Bear of the Day: Armstrong World Industries (AWI)

Armstrong World Industries AWI designs, manufactures, and sells ceiling systems primarily for use in the construction and renovation of residential and commercial buildings in the United States, Canada, and Latin America. The company produces suspended mineral fiber, wood and wood fiber, fiberglass wool, and metal ceiling systems. AWI also produces ceiling perimeters and trims, as well as grid items that support drywall ceiling systems. It sells its systems to resale distributors and contractors, as well as wholesalers and retailers.

The Zacks Rundown

AWI has been severely underperforming the market over the past year. A Zacks Rank #5 (Strong Sell) stock, AWI experienced a climax top in December of last year and has been in a price downtrend ever since. The stock is hitting a series of 52-week lows and represents a compelling short opportunity as the market continues to hover in a deep correction.

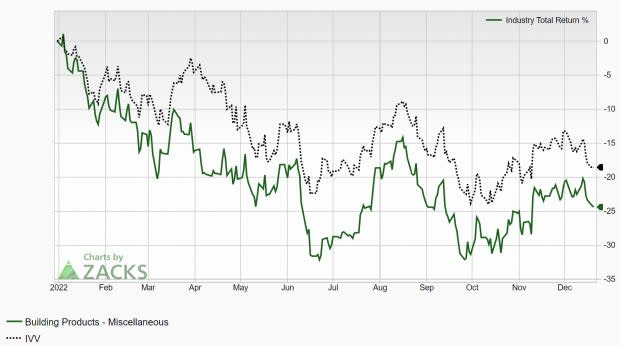

Armstrong World Industries is part of the Zacks Building Products - Miscellaneous industry group, which currently ranks in the bottom 14% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. Candidates in the bottom half of industry groups can often represent solid potential short candidates. While individual stocks have the ability to outperform even when included in poor-performing industries, their industry association serves as a headwind for any potential rallies.

Also note how this industry has underperformed the market at nearly every turn this year:

Image Source: Zacks Investment Research

Weak Foundation: Falling Short on Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for AWI during the past year. The ceiling system provider has fallen short of estimates in three of the past four quarters. AWI most recently reported Q3 EPS back in October of $1.36/share, missing the $1.47 consensus estimate by -7.48%. Revenues of $325 million also missed the mark by -1.66%. These are the types of negative trends that the bears like to see.

AWI has posted an average earnings miss of -5.23% over the past four quarters. Analysts have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed –16.3% over the past 60 days. The Q4 Zacks Consensus EPS Estimate now stands at $1.13/share, translating to minimal growth of just 3.67% relative to the same quarter last year – and this estimate may be high considering the string of misses lately.

Image Source: Zacks Investment Research

Technical Outlook

AWI stock has been steadily falling since last year and has now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined more than 40% in the past year. The stock continues to trade below both averages, while the 50-day moving average has acted as resistance several times throughout the down move:

Image Source: StockCharts

While not the most accurate indicator, AWI has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. AWI would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock.

Final Thoughts

The recent earnings misses in addition to deteriorating estimates are both huge red flags and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

AWI’s characteristics have resulted in a Zacks Value Style Score of ‘D’, indicating weak valuation metrics. The fact that AWI is included in a bottom-performing industry group simply adds to the growing list of concerns. Investors will want to steer clear of AWI until the situation shows major signs of improvement, or possibly include it as part of a hedge or short strategy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance