Auto Roundup: GM's Q1 Deliveries, CMI's $1B Investment & More

Last week, various auto biggies released their U.S. vehicle delivery numbers for the quarter ended March 2023.Despite economic uncertainties, demand for vehicles seems to have held its ground. Through the three months ended March 2023, the seasonally adjusted annual rate (SAAR) is forecast at 15 million units, an increase from 14.1 million SAAR in the corresponding period of 2022. Most companies posted year-over-year growth in sales for the first quarter of 2023. U.S. auto giants General Motors GM and Ford F witnessed double-digit percentage growth in sales. Meanwhile, Japan-based Toyota TM saw its deliveries fall year over year. Close peer Honda’s HMC deliveries increased in the first quarter of 2023. Leading truck engine maker Cummins CMI also made to the top stories as it stated plans to invest $1 billion to support the industry's first fuel-agnostic engine platforms operating on low-carbon fuels to help decarbonize the U.S. truck fleets.

Last Week’s Top Stories

General Motors’ total deliveries were 603,208 vehicles in the first quarter of 2023, an 18% rise year on year. In the first quarter, the company experienced growth across all brands, with GMC sales increasing 8%. Cadillac, Buick and Chevrolet recorded double-digit percentage growth of 29%, 99%, and 16%, respectively.For the first time, the company sold more than 20,000 electric vehicles (EVs) in a quarter. The U.S. legacy automaker is on track to build 50,000 EVs in North America through the first half of 2023 and 100,000 in the second half of the year.

The company delivered 270,376 full-size pickups, midsize pickups and full-size SUVs. Launches of new Chevrolet Colorado and GMC Canyon midsize vehicles, as well as Chevrolet Silverado HD and GMC Sierra HD pickups, are underway. Retail sales of Chevrolet Silverado and GMC Sierra witnessed year-over-year growth of 9% in deliveries.

GM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ford registered sales of 475,906 units, up 10.1% year over year. Soaring demand for F-Series trucks, Bronco and Explorer SUVs, and electric vehicles largely contributed to the sales growth. Ford’s total truck sales jumped 19.6% year over year to 254,023 units during the quarter under discussion. Sales of Ford F-Series—America’s best-selling truck—totaled 170,377 units, up 21%. A total of 4,291 F-150 Lightning e-trucks were sold in the first quarter of 2023, rocketing from 254 units delivered in the corresponding period of 2022. Ford’s electric vehicle sales totaled 10,866 units, up 41% on a yearly basis.

Sales of SUVs inched up 1.7% in the quarter to 207,142 units. While Bronco, Explorer and Expedition SUVs witnessed double-digit percentage sales growth, deliveries of EcoSport, Mustang Mach-E and Edge brands declined. Sales of Bronco, Explorer and Expedition totaled 32,430, 58,061 and 19,356 units, soaring 37.6%, 35.9% and 99.2%, respectively. The best-selling, three-row midsize SUV in America was the Ford Explorer.

Toyota reported total U.S. sales of 469,558 vehicles in the first quarter of 2023, down 8.8% year over year. Of the total vehicles sold in the reported quarter, 118,836 were EVs, representing 25.3% of the total sales. In the first quarter of 2022, out of the total vehicles sold, 132,938 were EVs, representing 25.8% of the total sales. In March 2023, Toyota sold 176,456 vehicles, down from 194,178 vehicles sold in the same quarter of 2022. EV sales in March 2023 represented 27.5% of total sales, up from 25.4% in March 2022.

For the first quarter of 2023, while the namesake brand registered sales of 401,306 vehicles, down 11% year over year, the Lexus division registered total sales of 68,252 vehicles, up 6% year over year. In March, Toyota’s division registered total sales of 150,099 vehicles, down 12% year over year. Meanwhile, Lexus sold 26,357 vehicles last month, up from 23,514 vehicles in March 2022. Toyota’s best-ever Q1-selling models include the Corolla HEV, Corolla Cross, Highlander HEV, RAV4 PRIME, Tundra HEV, NX HEV, NX PHEV, UX HEV and LC HEV.

Honda reported U.S. sales of 284,507 vehicles in the first quarter of 2023, up from 266,418 vehicles in the first quarter of 2022. In the first quarter of 2023, the Acura division sold 33,465 vehicles, up from 28,236 vehicles in the same quarter of 2022, while the Honda division sold 251,042 vehicles, up from 238,182 vehicles in the same quarter of 2022. In the first quarter of 2023, out of the total American Honda vehicles sold, 49,342 were EVs, up from 25,361 in the first quarter of 2022.

In March 2023, American Honda reported its best sales since July 2021, with total sales of 116,746 vehicles. In the same period, the Acura division sold 13,569 vehicles, up from 13,220 in March 2022, whereas the Honda division sold 103,177 vehicles, up from 94,855 vehicles in March 2022. In March 2023, the all-new Acura Integra sold 3,012 units for the first time, while Acura MDX and RDX together sold nearly 9,000 units. MDX remained Acura’s top-selling model in March with over 6,000 units sold. Acura is set to reveal a high-performance Integra Type S model this April.

Cummins announced its decision to invest $1 billion across its manufacturing sites in North Carolina, Indiana and New York. This investment will be utilized to upgrade those manufacturing sites to support fuel-agnostic engine platforms that run on low-carbon fuels, including diesel, natural gas and eventually hydrogen. The investment includes a $452 million outlay to upgrade its 998,000-square-foot facility at the Jamestown Engine Plant in Western New York. At this facility, Cummins plans to produce a fuel-agnostic internal combustion engine platform.

Cummins will start manufacturing an essential piece of technology called electrolyzer to produce green hydrogen that will help decarbonize the U.S. economy. With the production of electrolyzer in Minnesota and investments in Indiana, North Carolina and New York facilities, Cummins has taken a dual-path approach and will work toward advancing engine-based and zero-emission solutions. The electrolyzer will produce hydrogen that can be used to power hydrogen fuel cell vehicles and in the production of steel. Building an electrolyzer in Minnesota is a $10 million investment and an important step toward bringing the supply chain for zero-emissions vehicles to the United States.

Price Performance

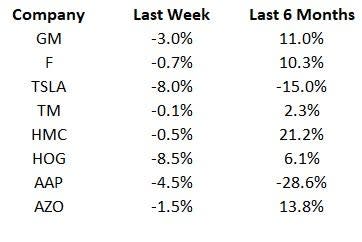

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

The first-quarter 2023 earnings season for the auto sector kicks off next week. Investors are keenly awaiting Tesla’s results, set to be released on Apr 19. Other auto stocks like Lithia Motors, Genuine Parts and AutoNation will be reporting next week. Also, industry watchers will track China vehicle sales data for March 2023, which will be released by the China Association of Automobile Manufacturers soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance