Australian Dollar Facing Conflicting Domestic, External Catalysts

Fundamental Forecast for Australian Dollar: Neutral

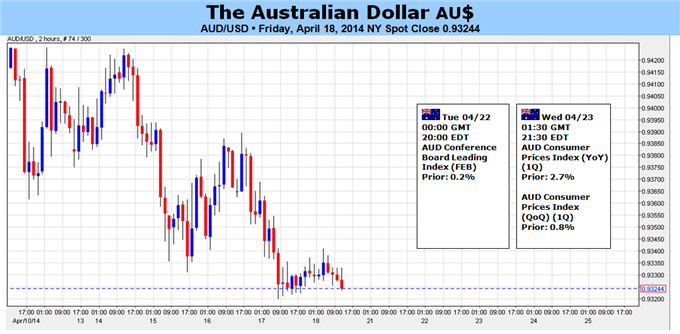

Australian Dollar Looking to Upbeat CPI Data to Rekindle Up Move

Firming US News-Flow May Hurt AUD/USD on Narrowing Policy Gap

Help Time Turning Points for the Australian Dollar with DailyFX SSI

The Australian Dollar’s month-long winning streak ran into resistance last week as the build-up in RBA policy expectations stumbled. A Credit Suisse measure of investors’ priced-in policy bets over the coming 12 months declined for the first time in three weeks. A potentially conflicting set of fundamental event risk in the week ahead promises to keep driving policy outlook speculation and keep volatility elevated.

On the domestic news-flow front, the spotlight will be on first-quarter CPIdata. Expectations suggest the headline year-on-year inflation rate will rise to 3.2 percent from 2.7 percent recorded in the three months through December 2013, marking the highest level in over two years.

Data from Citigroup shows Australian economic news-flow has increasingly outperformed relative to consensus forecasts since mid-February, suggesting economists are underestimating Australia’s place in the business cycle. That opens the door for an upside surprise. Such a result may go a long way toward rebuilding support on from the RBA policy outlook and driving the Aussie higher.

Externally, a busy docket of US activity data will help inform bets on the continuity of the Fed’s effort to “taper” QE asset purchases. Home Sales, Durable Goods Orders and Consumer Confidence figures are in the spotlight. Economic data outcomes from the world’s largest economy showed a notable improvement relative to expectations over the past two weeks. If that trend continues, ebbing doubt about the continued withdrawal of Fed stimulus. That may highlight the immediacy of the Fed’s move to narrow the policy gap compared with the RBA’s apparent preference for inaction in the near term, weighing on AUD/USD.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance