Auto Roundup: CVNA's Debt Restructuring, WGO's Quarterly Results & More

Last week, the European Automobile Manufacturers Association (“ACEA”) released data on passenger car registrations for February 2023. The European Union (“EU”) passenger vehicle market rose 11.5% last month to 802,763 units, marking the seventh straight month of growth. Most EU markets witnessed robust growth. Registrations in Italy, France and Spain rose 17.4%, 9.4% and 19.2%, respectively, on a year-over-year basis. Germany saw a modest increase of 2.8% in registrations last month. Registrations of battery-powered electric vehicles (BEVs) rose 39.7% to 97,300 cars. In the first two months of 2023, EU market vehicle registrations reached 1.6 million units, up 11.4% year over year.

On the news front, the used car e-retailer Carvana CVNA came to the spotlight with its plan to restructure its debt load in its latest attempt to stay afloat. The company also announced preliminary first-quarter 2023 results and expects a narrower year-over-year core loss in the quarter to be reported. Auto replacement parts provide Genuine Parts Company GPC partnered with Google Cloud to support business transformation and elevate customers’ experience. The company also laid out its long-term targets.

Recreational vehicle maker Winnebago Industries WGO came out with its second-quarter fiscal 2023 results. Itcmanaged to keep its earnings beat streak alive. Meanwhile, Germany-based auto giant Volkswagen's VWAGY withdrawal plan from Russia hit a roadblock after the Russian court froze its assets based on a lawsuit filed by Gaz Group.

Last but not least, the U.S. auto biggie Ford F made it to the top stories as it disclosed that its electric vehicle (EV) business is set to report a $3 billion loss this year amid increasing spending. Last year, in one of the boldest steps taken under the leadership of CEO Jim Farley, Ford unveiled its ambitious rejig plan to split its EV business into a separate unit within the company. While Ford Blue will focus on the firm’s legacy gas-powered business, Ford Model e will focus on EVs, advanced technologies and several related aspects to support electrification plans. Meanwhile, Ford Pro will deal with commercial vehicles and services.

While VWAGY currently carries a Zacks Rank #2 (Buy), GPC, WGO and CVNA are #3 Ranked (Hold). Meanwhile, F carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

Genuine Parts announced a partnership with Google Cloud to draw on the latter’s spectrum of services. Google Cloud’s trailblazing data and analytics platforms are set to modernize Genuine Parts’ supply chain and improve customer experience. With a multitude of services provided by Google Cloud, Genuine Parts plans to optimize its tech infrastructure to support more than 10,000 stores and fulfillment centers across the globe.

The company also hosted its 2023 Investor Day last week and reaffirmed its outlook for the current year. GPC also provided an update on its long-term target and growth initiatives.For 2023, the auto replacement part distributor expects its automotive sales growth, industrial sales growth and total sales growth within the range of 4-6%. Adjusted diluted earnings per share and diluted earnings per share are both expected to be between $8.85 and $8.95.

Genuine Parts expects its total sales and EBITDA to range within $26.5 billion-$27 billion and $2.65 billion-$2.75 billion, respectively, for 2025. Earnings per share are expected to fall within the range of $11.00-$11.50. During the span of three years (2023-2025), the company projects its sales to record a compounded annual growth rate (CAGR) of 6-7%. Earnings per share are likely to see a CAGR of 10-11%. Cumulative free cash flow for the three years is expected within the range of $2.6 billion-$2.8 billion.

Winnebago reported adjusted earnings of $1.88 per share for second-quarter fiscal 2023 (ended Feb 25, 2023), which topped the Zacks Consensus Estimate of $1.32 on higher-than-anticipated EBITDA across all segments. The bottom line, however, plunged 40% year over year. The company reported revenues of $866.7 million in the quarter under review, crossing the Zacks Consensus Estimate of $781 million. Nonetheless, the top line fell 25.5% year over year.

Revenues in the Towable segment in the reported quarter fell 47% year over year to $342.5 million. Adjusted EBITDA declined 60.9% to $39.3 million. The segment’s backlog was $278.2 million (5,841 units), decreasing 85.1%. Revenues in the Motorhome segment slid 3.3% year over year to $403.8 million. The segment recorded an EBITDA of $42.5 million, down 7.8%. The backlog was $872.7 million (5,341 units), down 60.6% from the prior year. Revenues in the Marine segment were $112.9 million, jumping 16.1%. The segment recorded an EBITDA of $14.4 million, up 11.4% year over year. The backlog for the Marine segment was $238.5 million (2,511 units), down 14.1%.

Winnebago had cash and cash equivalents of $229.3 million as of Feb 25, 2023. The long-term debt (excluding current maturities) increased to $591 million from $545.9 million, recorded on Aug 27, 2022. The company approved a dividend of 27 cents a share, to be paid on Apr 26, 2023, to shareholders of record at the close of business on Apr 12, 2023.

Carvana announced that it is offering its creditors an option to exchange their unsecured notes at a premium to current trading prices for new secured notes backed by collateral. The offer is for exchanging as much as $1 billion of bonds, including a condition that at least $500 million existing notes be validly tendered. The exchange will push back repayment on some obligations to 2028 from as early as 2025. It will also help in “reducing Carvana’s cash interest expense and maintaining significant flexibility,” per the company.

The company is offering to swap five series of bonds, maturing between 2025 and 2030. Per Financial Times, “if fully subscribed, the exchange offer to existing creditors would reduce the face value of its outstanding $5.7 billion of unsecured bond debt by $1.3 billion and its annual cash interest bill by roughly $100 million. If fully subscribed, $1 billion of secured bonds would replace $1.3bn of unsecured debt.”

The company also released its preliminary first-quarter 2023 results. CVNA expects adjusted negative EBITDA in the band of $50-$100 million, implying an improvement from $348 million in the corresponding quarter of 2022 due to higher GPU and lower SG&A costs.While the company expects an improvement in EBITDA thanks to operational efficiency, it estimates retail units sold in the first quarter of 2023 to be between 76,000 and 79,000 units, down from 105,185 in the year-ago period. Consequently, total revenues are envisioned in the range of $2.4-$2.6 billion, implying a decline from $3.5 billion in the first quarter of 2022.

Volkswagen’s efforts to wind down its operations in Russia suffered a massive blow last week as the Russian court froze its assets. Last year, amid mounting tension between Russia and Ukraine, the German automaker announced to cease production in Russia. The automaker has been trying to sell its Russian assets, which include its flagship plant in Kaluga and an automotive assembly plant in Nizhny Novgorod, which it used to run in collaboration with local carmaker Gaz Group.

Gaz filed a lawsuit against Volkswagen, claiming that the latter abruptly ended the agreement that was due to run until 2025 and sought to freeze the German automaker’s assets. In its filing, Gaz mentioned that Volkswagen’s plan to leave the Russian market conflicts with its own interest and claimed compensation of RUB 15.6 billion.

In response to the filing, the Russian court froze Volkswagen’s shares in its Russian subsidiary Volkswagen Rus, shares in four different financial services companies along with several factories and manufacturing equipment.Volkswagen’s Russian subsidiary said that it is stunned by the lawsuit and that their partnership "ended on mutually agreed terms." In a statement to Reuters, it said, "We are aware of the claim from GAZ and are familiarizing ourselves with the case materials."

Ford anticipates its EV business unit to witness a pretax loss of $3 billion this year. As we know, effective first-quarter of 2023 results to be released on May 2, the U.S. legacy automaker will report its automotive results under three business segments — Ford Model e, Ford Blue and Ford Pro. Till now, it used to report based on geographical regions.Ford expects Model e’s cumulative three-year loss (2021-2023) to be around $6 billion, including a pro-forma loss of $900 million and $2.1 billion in 2021 and 2022, respectively.

Nonetheless, the auto giant expects its first generation of EVs, including the F-150 e-pickup and Mustang Mach E, to become profitable on a pretax basis by the end of next year. The automaker reaffirms its target to produce 600,000 EVs by the end of 2023 and 2 million by 2026-end. It also forecasts the Model e unit to achieve a pretax profit margin of 8% by late 2026.

As for Ford Blue, the company expects pretax income from the segment to increase nominally by around 3% year over year to $7 billion. Ford Pro unit’s pretax income is expected to almost double to $6 billion in 2023. Meanwhile, Ford Credit profits are expected to decline around 50% year over year to $1.3 billion.

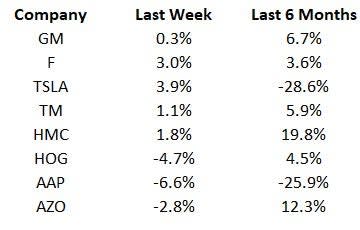

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

Industry watchers will keep a tab on February commercial vehicle registrations to be released by the ACEA.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance