The Bank of Mum and Dad hits record high, funding one third of first-time buyers

A record high number of first-time buyers are using the Bank of Mum and Dad to fund their purchase, according to a new report by the Social Mobility Commission.

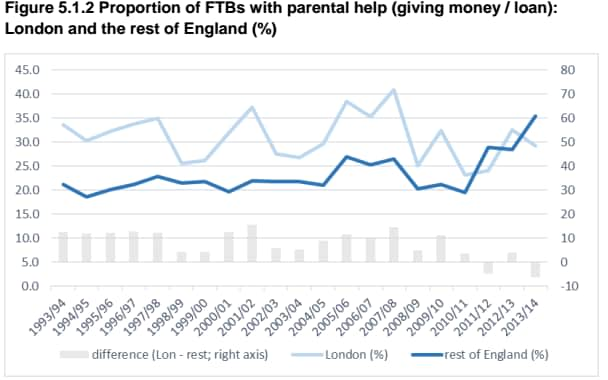

It found that 34pc of these buyers are using loans or gifts from family members, having risen from 20pc seven years ago.

This comes as researchers from the University of Cambridge and Anglia Ruskin University found that among 25-29-year-olds, home ownership has fallen by more than half in the last 25 years, from 63pc in 1990 to 31pc.

The Rt Hon Alan Milburn, chair of the Social Mobility Commission, said: “The way the housing market is operating is exacerbating inequality and impeding social mobility.”

He added: “Owning a home is becoming a distant dream for millions of young people on low incomes who do not have the luxury of relying on the bank of mum and dad to give them a foot up on the housing ladder.”

The researchers forecast that the number of first-time buyers is to climb slightly in the short term, and then gradually fall in the next 25 years.

The report also found that first-time buyers who receive money from their parents can become homeowners 2.6 years earlier than those who self-fund their purchase; in London, this rises to 4.6 years.

One in ten existing buyers also use loans and gifts from family members to buy a new home, and another 9.6pc used inheritance to fund a purchase.

Legal and General said last year that the Bank of Mum and Dad was lending £5bn a year to help their children on to the housing ladder, lending an average amount of £17,500. The amount lent every year puts it in the top 10 of mortgage lenders.

Reader Service: Looking at equity release to help a first-time buyer? Find out more

The Commission, which is an advisory public body, urged the Government to build three million homes over the next decade, a million of which should be constructed by the public sector. It added that to hit these targets, homes should be built on the Green Belt.

Use our free Telegraph equity release calculator or download our free guide to equity release.

Yahoo Finance

Yahoo Finance