Is a Beat in the Offing for Earthstone's (ESTE) Q1 Earnings?

Earthstone Energy, Inc. ESTE is expected to beat earnings estimates when it releases first-quarter 2020 results on May 7, before the opening bell.

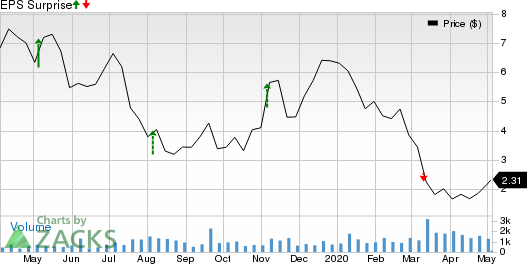

In the last reported quarter, the company reported earnings per share of 28 cents, missing the Zacks Consensus Estimate of 30 cents. However, the metric rose from the year-ago quarter’s 13 cents, primarily due to strong production volumes. Notably, the upstream energy company beat earnings estimates thrice and missed the same once in the trailing four quarters, with the average positive surprise being 120.3%.

Earthstone Energy, Inc. Price and EPS Surprise

Earthstone Energy, Inc. price-eps-surprise | Earthstone Energy, Inc. Quote

Let’s see how things have shaped up prior to the upcoming announcement.

Tread in Estimate Revision

The Zacks Consensus Estimate for first-quarter earnings of 14 cents has seen no upward revision but two downward movements over the past 30 days. The figure indicates an increase of 80.6% year over year.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $50.9 million, suggesting a rise of 25% from the year-ago reported figure.

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for Earthstone this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: Earthstone has an Earnings ESP of +22.81%. This is because the Most Accurate Estimate for the quarter of 18 cents is currently pegged higher than the Zacks Consensus Estimate of 14 cents per share. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Earthstone currently carries a Zacks Rank #3.

Factors Driving the Better-Than-Expected Earnings

Upstream company Earthstone’s rising production, supported by Eagle Ford and Midland Basin assets, is likely to reflect on first-quarter results. The Zacks Consensus Estimate for overall production is pegged at 1,388 thousand barrels of oil equivalent (MBoe), indicating a significant rise from 1,009 MBoe in the year-ago period.

The consensus mark for oil production is pegged at 826 thousand barrels (MBbls), signaling a surge from the year-ago level of 678 MBbls. Moreover, Zacks Consensus Estimate for natural gas production is pegged at 1,392 million cubic feet (MMcf), indicating a rise from the year-ago level of 827 MMcf.

However, the Zacks Consensus Estimate for average sales price for oil is pegged at $44.03 per barrel, indicating a decline from $52.30 in the year-ago period. Moreover, the consensus mark for realized average natural gas prices is pegged at $1.02 per thousand cubic feet, signaling a decrease from the year-ago level of $1.32.

Higher production volumes are expected to have offset the negative impact of lower commodity price realizations in the to-be-reported quarter.

Other Stocks That Warrant a Look

While Earthstone is likely to deliver an earnings beat this time around, here are a few other firms that you may also want to consider on the basis of our model. These too have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Comstock Resources, Inc. CRK has an Earnings ESP of +2.63% and is a Zacks #2 Ranked player. The company is scheduled to release first-quarter results after the market closes on May 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sunoco LP SUN has an Earnings ESP of +14.75% and a Zacks Rank of 3. It is scheduled to report first-quarter results on May 11.

Canadian Natural Resources Limited CNQ has an Earnings ESP of +36.36% and holds a Zacks Rank #3. It is set to report first-quarter results on May 7.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance