AUD/USD Risks Fresh Monthly High on Upbeat Australia Employment

DailyFX.com -

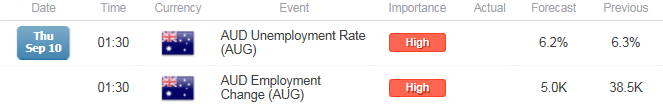

- Australia Employment Projected to Increase for Fourth Consecutive Month.

- Jobless Rate to Narrow to 6.2% from 2015 High.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Australia Employment Change

Another 5.0K expansion in Australia Employment may spur a larger rebound in AUD/USD as signs of a stronger recovery encourage the Reserve Bank of Australia (RBA) to retain its current policy throughout 2015.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

RBA Governor Glenn Stevens may continue to endorse a wait-and-see approach as the board anticipates a sustainable recovery ahead, and a further improvement in the labor market may boost the appeal of the higher-yielding currency as the central bank appears to be moving away from its easing cycle.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

AiG Performance of Construction Index (AUG) | -- | 53.8 |

AiG Performance of Services Index (AUG) | -- | 55.6 |

Building Approvals (MoM) (JUL) | 3.0% | 4.2% |

The pickup in building activity may help to generate a strong employment report, and the aussie-dollar may continue to retrace the decline from the previous month should the data heighten interest rate expectations.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

NAB Business Confidence (AUG) | -- | 1 |

Retail Sales (MoM) (JUL) | 0.4% | -0.1% |

Gross Domestic Product (YoY) (2Q) | 2.2% | 2.0% |

However, waning confidence paired with the slowdown in private-sector may drag on hiring, and a dismal development may fuel the bearish sentiment surrounding the Australian dollar as the RBA largely retains the verbal intervention on the local currency.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Employment Climbs Another 5.0K or Greater

Need green, five-minute candle following the report for a potential long AUD/USD trade.

If market reaction favors a long aussie trade, buy AUD/USD with two separate position.

Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Australia Job Growth Falls Short of Market Forecast

Need red, five-minute candle to consider a short AUD/USD position.

Carry out the same setup as the bullish aussie trade, just in the opposite direction.

Read More:

USDCAD Levels to Know Ahead of BoC - 1.3335 Marks Critical Resistance

USD/CAD Continues to Coil- Aussie Faces Employment Report, China CPI

Potential Price Targets For The Release

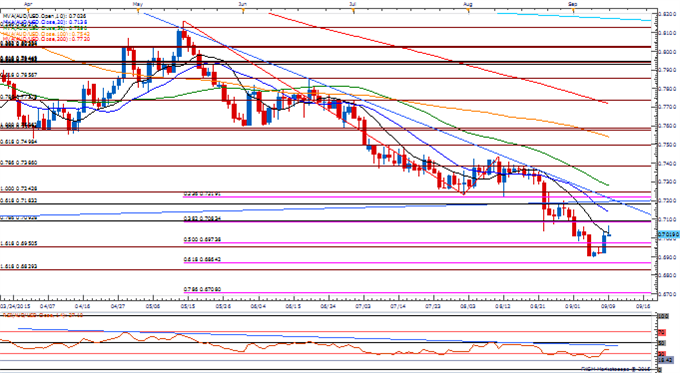

AUD/USD Daily

Chart - Created Using FXCM Marketscope 2.0

Despite the risk for a larger pullback, will favor the approach to sell-bounces in AUD/USD as long as price & the Relative Strength Index retain the downward trend carried over from late-April/May.

DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long AUD/USD since May 15, but the ratio remains off of recent extremes as it sits at +2.19, with 69% of traders long.

Interim Resistance: 0.7220 (23.6% expansion) to 0.7240 (100% expansion)

Interim Support: 0.6830 (161.8% expansion) to 0.6860 (61.8% expansion)

Join DailyFX on Demandfor Real-Time Updates on the DailyFX Speculative Sentiment Index!

Impact that Australia Employment Change has had on AUD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JUL 2015 | 08/06/2015 01:30 GMT | 10.0K | 38.5K | -25 | -23 |

July 2015 Australia Employment Change

Australia added another 38.5K jobs in July following a revised 0.2K expansion the month prior, while the jobless rate climbed to an annualized rate of 6.3% from 6.1% as discouraged workers returned to the labor force. After cutting the benchmark rate to record-low of 2.00% in May, the Reserve Bank of Australia (RBA) may continue to endorse a wait-and-see approach as the positive data prints coming out of the real economy raises the outlook for growth and inflation. Despite the better-than-expected print, the initial spike in the Australian dollar was short-lived, with AUD/USD struggling to hold its ground throughout the Asia/Pacific trade as the pair ended the session at 0.7330.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance