Auto Roundup: WGO to Acquire Lithionics, F Signs Nickel Deal & More

In a bid to accelerate electrification goals and achieve a greater control over the supply chain, automakers are boosting upstream investments to secure the supply of critical battery metals. To that end, U.S. legacy automaker Ford F announced last week that it has partnered with mining company PT Vale Indonesia and China-based material processor Zhejiang Huayou to spur nickel production in Indonesia.

Recreational vehicle (RV) maker Winnebago Industries Inc. WGO is set to buy lithium-ion battery manufacturer, Lithionics Battery ("Lithionics"), deepening its focus on electric RVs as the world is gradually transitioning to an e-mobility future. Auto retailer Group 1 Automotive GPI acquired a Chevrolet dealership in Florida and provided a year-to-date update on its repurchase activity.

Trucking giant PACCAR Inc. PCAR has made an equity investment in Platform Science, PACCAR’s connected truck partner. Japan’s auto giant Honda’s HMC also made it to the top stories as it grapples with vehicle recalls.

While GPI and PCAR currently carry a Zacks Rank #2 (Buy), WGO and HMC are #3 Ranked (Hold). Meanwhile, F carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

Winnebago inked an agreement to acquire Lithionics as it looks to secure supply chain for its electric offerings, going forward. The acquisition of Lithionics will empower Winnebago Industries with enhanced technological and engineering capabilities to offer consumers more innovative products with cutting-edge electrical solutions.The terms of the deal have been kept under wraps. The acquisition is expected to boost WGO’s near-and long-term margins.

Winnebago’s CEO Michael Happe said, “The addition of Lithionics enhances Winnebago Industries’ ability to develop unique and diverse battery solutions across our portfolio, advancing our overall electrical ecosystem, driving organic growth and supply chain security, reinforcing our technological competitive advantage and allowing us to capitalize on consumer preferences for fully immersive, off-the-grid outdoor experiences.”

In a separate development, Winnebago’s subsidiary, Chris-Craft, is opening a new manufacturing facility in Sarasota. The state-of-the-art manufacturing site spans over 70,000 sq ft and will boost the company’s production capacity by 50%.

Group 1 announced the acquisition of Estero Bay Chevrolet dealership in Estero, FL in a bid to further expand its operations in the United States and boost revenues.Located near Fort Myers in Southwest Florida. Estero Bay Chevrolet is the fifth largest Chevrolet dealership in terms new vehicle volume in Florida. The buyout is expected to add $150 million in annualized sales.

Group 1’s acquisitions of dealerships and franchises to expand and optimize its portfolio are likely to boost the firm’s prospects. In 2021, the company acquired Prime Automotive in Northeastern United States and the Robinsons Group in the UK, which diversified Group 1’s footprint and are set to buoy top-line growth. In 2022, Group 1 completed transactions representing $1 billion of acquired revenues.

Meanwhile, Group 1 also provided an update on its share buyback activity. From the beginning of 2023 to Mar 28, 2023, the company repurchased 180,982 shares for $34.7 million at an average price of $191.85.

Honda is recalling over 330,000 vehicles because the heating pads behind both side-view mirrors may not be properly bonded, possibly resulting in the mirror glass coming out and increasing the risk of accidents. The recall covers the 2020-2022 Odyssey, 2020-2022 Passport, 2020-2021 Pilot and 2020-2021 Ridgeline. As stated by the National Highway Traffic Safety Administration, the vehicles do not comply with the necessary rear visibility standards. Honda dealers will replace impacted vehicles' side-view mirrors at no cost.

This is the second recall issue in March. A couple of weeks back, Honda recalled nearly 500,000 vehicles due to manufacturing issues that could prevent front seat belts from latching properly.The models that are part of the recall are 2017-2020 CR-V, 2018-2020 Odyssey, 2018-2019 Accord and Accord Hybrids, 2019-2020 Acura RDXs and the 2019 Insight.

Ford will be investing in the Pomalaa Block High-Pressure Acid Leaching (HPAL) Project in Indonesia. Vale and Huayou commenced construction of the plant last November and commercial operations at the facility are expected to begin in 2026. The three-way nickel project aims to produce up to 120 kilotons per year of contained nickel in the form of "mixed hydroxide precipitate," which is a lower-cost nickel product used in EV batteries. The partnership supports Ford’s ambitious targets to deliver 2 million EVs by the end of 2026.

Quoting Lisa Drake, vice president of Ford Model e EV industrialization, “This framework gives Ford direct control to source the nickel we need – in one of the industry’s lowest-cost ways – and allows us to ensure the nickel is mined in line with our company’s sustainability targets, setting the right ESG standards as we scale. Working this way puts Ford in a position to help make EVs more accessible for millions and to do it in a way that helps better protect people and the planet.”

Meanwhile, in a bid to offset commodity inflation pressures, Ford hiked the prices of its hot-selling F-150 Lightning e-pickup. The company is raising the price of F-150 Lightning Pro from $55,974 to $59,974.

PACCAR and Platform Science recently partnered to integrate Platform Science’s Virtual Vehicle technology with the PACCAR Connect telematics system. This strategic investment will supplement the integration process. The investment in Platform Science will make PACCAR Connect a handy, customizable and productive connected truck solution and improve customers’ agility and operating efficiency. The product will be launched on Kenworth and Peterbilt trucks in 2024.

The product will offer customers a standardized telematics operating solution and application store through which they can directly access software solutions, real-time vehicle data and third-party applications from their vehicles. The number of telecommunications devices used in the vehicles will be reduced to uncomplicate the vehicle information technology environment. Factory installation will eliminate the need for aftermarket installation, increasing customer productivity and uptime.

Price Performance

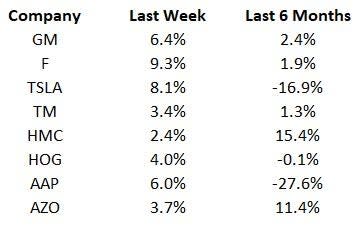

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

Industry watchers will keep a tab on auto biggies releasing first-quarter 2023 U.S. vehicle deliveries data.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance