Auto Stock Roundup: TSLA, HOG & CMI Top Q1 Earnings Estimates, F Incurs Loss

We are in the thick of the Q1 earnings season, with a host of auto companies having reported quarterly numbers in the past week. U.S. auto bigwigs like Tesla, Harley Davidson and Cummins, among others, managed to deliver earnings beat despite coronavirus woes. Conversely, Ford posted wider-than-expected loss in the first quarter of 2020.

As the virus continues to crimp demand, April deliveries in the United States slid further. Toyota, Honda Motor, Subaru, Hyundai and Kia sales declined 54%, 54%, 47%, 39% and 38%, respectively, on a year-over-year basis. To add to the woes, inventory glut is making things worse for the auto industry. With stalled car sales amid the coronavirus pandemic, new vehicles are piling up.

(Read the Last Auto Stock Roundup here)

1. Harley-Davidson, Inc. HOG reported earnings per share of 45 cents in first-quarter 2020, surpassing the Zacks Consensus Estimate of 40 cents. The bottom line, however, declined from the prior-year quarter’s 80 cents per share. Total revenues from Motorcycle and Related products, which form the bulk of overall revenues, declined 8% year over year to $1099.8 million in the reported quarter. However, the top line surpassed the Zacks Consensus Estimate of $1,017 million.During second-quarter 2020, the company approved a cash dividend of 2 cents per share, down from first-quarter dividend of 38 cents. Harley-Davidson withdrew its 2020 guidance in response to disruptions to the company’s supply chain due to coronavirus crisis. (Harley-Davidson Beats on Q1 Earnings, Scraps '20 View)

2. Ford F reported first-quarter 2020 adjusted loss per share of 23 cents, wider than the Consensus Estimate of a loss of 10 cents. In the prior-year quarter, adjusted earnings were 44 cents per share. The weaker year-over-year results can be attributed to lower automotive sales across all markets served. The firm’s first-quarter sales were affected by depressed demand for vehicles, thanks to the coronavirus outbreak. Ford registered revenues of $34,320 million in first-quarter 2020, down from the year-ago quarter’s $40,342 million. The firm has drawn down its credit revolvers, and suspended dividends as well as anti-dilutive share buyback programs. Importantly, Ford expects second-quarter operating loss of more than $5 billion. (Ford Q1 Loss Wider Than Estimated, Q2 to be Worse)

3. Tesla, Inc. TSLA reported earnings per share of $1.24 in first-quarter 2020 against the Zacks Consensus Estimate of a loss of 22 cents. This outperformance stemmed from higher-than-anticipated automotive revenues of $5.13 billion, which beat the consensus mark of $4.47 billion. The prior-year quarter’s loss was $2.90 per share.For full-year 2020, the company expects vehicle deliveries to exceed 500,000 units. However, amid coronavirus-related setbacks, Tesla refrained from providing any profit or cash-flow forecast.The EV maker expects to ramp-up production of Model 3 in Shanghai and Model Y in Fremont through second-quarter 2020, and start deliveries from both locations by 2021. (Tesla's Q1 Earnings & Revenues Beat Estimates, Up Y/Y)

4. Sonic Automotive, Inc. SAH registered adjusted earnings per share of 40 cents in first-quarter 2020, beating the Zacks Consensus Estimate of 20 cents. Higher sales from the used vehicle unit led to outperformance. Moreover, the bottom line was a penny higher than 39 cents per share reported in the year-ago quarter on the back of solid performance of the EchoPark segment. However, total revenues in the reported quarter amounted to $2,308 million, down 3.4% from the prior-year period. Further, revenues missed the Zacks Consensus Estimate of $2,325 million. In the quarter under review, the EchoPark segment recorded revenues of $331.7 million, reflecting a 33% uptick from the year-ago figure. Its stores sold 13,986 units, up 27% on a year-over-year basis. (Sonic Automotive Q1 Earnings Beat on EchoPark Strength)

5. Cummins Inc. CMI reported earnings of $3.18 per share in first-quarter 2020, surpassing the Zacks Consensus Estimate of $2.18.The bottom line, however, declined from earnings of $4.20 a share recorded in first-quarter 2019. Cummins’ revenues also declined 16.7% year over year to $5,011 million in the reported quarter. However, revenues beat the Zacks Consensus Estimate of $4,946 million. Amid coronavirus-led uncertainty, Cummins scrapped its annual view. The company anticipates second-quarter results to take a severe hit due to disruptions across customer and supplier operations, and lower end-market demand. (Cummins Tops Q1 Earnings Estimates, Revokes '20 View)

6. LKQ Corporation LKQ reported adjusted earnings of 57 cents per share in first-quarter 2020, surpassing the Zacks Consensus Estimate of 51 cents. The bottom line also increased 1.8% year over year. Quarterly revenues came in at 3,000.9 million, topping the Zacks Consensus Estimate of $2,984 million. However, the top line decreased from the year-ago level of $3,100.3 million. Parts and services organic growth also fell 3.5% year over year. Amid coronavirus-led uncertainty and financial crisis, the company suspended share buybacks as well as withdrew its view for 2020. (LKQ Corp. Q1 Earnings Top, Up Y/Y Amid Coronavirus Woes)

Price Performance

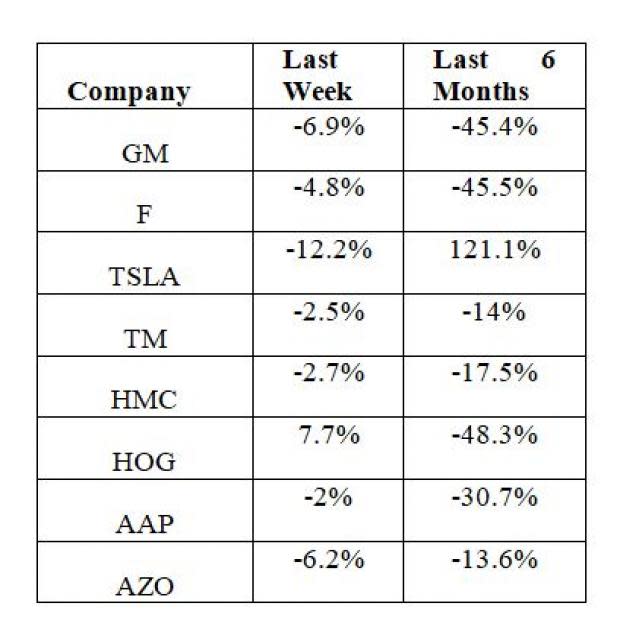

The following table shows the price movement of some of the major auto players over the past week and six-month period.

In the past week, all the stocks have declined apart from Harley-Davidson. In the past six months, all the stocks except Tesla have witnessed a decline.

What’s Next in the Auto Space?

Watch out for further impact of the pandemic on the auto sector. Investors in the auto sector are keenly awaiting quarterly results of major auto companies including General Motors, BorgWarner and Genuine Parts Company that are scheduled to release this week.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance