Beat in the Cards for Huntington (HBAN) in Q3 Earnings?

Huntington Bancshares HBAN is scheduled to report third-quarter 2019 results on Oct 24, before the opening bell. While the company’s revenues are expected to have increased year over year, earnings might have remained stable.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Higher net interest income and fee income were the positives. Improvement in loans along with margin expansion acted as tailwinds. However, results reflected rise in operating costs and provisions.

Huntington’s activities in the quarter were inadequate to impress analysts. The Zacks Consensus Estimate for earnings of 33 cents remained unchanged over the past 30 days. Also, it is in line with the year-ago reported figure.

Moreover, the consensus estimate for revenues of $1.17 billion suggests a rise of 1.8%.

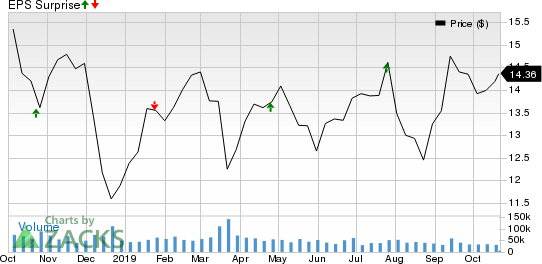

Huntington Bancshares Incorporated Price and EPS Surprise

Huntington Bancshares Incorporated price-eps-surprise | Huntington Bancshares Incorporated Quote

Let’s check the factors that are expected to have influenced third-quarter earnings.

Key Factors

Muted Net Interest Income (NII): A soft lending scenario during the to-be-reported quarter is likely to have impeded growth in NII to an extent. Particularly, weakness in revolving home equity loans, commercial and industrial, and commercial real estate loans might have offset growth in consumer loans.

Moreover, the company’s net interest margin is likely to have been affected by yield-curve flattening, lower interest rates and steadily rising deposit betas, thereby hurting interest income.

However, rise in interest earning assets is likely to have supported top-line growth. The Zacks Consensus Estimate of $99.6 billion for earnings assets indicates a rise of 2.9% from the year-ago reported number.

Higher Fee Income: During the third quarter, several concerns, including some from the prior quarters, like Brexit-related and U.S.-China trade war uncertainties, and expectations of global economic slowdown persisted. Therefore, capital markets income is likely to have disappointed.

Nonetheless, consumer spending trend was stronger during the quarter, which is likely to have bolstered the bank’s credit and debit card revenues. In a reversal in trend, mortgage banking performance is also expected to have improved on the back of lower mortgage rates, which might have driven refinancing activities during the quarter.

Also, non-interest income is expected to have benefited from rise in service charge on deposits as deposit balances are likely to have increased in the quarter.

Expenses Under Control: Management remains focused on expense management. As there were no major outflows during the quarter, the firm’s earnings might not have been negatively impacted in the to-be-reported quarter.

Here is what our quantitative model predicts:

Our proven model predicts an earnings beat for Huntington this time around. It has the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The company has an Earnings ESP of +0.60%.

Zacks Rank: It carries a Zacks Rank #3, at present.

Other Stocks That Warrant a Look

Here are some other stocks you may want to consider, as according to our model these have the right combination of elements to post an earnings beat this quarter.

BOK Financial Corporation BOKF is set to release results on Oct 23. The company has an Earnings ESP of +1.50% and carries a Zacks Rank of 3, at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Earnings ESP for Cullen/Frost Bankers CFR is +0.07% and it carries a Zacks Rank of 3. The company is scheduled to report quarterly numbers on Oct 24.

The Blackstone Group BX has an Earnings ESP of +3.70% and holds a Zacks Rank of 3 currently. It is set to report results on Oct 23.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

BOK Financial Corporation (BOKF) : Free Stock Analysis Report

Cullen/Frost Bankers, Inc. (CFR) : Free Stock Analysis Report

Blackstone Group Inc/The (BX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance