Atmos Energy (ATO) to Report Q4 Earnings: What's in Store?

Atmos Energy Corporation ATO is set to report fourth-quarter fiscal 2019 results on Nov 6, after the market closes. This natural gas distribution company delivered a negative earnings surprise of 1.45% in the last reported quarter.

Let’s see how things have shaped up before the upcoming earnings announcement.

Factors at Play

Rate revision in Atmos Energy’s Distribution and Pipeline & Storage segments is likely to have positively impacted fourth-quarter earnings. The company has been experiencing increase in customer volumes in its service territories. This is likely to have continued in the quarter and positively impacted net income.

The Zacks Consensus Estimate for total revenues and earnings per share (EPS) for fourth-quarter fiscal 2019 is currently pegged at $577.8 million and 48 cents, respectively. The revenue and EPS estimates indicate growth of 29.93% and 17.07%, respectively, from the year-ago reported figures.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Atmos Energy this season. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to surpass estimates. That is not the case here as you will see below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: The company’s Earnings ESP is 0.00%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Atmos Energy currently carries a Zacks Rank #2.

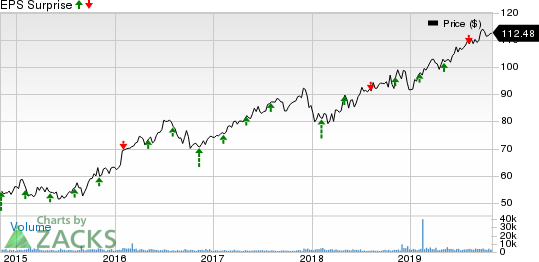

Atmos Energy Corporation Price and EPS Surprise

Atmos Energy Corporation price-eps-surprise | Atmos Energy Corporation Quote

Stocks to Consider

Investor can consider the following players from the same sector that have the right combination of elements to post an earnings beat in the to-be-reported quarter.

Pacific Gas & Electric Co. PCG is slated to release third-quarter 2019 results on Nov 4. It has an Earnings ESP of +3.03% and a Zacks Rank #3.

South Jersey Industries Inc. SJI is scheduled to release third-quarter 2019 results on Nov 6. It has an Earnings ESP of +15.85% and a Zacks Rank #3.

Spire Inc. SR is set to release fourth-quarter fiscal 2019 results on Nov 21. It has an Earnings ESP of +2.55% and a Zacks Rank #2.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

South Jersey Industries, Inc. (SJI) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Spire Inc. (SR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance