Barrick (ABX) Inks Deal to Acquire 19.9% Stake in Midas Gold

Barrick Gold Corporation ABX has inked a subscription agreement to acquire 46,551,731 common shares of Midas Gold Corp., for gross proceeds of roughly $38.1 million in a non-brokered private placement. The company expects the deal to close on or about May 15, following which, it will own roughly 19.9% of the outstanding common shares of Midas Gold, on a non-diluted basis.

According to Barrick Gold, Midas Gold’s Stibnite Gold project in Idaho has low geopolitical risk. It also has the potential to produce more than 300,000 ounces of gold per annum at competitive operating costs and exploration upside.

Barrick Gold and Midas Gold will enter into an investor rights agreement on deal closure, subject to which, as long as Barrick Gold maintains a minimum of 10% ownership in Midas Gold, the agreement will grant the former the right to appoint one director to the latter’s board, a right to partake in future Midas Gold equity issuances, certain top-up rights with regards to outstanding convertible notes of Midas gold and right to first refusal of gold concentrates.

Midas Gold will increase the number of directors on its board to eight from seven. It will appoint an independent director to fill the position.

Notably, Barrick Gold is acquiring the shares for investment purposes. Subject to market conditions and other factors, the company may acquire additional ordinary shares or other securities of Midas Gold or dispose of some or all of the common shares or other securities of Midas Gold that it owns.

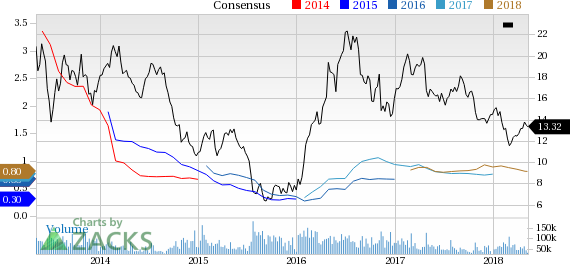

Barrick Gold’s shares have inched up 0.4% in the past three months, underperforming the 2.4% gain recorded by its industry.

Barrick Gold recorded net earnings (attributable to equity holders) of $158 million or 14 cents per share for first-quarter 2018 compared with $679 million or 58 cents a year ago. Adjusted net earnings of 15 cents per share for the quarter came in line with the Zacks Consensus Estimate.

Revenues fell roughly 10.2% year over year to $1,790 million in the first quarter. The figure however, beat the Zacks Consensus Estimate of $1,764.9 million.

The company expects gold production in the second quarter of 2018 to be more or less in line with the first quarter at around 1 million ounces. The results in the second quarter are likely to be impacted by a scheduled maintenance shutdown at the Barrick Nevada roaster.

Barrick Gold Corporation Price and Consensus

Barrick Gold Corporation Price and Consensus | Barrick Gold Corporation Quote

Zacks Rank & Stocks to Consider

Barrick Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space are The Chemours Company CC, Steel Dynamics, Inc. STLD and Huntsman Corporation HUN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth rate of 15.50%. Its shares have jumped 21% over a year.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have rallied 37.5% over a year.

Huntsman has an expected long-term earnings growth rate of 8.3%. Its shares have moved up 19.8% over a year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Chemours Company (The) (CC) : Free Stock Analysis Report

Barrick Gold Corporation (ABX) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance