Bear of the Day: Walmart (WMT)

Walmart (WMT) is a Zacks Rank #5 (Strong Sell) that is the popular retail giant known for low prices. The company engages in retail and wholesale, but over the years has evolved its online business and branched into other areas of retail through acquisitions.

The stock did very well during the pandemic, moving from the $120 level to a high of $160 earlier this year. However, a recent earnings miss showed that inflationary costs are eating into the bottom line. The stock is now trading below that $120 mark and investors are wondering where to buy this big down move.

About the Company

Walmart is headquartered in Bentonville, Arkansas and employs almost over 2 million people. The company was founded in 1945 and has grown to operate supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, discount stores, and ecommerce websites.

The company offers grocery and consumables, which includes dairy, meat, bakery, deli, produce, dry, chilled or frozen packaged foods, alcoholic and nonalcoholic beverages, floral, snack foods, candy, other grocery items, health and beauty aids, paper goods, laundry and home care, baby care, pet supplies, and other consumable items; and health and wellness products covering pharmacy, over-the-counter drugs and other medical products, and optical and hearing services.

The stock has a Zacks Style Scores of “A” in both Growth and Momentum, while sporting a “C” in Value.

Q1 Earnings and Estimates

Walmart reported earnings on May 17th, seeing an 11% miss in EPS. Revenues came in above expectations, showing that sales are not the issue. The big miss had to do with costs that ate in to the bottom line and made Walmart much less profitable than it has been in the past.

Looking closer at the quarter, e-commerce grew at 1%, SSS were up 3% and FCF was down $7.3B v up $0.6B year over year.

Management blamed inflationary costs of food and fuel for the pressures on margins this quarter. The company plans to adjust to the environment to deliver profit and growth for the future.

The company guided Q2 EPS “flat to up slightly” and revenues up 5%. So for the short-term, the company is expecting the problems to persist.

Estimates

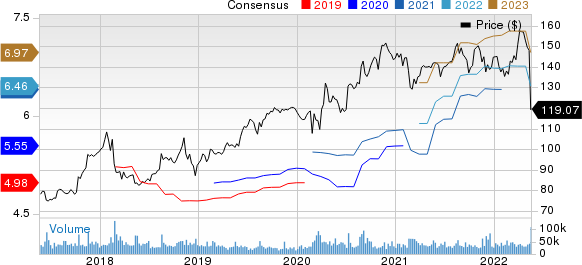

Analysts are taking their numbers down due to the earnings miss and margin fear. Over the last 7 days, numbers have fallen across all time frames. For the current quarter, estimates have ticked down from $1.90 to $1.82, or 4%. For the current year, estimates have fallen to $6.46 from $6.75, again 4%.

Walmart Inc. Price and Consensus

Walmart Inc. price-consensus-chart | Walmart Inc. Quote

Technical Take

Walmart's stock saw one of the biggest losses in its history, falling from $150 to $120 after earnings. This brings the stock down to levels not seen stocks rallied after the COVID lows.

Buying this earnings dip might be a little early, as management thinks its cost issue will remain. Investors should be watching that low from March of 2020 around $102 as a possible entry point. If the stock takes out those lows and holds the $100 area, this is likely the time to buy.

This possible move lower is over 15% from current levels. So investors can likely sit back and wait as the bears take Walmart down to lower prices.

In Summary

At some point Walmart will be a great long-term buy for investors. But for now, money might be better off spent somewhere else in retail.

The sector is struggling, but a better choice in the space might be Korger (KR). The stock is a Zacks Rank #2 (Buy) that has held up well in the recent market sell off.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance