AUD/NZD Outlook Hinges on 1Q CPI- EUR/GBP Risks Fresh Lows on BoE

Talking Points:

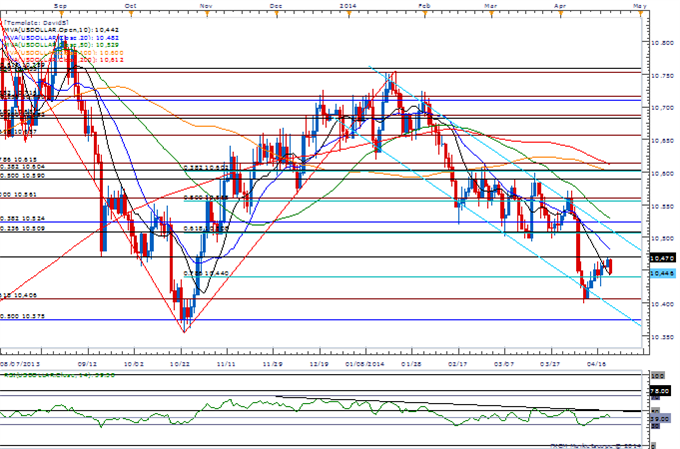

- USDOLLAR Eyes October Low (10,354) After Carving Lower High.

- EUR/GBP Risks Fresh Lows on Hawkish BoE Minutes.

- AUD/NZD Continues to Mark Failed Attempts to Close Above 1.0900.

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10446.6 | 10470.17 | 10444.65 | -0.21 | 84.71% |

The Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) remains at risk of giving back the advance from back in October (10,354) as it fails to push back above the 10,470 pivot, and the bearish sentiment surrounding the greenback may gather pace ahead of the Federal Open Market Committee (FOMC) meeting on April 30 as the central bank retains a rather dovish tone for monetary policy.

Indeed, the limited reaction to the better-than-expected U.S. data continues to highlight a bearish outlook for the dollar, and it seems as though the reserve currency will continue to carve a series of lower highs & lower lows ahead of the second-half of 2014 as the Fed sticks to its measured approach in normalizing monetary policy.

With that said, we continue to favor ‘selling bounces’ in the greenback, and the USDOLLAR may face fresh lows in the days ahead as Fed Chair Janet Yellen remains reluctant to move away from the zero-interest rate policy (ZIRP).

Join DailyFX on Demand to Cover Current U.S. dollar Trade Setups

Read More:

Price & Time: FX Volatility - How Low Can It Go?

An Uncommon Risk-On Set-Up with Ichimoku

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

Failure to Break and Close Above 10,470 Highlights Near-Term Top

Interim Resistance: 10,602 (38.2 retracement) to 10,615 (78.6 expansion)

Interim Support: 10,406 (1.618 expansion)

Release | GMT | Expected | Actual |

House Price Index (MoM) (FEB) | 13:00 | 0.5% | 0.6% |

Richmond Fed Manufacturing Index (APR) | 14:00 | 2 | 7 |

Existing Home Sales (MAR) | 14:00 | 4.56M | 4.59M |

Existing Home Sales (MoM) (MAR) | 14:00 | -1.0% | -0.2% |

Former Fed Chairman Ben Bernanke Speaks on U.S. Economy | 15:45 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance