AUD/JPY Breakout Appears Exhausted as RSI Struggles Again

DailyFX.com -

The ongoing pickup in risk appetite may drive AUD/JPY higher throughout the remainder of the year as there appears to be a broader shift in market behavior.

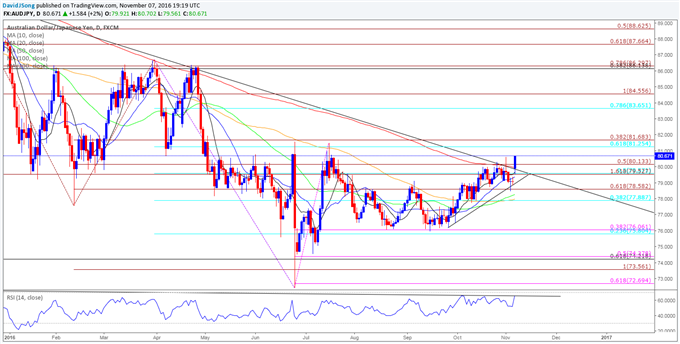

AUD/JPY Daily

Following the U.S. Presidential election, AUD/JPY has broken out of the bearish trend carried over from 2014, with the Relative Strength Index (RSI) highlighting a similar dynamic. In light of the meaningful developments, aussie-yen may continue to retrace the decline from earlier this year, with the broader outlook favoring opportunities to buy-dips in the exchange rate.

Nevertheless, the lack of momentum to break/close above the 84.60 (100% expansion) region raises the risk for a near-term pullback especially as the RSI appears to be making another failed attempt to push into overbought territory, with the first downside region of interest coming in around 83.70 (78.6% retracement) followed by 83.10 (78.6% expansion). Failure to hold above these levels may spur a move back towards the former resistance-zone around 81.30 (61.8% retracement) to 81.70 (38.2% expansion), which also lines up with trendline support.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance