year growth in revenues, funds from operations (FFO) per share might exhibit a decline.

In the last quarter, American Tower surpassed adjusted FFO per share estimates by 4.93%. The quarterly results reflected an improvement in revenues across its Property segment. AMT also recorded decent year-over-year organic tenant billings growth of 4.7% and total tenant billings growth of 5.7%.

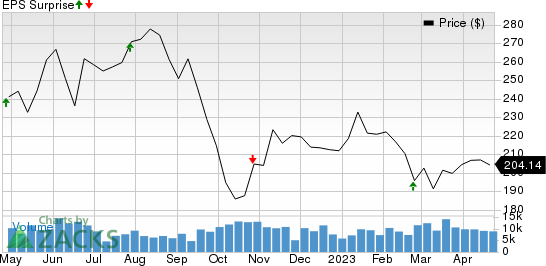

Over the preceding four quarters, the company topped FFO per share estimates on three occasions and missed the same once, the average beat being 2.25%. The graph below depicts this surprise history:

American Tower Corporation Price and EPS Surprise

American Tower Corporation price-eps-surprise | American Tower Corporation Quote

Factors to Note

The advancement in mobile technology, such as 4G and 5G networks, and the proliferation of bandwidth-intensive applications have driven the growth in mobile data usage globally. Also, rampant usage of network-intensive applications for video conferencing and cloud services, and remote-working scenarios have fueled the rise.

American Tower’s first-quarter earnings are likely to have benefited from the rise in capital spending by wireless carriers on the incremental demand from global 4G and 5G deployment efforts, growing wireless penetration and spectrum auctions.

This phenomenon is expected to have driven tower leasing demand during the to-be-reported quarter, boosting AMT’s top-line growth.

Also, the demand for the company’s highly interconnected data center facilities and critical cloud on-ramps is anticipated to have remained robust during the quarter.

American Tower’s non-cancellable, long-term (typically 5-10 year) tower leases with major wireless carriers with multiple renewal period options are likely to have helped it generate stable cashflows in the to-be-reported quarter.

The Zacks Consensus Estimate for first-quarter 2023 revenues is pegged at $2.74 billion, indicating a rise of 3.1% from the year-earlier period.

The Zacks Consensus Estimate for operating revenues from the Property segment is pegged at $2.66 billion, indicating growth from $2.60 billion reported in the year-ago period. Our estimate for the same stands at $2.63 billion, implying an increase of 1.2%.

The Zacks Consensus Estimate for operating revenues from the Service segment stands at $61.8 million, suggesting an increase from $59.5 million reported in the prior-year quarter. We expect Service segment operating revenues to be $60.6 million, up 1.9% year over year.

Further, the company’s solid balance sheet strength is expected to have aided its investments in the existing 4G networks and its efforts for 5G deployment during the quarter.

However, higher interest expenses might have been a key headwind for AMT. We expect interest expenses to rise 23.8% year over year in first-quarter 2023.

Also, elevated churn in certain markets where the company operates and exposure to adverse foreign currency exchange rate fluctuations are likely to have had a negative impact on its quarterly performance.

American Tower’s activities during the to-be-reported quarter were not adequate to secure analysts’ confidence. The Zacks Consensus Estimate for quarterly FFO per share has been unchanged at $2.38 over the past month. Also, the figure suggests a year-over-year decline of 6.7%.

What Our Quantitative Model Predicts

Our proven model predicts a surprise in terms of FFO per share for American Tower this season. The right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — increases the odds of a beat. This is the case here.

Earnings ESP: American Tower has an Earnings ESP of +0.63%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: American Tower currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks That Warrant a Look

Here are some other stocks that are worth considering from the REIT sector, as our model shows that these have the right combination of elements to deliver a surprise this reporting cycle:

VICI Properties VICI is slated to report quarterly numbers on May 1. VICI has an Earnings ESP of +3.34% and carries a Zacks Rank #2 (Buy) presently.

Welltower WELL is scheduled to report first-quarter earnings on May 2. WELL has an Earnings ESP of +0.35% and a Zacks Rank #3 currently.

Equinix EQIX is scheduled to report first-quarter earnings on May 3. EQIX has an Earnings ESP of +0.44% and a Zacks Rank #2 currently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance