AvalonBay Communities (AVB) Q3 FFO & Revenues Lag, View Revised

AvalonBay Communities, Inc. AVB reported third-quarter 2022 core funds from operations (FFO) per share of $2.50, lagging the Zacks Consensus Estimate of $2.53.

The third-quarter results reflect a year-over-year increase in same-store residential rental revenues driven by solid lease rate growth. The same-store average rental revenue per occupied home rises. However, occupancy falls sequentially.

Total revenues in the quarter came in at $665.3 million, missing the Zacks Consensus Estimate of $666.3 million.

Nonetheless, on a year-over-year basis, FFO per share and revenues increased 21.4% and 14.5%, respectively.

In October 2022, AVB acquired Avalon Highland Creek in Charlotte, NC, for $76.7 million. This is a wholly-owned community having 260 apartment homes.

Quarter in Detail

In the reported quarter, the same-store residential rental revenues on a cash basis increased 10.5% year over year to $567.9 million. Same-store operating expenses rose 6.5% to $179.9 million. The same-store residential net operating income (NOI) climbed 14.4% to $388.4 million from the prior-year period.

Same-store average rental revenue per occupied home rose to $2,839 as of Sep 30, 2022, from $2,766 as of Jun 30, 2022. However, the same-store economic occupancy decreased 40 basis points sequentially to 96.4%.

As of Sep 30, 2022, AvalonBay had 17 consolidated development communities under construction (expected to contain 5,427 apartment homes and 56,000 square feet of commercial space). The estimated total capital cost of these development communities at completion is $2.28 billion.

Portfolio Activity

During the third quarter, AVB acquired Avalon Miramar Park Place in Miramar, FL, for $295 million. This is a wholly-owned community containing 650 apartment homes.

AvalonBay sold 10 of the 172 residential condominiums at The Park Loggia in New York, NY, for gross proceeds of $38.9 million in the reported quarter. As of Sep 30, 2022, it concluded the sale of 161 of the 172 residential condominiums for total gross proceeds of $472.2 million.

In the reported quarter, AVB disposed of five wholly-owned communities, namely Avalon Green I, Avalon Green II and Avalon Green III in Elmsford, NY, Avalon Del Mar Station in Pasadena, CA, and Avalon Sharon in Sharon, MA, for $543.9 million. The communities have a total of 1,120 apartment homes.

Balance Sheet

AVB had $487.1 million of unrestricted cash and cash in escrow as of Sep 30, 2022.

In September 2022, AVB amended and restated its unsecured revolving credit facility. It increased the borrowing capacity from $1.75 billion to $2.25 billion and extended the maturity of the same from February 2024 to September 2026. The company has the option to prolong the maturity by two successive terms of six months each for a fee. As of Sep 30, 2022, AVB did not have any borrowings outstanding under its unsecured revolving credit facility.

Additionally, its annualized net debt-to-core EBITDAre for the July-September period was 4.6 times and the unencumbered NOI for the nine months ended Sep 30, 2022, was 95%.

2022 Outlook Revised

AvalonBay revised its 2022 outlook.

For fourth-quarter 2022, it expects core FFO per share to lie in the range of $2.55-$2.65. The Zacks Consensus Estimate for the same is currently pegged at $2.53.

For 2022, AVB expects core FFO per share between $9.74 and $9.84, revised from $9.76-$9.96 guided earlier. The Zacks Consensus Estimate for the same presently stands at $9.87.

Management expects same-store residential rental revenues to lie between 10.8% and 11.2%, revised from 10.75-11.75%. Same-store residential NOI is expected in the range of 13-13.8%, revised from 13.5-15.0% estimated earlier.

AvalonBay Communities currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

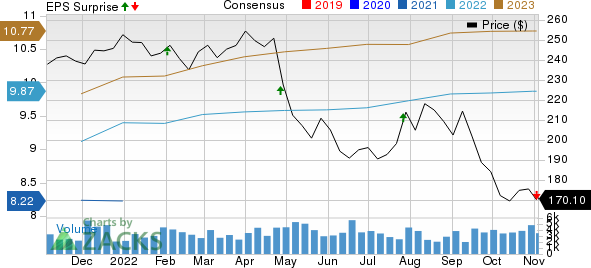

AvalonBay Communities, Inc. Price, Consensus and EPS Surprise

AvalonBay Communities, Inc. price-consensus-eps-surprise-chart | AvalonBay Communities, Inc. Quote

Performance of Other REITs

Equity Residential’s EQR third-quarter 2022 normalized FFO per share of 92 cents outpaced the Zacks Consensus Estimate of 91 cents. On a year-over-year basis, the FFO per share grew 19.5% from 77 cents.

Results reflect healthy demand during the primary leasing season. This residential REIT also benefited from the favorable real estate tax and payroll expenses. EQR narrowed its full-year guidance for normalized FFO per share.

Essex Property Trust Inc. ESS reported third-quarter 2022 core FFO per

share of $3.69, beating the Zacks Consensus Estimate of $3.68. The figure also surpassed the midpoint of the company’s guidance range by 4 cents and improved by 18.3% from the year-ago quarter.

Results reflect improving same-property NOI in the quarter. ESS raised the full-year 2022 core FFO per share guidance.

Mid-America Apartment Communities, Inc. MAA, commonly referred to as MAA, reported third-quarter 2022 core FFO per share of $2.19, surpassing the Zacks Consensus Estimate of $2.09. The reported number improved 23% year over year.

This residential REIT’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. MAA also increased its outlook for core FFO per share growth for the year.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

MidAmerica Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance