Baxter (BAX) Plans to Form Standalone Kidney Care Company

Baxter International BAX announced a comprehensive strategic roadmap to simplify its operating model and improve operating efficiencies. These strategic initiatives will also help the company to improve long-term performance, accelerate innovation and create additional value for all stakeholders. These strategic plans include the spin-off of its Renal Care and Acute Therapies global business units into an independent, publicly traded company; simplification of its commercial and manufacturing footprint that will enhance underlying business performance; and portfolio actions to improve Baxter's capital structure.

Standalone Kidney Care

Baxter is a leader in the global kidney care industry with a legacy of more than seven decades. It serves more than one million patients annually in over 70 countries. The company is planning to spin-off the business into a separate entity. Management expects the spinoff to qualify as tax-free for Baxter and its shareholders for U.S. federal income tax purpose, and to be completed in 12 to 18 months.

Renal Care is the biggest division of Baxter’s businesses by sales, accounting for about 25% of third-quarter revenues. Renal Care is being spun off with a smaller business, Acute Therapies, which brought in about 4% of sales in the quarter.

The company believes that the spin off of Renal Care and Acute Therapies businesses into an independent company will help it focus on its own investment priorities. Enhanced management focus will likely lead to better growth opportunities and investments for innovation. As a standalone unit, it is likely to be better-equipped and focused to deliver robust service capabilities that will support its therapies delivered in homes, clinics, and Intensive Care Units across the globe.

Following the separation, the standalone business will target market segments worth approximately $15 billion. These segments are likely to grow between 3% to 4% every year on average for the next three years, suggesting growth opportunities to continue. Baxter’s Renal Care and Acute Therapies global businesses recorded total revenues of approximately $5 billion globally in 2021.

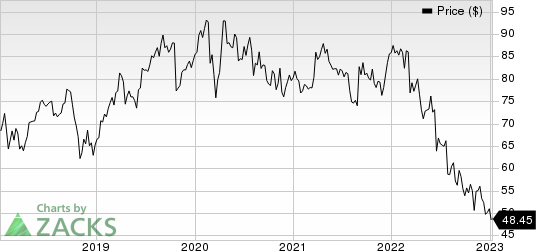

Baxter International Inc. Price

Baxter International Inc. price | Baxter International Inc. Quote

Other Initiatives

Baxter also announced that it is working on a new operating model that will be implemented parallelly with the spin-off actions. This new model is likely to help the company in becoming a more integrated and nimble organization that can respond to changes in the environment quickly and more effectively. It will also help in enhancing Baxter’s ability to advance innovation for its patients. The company looks to provide an update on its new operating model plans on its next earnings call scheduled on Feb 9.

Following the reorganization and the proposed spin-off, the existing businesses of the company are likely to target market segments worth more than $100 billion. These market segments, together, are likely to grow by approximately 3% every year for the next three years.

As part of its strategic actions, Baxter is also pursuing strategic alternatives for its BioPharma Solutions (BPS) business, which includes a potential sale or other separation options. Although the BPS business has continued opportunities for growth, the business model and client focus have limited strategic alignment with the rest of Baxter's portfolio. The divestment of this business segment will help the company streamline its focus and provide an opportunity for capital redeployment in accordance with its stated capital allocation priorities, including debt repayment.

Zacks Rank & Stocks to Consider

Baxter currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks to consider from the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health CAH and Merit Medical Systems MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.96%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has declined 6.2% compared with the industry’s 9.8% decrease in the past six months.

Cardinal Health, carrying a Zacks Rank of 2 at present, has an estimated growth rate of 5.1% for fiscal 2023. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, the average beat being 3.04%.

Cardinal Health has gained 48.4% compared with the industry’s 4.7% increase in the past six months.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.35%.

Merit Medical has gained 35.6% compared with the industry’s 4.7% increase over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance