AstraZeneca (AZN), Sanofi Simply RSV Antibody Agreement Terms

AstraZeneca AZN and Sanofi SNY announced an update to their contractual agreement pertaining to the development and commercialization of respiratory syncytial virus (“RSV”) antibody Beyfortus (nirsevimab) in the United States.

Following the changes in the contractual agreement, Sanofi will hold full commercial control of Beyfortus in the United States. However, these changes are limited to Beyfortus’ U.S. rights only. These changes do not impact the terms of the agreement between Sanofi and AstraZeneca for territories outside the United States.

To effect the above changes, Swedish Orphan Biovitrum AB (“Sobi”) will enter into a direct royalty agreement with Sanofi wherein the latter will pay royalties on net product sales of Beyfortus in the United States to the former. This agreement intends to simplify and streamline the previous deal by AstraZeneca with Sobi.

Sanofi and AstraZeneca initially entered into an agreement in 2017 to develop and commercialize Beyfortus. Per the initial terms, AstraZeneca was responsible for development and manufacturing activities. Sanofi was responsible for commercialization activities. However, AstraZeneca sold its rights to participate in the profits or losses for Beyfortus product sales in the United States to Sobi in 2018.

As a result of the new royalty agreement with Sanofi, Sobi will receive all payments pertaining to Beyfortus’ U.S. sales from Sanofi directly instead of AstraZeneca. Sobi has also entered into a new agreement with AstraZeneca wherein both parties have terminated the profit/loss participation rights related to Beyfortus entered in 2018.

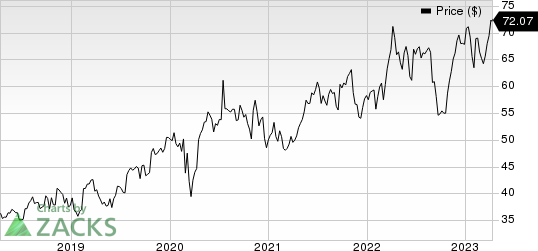

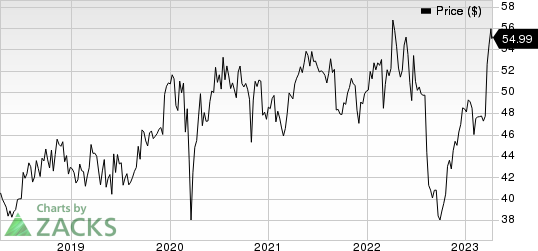

In the year so far, shares of AstraZeneca and Sanofi have risen 6.3% and 13.6%, respectively. During the same period, the industry has moved up 0.7%.

Image Source: Zacks Investment Research

In consideration for entering into these agreements, Sobi will pay $66 million to Sanofi and $15 million to AstraZeneca. While the amount payable to Sanofi will act as reimbursement of prior costs for the research & development of Beyfortus, the amount to AstraZeneca is an upfront payment. Following these payments, Sobi will owe no further payments going forward.

Beyfortus was authorized in the European Union in November 2022 to prevent RSV lower respiratory tract disease (“LRTD”) in newborns and infants during their first RSV season. In the United States, a biologics license application (“BLA”) was filed last year for Beyfortus as the first protective option against RSV disease for all infants. A final decision on the BLA is expected in third-quarter 2023.

Other than AstraZeneca and Sanofi, Pfizer PFE has developed an RSV vaccine to prevent LRTD caused by RSV in infants from birth up to six months of age by actively immunizing pregnant individuals. A regulatory filing has already been submitted by Pfizer to the FDA seeking approval for the RSV vaccine. Pfizer expects the agency’s final decision later this August. A regulatory filing for Pfizer’s RSV candidate is also under review seeking approval for use in older adults (aged 60 years and above) to prevent LRTD, with a final decision expected in the next month.

Currently, there are no FDA-approved vaccines against RSV infections. The LRTD-RSV disease causes a high morbidity and mortality rate in older adults and young kids.

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Sanofi Price

Sanofi price | Sanofi Quote

Zacks Rank & Key Picks

AstraZeneca and Sanofi both carry a Zacks Rank #3 (Hold).A better-ranked stock in the overall healthcare sector is Novo Nordisk NVO, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $4.20 to $4.51. During the same period, the earnings estimates per share for 2024 have risen from $4.90 to $5.26. Shares of Novo Nordisk are up 17.4% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 3.00%. In the last reported quarter, Novo Nordisk’searnings beat estimates by 2.47%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance