Bear of the Day: Nutrien Ltd. (NTR)

Nutrien NTR, a current Zacks Rank #5 (Strong Sell), has seen its near-term earnings outlook shift negatively across the board over the last several months.

Image Source: Zacks Investment Research

Nutrien is a leading integrated provider of crop inputs and services, supplying growers through its leading global retail network. The company plays a vital role in helping farmers around the world sustainably increase food production.

Current Standing

In its latest release, Nutrien posted weak quarterly results, falling short of earnings expectations by nearly 30% and reporting revenue 8.5% below the Zacks Consensus estimate.

In fact, the company has fallen short of both earnings and revenue expectations in four consecutive quarters, with the average EPS surprise during the period sitting at -22%. The market reacted negatively to the lighter-than-expected results, as illustrated in the chart below.

Image Source: Zacks Investment Research

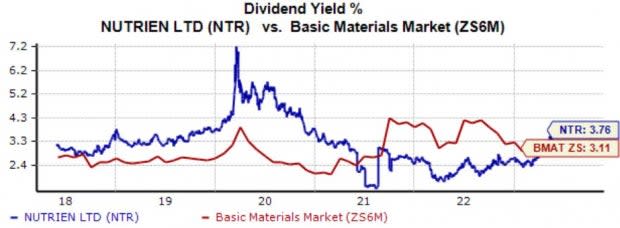

Shares pay a solid dividend, currently yielding 3.8% annually and well above the Zacks Basic Materials sector average. Of course, it’s worth noting that the company’s poor share performance year-to-date has amplified the yield.

Image Source: Zacks Investment Research

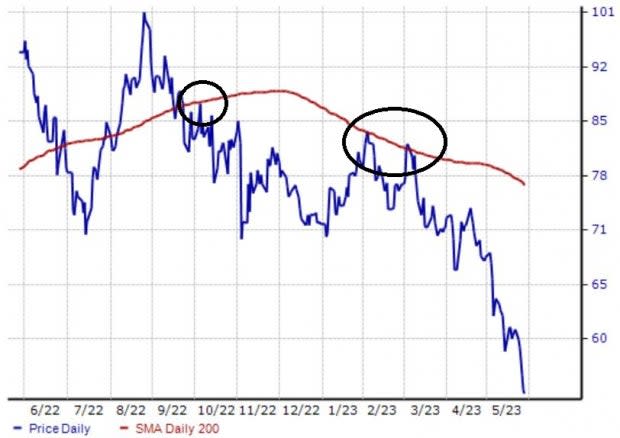

NTR shares broke through the 200-day moving average in late 2022, reflecting a change in trend. As we can see below, shares have been fiercely rejected in both instances they brushed up against the level.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and weak quarterly results paint a challenging picture for the company’s shares in the near term.

Nutrien NTR is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance