Atea (AVIR) Dengue Candidate Gets Fast Track Designation

Atea Pharmaceuticals, Inc. AVIR recently announced that the FDA has granted Fast Track Designation to pipeline candidate AT-752, a novel, orally administered, direct-acting antiviral for the treatment of dengue virus infection. Shares were up on Sep 26 on the same, but the gains were pared by the end of the day. Nevertheless, the stock jumped 4.91% in after-hours trading.

The FDA’s Fast Track designation accelerates the development and review of new drugs or biologics that have been developed to treat serious or life-threatening conditions and demonstrate the potential to address unmet medical needs. The designation will allow Atea to engage in frequent communications with the FDA to discuss the development plan of AT-752 for treating dengue virus infection and facilitate a rolling review of any completed sections of a resulting new drug application (NDA).

Dengue is one of the most prevalent mosquito-borne viral diseases affecting more than half the world’s population.

AT-752 works by impairing the dengue viral polymerase, which then inhibits replication of the virus.

Atea is currently conducting two studies on AT-752. The first study is a global, randomized, double-blind, placebo-controlled phase II study in adult patients with dengue virus infection. The study is designed to evaluate the antiviral activity, safety and pharmacokinetics of multiple doses of AT-752 in areas where dengue is endemic. The candidate was generally well tolerated in phase I clinical study and is currently in phase II.

The second study is a human challenge study conducted in the United States. The challenge study is designed to evaluate healthy subjects who are challenged with a dengue virus-1 live attenuated virus strain after receiving AT-752 or placebo.

Results from the human challenge trial and initial results from the DEFEND-2 study are expected in the fourth quarter of 2022.

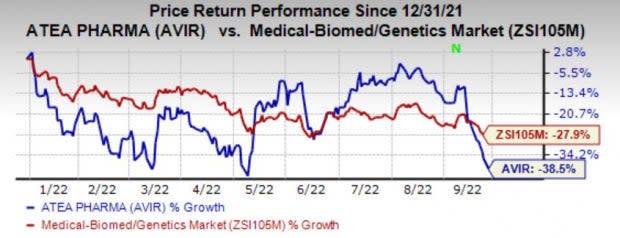

Shares of the company have plunged 38.5% in the year so far compared with the industry’s decline of 27.9%.

Image Source: Zacks Investment Research

Atea is focused on the development of orally available, potent and selective nucleos(t)ide prodrugs for difficult-to-treat, life-threatening viral infections, including SARS-CoV-2, the virus that causes COVID-19, dengue virus, chronic hepatitis C infection (HCV) and respiratory syncytial virus (RSV).

The company’s most advanced product candidate for the treatment of COVID-19 is an investigational, novel, orally administered guanosine nucleotide analog polymerase inhibitor – bemnifosbuvir.

The company is also advancing a novel combination of bemnifosbuvir and ruzasvir, an investigational nonstructural protein 5A (NS5A) inhibitor that it in-licensed from Merck MRK in December 2021 for the treatment of HCV.

Atea made Merck an upfront payment of $25 million and is obligated to pay Merck milestone payments up to $135 million for certain development and regulatory milestones and up to $300 million in the aggregate upon achievement of certain sales-based milestones. Atea will also pay Merck tiered royalties based on annual net sales.

Atea currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the biotech sector are Bolt Pharmaceuticals BOLT and Dynavax DVAX, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss estimates for BOLT have narrowed to $2.25 from $2.87 in the past 60 days. Earnings surpassed estimates in three of the trailing four quarters and missed the mark in the remaining one, the average beat being 2.39%.

Dynavax’s earnings estimates have increased to $1.73 from $1.14 for 2022 over the past 60 days. Earnings of DVAX surpassed estimates in two of the trailing four quarters and missed the mark in the remaining two, the average beat being 70.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Atea Pharmaceuticals, Inc. (AVIR) : Free Stock Analysis Report

Bolt Biotherapeutics, Inc. (BOLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance