AUD/USD Range Vulnerable to Less-Dovish RBA Minutes, RSI Trigger

DailyFX.com -

Talking Points:

- AUD/USD Range Vulnerable to Less-Dovish RBA Minutes; RSI Trigger in Focus.

- USDOLLAR Risks Further Losses on Dovish Yellen Testimony.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

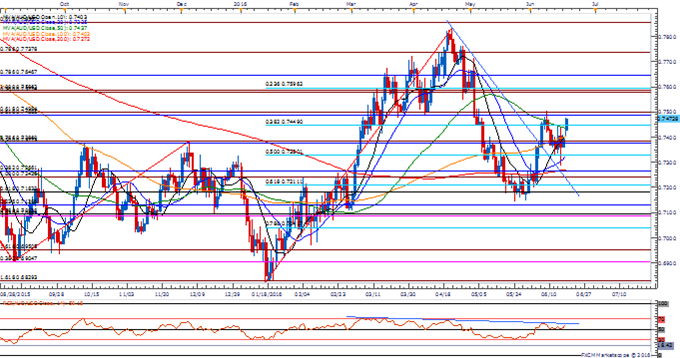

AUD/USD

Chart - Created Using FXCM Marketscope 2.0

With AUD/USD gapping higher to start the week, the pair may continue to retrace the decline from the April high (0.7834) as the pair fails to preserve the downward trend; watching the Relative Strength Index (RSI) for confirmation/conviction following the failed attempt earlier this month to breakout of the bearish formation carried over from March.

The Reserve Bank of Australia (RBA) Minutes may heighten the appeal of the aussie as Governor Glenn Stevens and Co. revert back to a wait-and-see approach following the rate-cut in May; may see the fresh comments foster a larger advance in AUD/USD should the central bank show a greater willingness to move away from its easing cycle.

Waiting on a close above the Fibonacci overlap around 0.7490 (61.8% retracement) to 0.7500 (61.8% expansion) to favor a larger advance in AUD/USD, with the next topside region of interest coming in around 0.7580 (50% retracement) to 0.7600 (23.6% retracement).

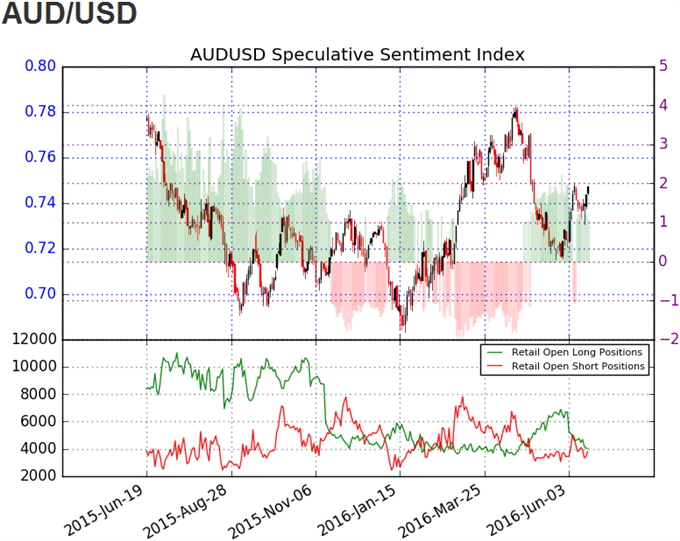

The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long AUD/USD on June 9, with the ratio hitting an extreme reading in May as it climbed to +2.25.

The ratio currently sits at +1.28 as 56% of traders are long, with short positions narrowing 22.9% from the previous week, while open interest stands 19.9% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11757.92 | 11806.79 | 11752.89 | -0.61 | 99.40% |

Chart - Created Using FXCM Marketscope 2.0

The USDOLLAR may continue to give back the advance from the May low (11,672) as it carve a near-term series of lower highs & lows; may see the downward trending channel continue to take shape as market participants push out bets for higher borrowing-costs, with Fed Funds Futures highlighting a less than 20% probability for a rate-hike in July.

The semi-annual Humphrey-Hawkins testimony with Fed Chair Janet Yellen may produce near-term headwinds for the greenback should the central bank head endorse a dovish outlook for monetary policy and show a greater willingness to further delay the normalization cycle.

With the USDOLLAR extending the decline from the previous week, a break/close below the Fibonacci overlap around 11,745 (50% retracement) to 11,759 (23.6% retracement) may open up the next downside area of interest coming in around 11,623 (100% expansion) to 11,646 (61.8% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

S&P 500: Crosses Important Short-term Resistance on Global Rally in Risk

USD/JPY Technical Analysis: A Return To USD/JPY Of 2008-2011?

EUR/USD Timing Compares Favorably with Early 2000s Base

EUR/USD: Breach of Weekly High to Fuel Reversal From Monthly Open

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance