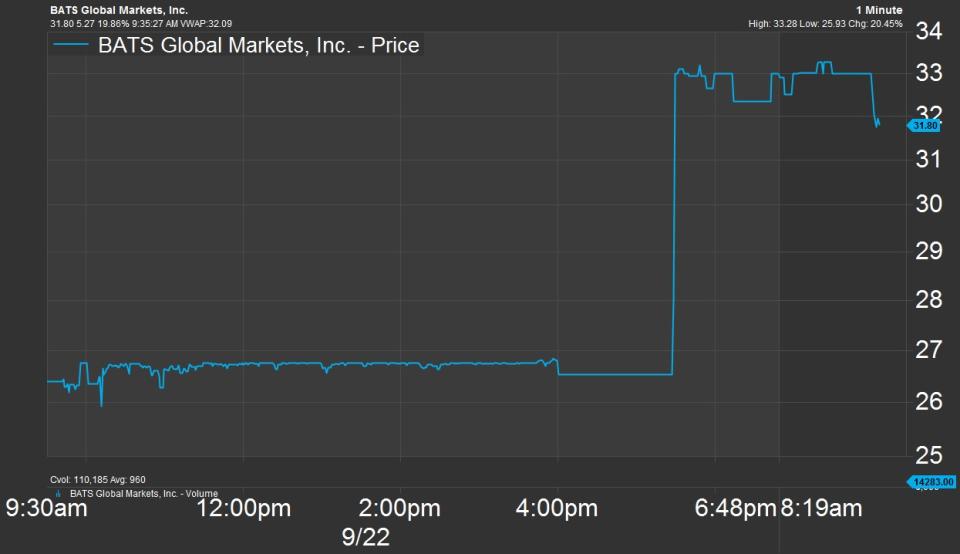

BATS shares surge after report of potential acquisition

Shares of Bats Global Markets (BATS) climbed nearly 20 percent on Friday after a late Thursday Bloomberg report, citing sources, said CBOE Holdings (CBOE) was in talks to buy Bats.

"We do not comment on market speculation or rumors," Bats spokeswoman Hannah Randall told CNBC.

CBOE spokeswoman Suzanne Cosgrove also said the firm does "not comment on rumors or market speculation."

An agreement between Bats and the options exchange operator could be announced in the next several weeks, the Bloomberg report said, noting that no final decision has been made and the talks may still fall apart. BATS shares briefly climbed 25 percent in premarket trade Friday.

Shares of CBOE Holdings swung on the news and gained 1 percent on Friday. They still hold gains of more than 8 percent for the year so far.

Source: FactSet

Bats went public in April in a highly anticipated initial public offering that came four years after a technology glitch foiled its first IPO attempt on its own exchange.

A deal between CBOE and Bats would likely help consolidate operation of options markets and give CBOE a global presence with Bats' business in Europe, said Spencer Mindlin, analyst at financial services research firm Aite Group.

"Generally, consolidation lowers costs for the industry and, hopefully, end investors," he said.

More From CNBC

Top News and Analysis

Latest News Video

Personal Finance

Yahoo Finance

Yahoo Finance