AstraZeneca (AZN) Q1 Earnings Beat, COVID Products Hurt Sales

AstraZeneca’s AZN first-quarter 2023 core earnings of 96 cents per American depositary share (ADS) beat the Zacks Consensus Estimate of 86 cents and our model estimate of 85 cents. Core earnings of $1.92 per share rose 1% year over year on a reported basis and 6% at constant exchange rates (CER).

Total revenues were $10.88 billion, down 4% on a reported basis. However, total revenues were flat at CER in the quarter. Revenues missed the Zacks Consensus Estimate of $11.03 billion and our estimates of $11.33 billion.

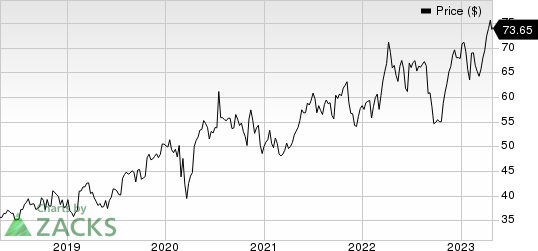

AstraZeneca’s shares have increased 8.6% in the year so far compared with the industry’s 1.5% rise.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-over-year basis and at CER.

Slight Rise in Product Sales

Product sales rose 1% at CER to $10.6 billion. Collaboration revenues were $27 million, down 89% from the year-ago quarter’s levels. Alliance revenues were up 90% year over year to $286 million, driven by continued growth in revenues from partnered medicines.

Among AstraZeneca’s various therapeutic areas, Oncology product sales were up 19%. CVRM product sales were up 22%, while the Respiratory & Immunology (R&I) segment rose 8%. Vaccines & Immune (V&I) Therapies sales declined 79%. Rare disease product sales were up 14%. Sales of other medicines declined 21%.

Sales of Some Key Drugs

In Oncology, Tagrisso recorded sales of $1.42 billion, up 15% year over year on strong demand as a first line and adjuvant treatment. In China, sales benefitted from rising patient demand, which offset the National reimbursement drug list (NRDL) renewal price reductions. However, Tagrisso sales missed the Zacks Consensus Estimate and our estimate of $1.46 billion and $1.51 billion, respectively.

Imfinzi generated sales of $900 million in the quarter, up 56% year over year, driven by increased use in biliary tract, liver and lung cancers. Product sales from Imjudo were also included in the Imfinzi line. Imfinzi sales beat the Zacks Consensus Estimate and our estimate of $737 million and $713 million, respectively.

Lynparza product revenues rose 10% year over year to $651 million, owing to usage growth in breast, ovarian, pancreatic and prostate cancers. Increased use in first-line HRD-positive ovarian cancer and increased uptake for an expanded label in breast cancer boosted sales in Europe. Lynparza sales missed the Zacks Consensus Estimate and our estimate of $709 million and $704 million, respectively.

AstraZeneca markets Lynparza in partnership with Merck MRK. The profit-sharing deal between AstraZeneca and Merck was inked in 2017. In addition to Lynparza, the deal included Koselugo.

AstraZeneca & Merck’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic. Lynparza is also being evaluated in an earlier-line setting for the approved cancer indications as well as some other cancer types.

Calquence generated sales of $532 million in the quarter, up 31% year over year, benefiting from the increased new patient market share.

Sales of AstraZeneca’s legacy cancer drugs, such as Iressa, Faslodex, Arimidex and Casodex declined during the quarter. However, sales of Zoladex rose 3% in the quarter.

In CVRM, Brilinta/Brilique sales were $334 million in the reported quarter, up 5% year over year, primarily due to post-pandemic recovery of oral antiplatelet medicines like Brilinta in the United States and Emerging markets. Sales in Europe were affected by clawbacks.

Farxiga recorded product sales of $1.30 billion in the quarter, up 37% year over year, reflecting volume growth across all regions and growth of the SGLT2 inhibitor class in general. The label expansion approvals for heart failure with reduced ejection fraction and chronic kidney disease indications contributed to Farxiga’s sales growth in the United States and Europe. In Emerging markets, Farxiga is witnessing growth in ex-China Emerging Markets. Farxiga sales beat the Zacks Consensus Estimate of $1.28 billion by a slight margin and were in line with our model estimates.

In Respiratory & Immunology, Symbicort sales rose 7% in the quarter to $688 million. Pulmicort sales rose 9% to $221 million.

Fasenra recorded sales of $338 million in the quarter, up 13% year over year, driven by increased market share performance in Europe and the United States due to market leadership. Fasenra sales missed the Zacks Consensus Estimate and our estimate of $360 million and $349 million, respectively.

AstraZeneca’s new triple combo COPD treatment Breztri recorded sales of $144 million, up 73% year over year. The reported figure beat our model estimate of $136 million.

New lupus drug, Saphnelo (anifrolumab) recorded sales of $47 million in the quarter, compared with $48 million in the previous quarter.

In the Rare Disease portfolio, which was added following the 2021 Alexion acquisition, Soliris recorded sales of $834 million, down 13% year over year due to conversion to Ultomiris. Ultomiris and Strensiq sales were $651 million and $262 million, up 61% and 28%, respectively.

In Other Medicines, sales of Nexium declined 20% to $244 million.

In Vaccines & Immune Therapies, AstraZeneca’s COVID-19 vaccine, Vaxzevria, generated $28 million of revenues, much less than $85 million in the previous quarter due to the conclusion of several contracts. No revenues were recorded in the U.S. market after the first quarter of 2022.

AZN’s COVID-19 antibody cocktail medicine Evusheld generated $127 million in sales compared with $734 million in the previous quarter. The company did not record any U.S. sales of the medicine after the FDA withdrew the emergency-use authorization granted to Evusheld. This withdrawal was based on data which showed that Evusheld does not neutralize Omicron subvariants that are in circulation and responsible for more than 90% of COVID cases in the country.

Profit Discussion

AstraZeneca’s core gross margin of 83.3% was up 4 percentage points at CER as the dilutive effect from profit-sharing arrangements were offset by a positive mix due to increased contribution from oncology and rare disease medicines. COVID-19 medications, which were dilutive to gross margin, declined substantially in the quarter, thereby improving the company’s gross margin mix. Core selling, general and administrative expenses increased 8% to $3.05 billion.

Core research and development expenses rose 10% to $2.30 billion. Core operating profit were up 4% to $3.95 billion in the quarter. The core operating margin was 36.3% in the quarter, up 1 percentage points at CER.

Maintains 2023 Guidance

Management maintained its financial guidance for 2023. AstraZeneca expects total revenues to increase in the low-to-mid single-digit percentage in 2023 at CER including its COVID products. Excluding the COVID products, total revenues are expected to increase in the low double-digit percentage.

Core earnings per share are expected to increase in the high single-digit to low double-digit percentage in 2023.

Foreign exchange is expected to have a low single-digit percentage adverse impact on total revenues and on core EPS in 2023.

Core operating expenses are expected to increase by a low-to-mid single-digit percentage.

Our Take

AstraZeneca’s first-quarter results were mixed as it beat estimates for earnings but missed the same for sales. Higher sales of key medicines across Oncology and CVRM units like Tagrisso, Imfinzi, Lynpaza and Farxiga were offset by a steep decline in sales of AstraZeneca’s COVID vaccine, Vaxzevria. Excluding COVID-19 medications, total revenues in the quarter increased 15% and product sales increased 16%.

The company also maintained its 2023 outlook, wherein total revenues (excluding COVID products) are expected to rise in the low double-digit percentage. As the world resumes to pre-pandemic behavior, sales of COVID-19 related products are expected to decline substantially from the 2022 level.

AstraZeneca noted that product sale improvement in China can be attributed to increased patient demand, which is expected to offset the pricing pressure associated with NRDL and VBP programs. Management expects China sales to return to growth and increase by a low single-digit percentage throughout 2023.

AstraZeneca is making rapid progress across its pipeline. While management has already initiated six new phase III studies (including new COVID-19 antibody AZD3152), it remains on track to start another 30 late-stage studies by this year’s end.

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Zacks Rank & Stocks to Consider

Currently, AstraZeneca has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include J&J JNJ and Novo Nordisk NVO. While Novo Nordisk sports a Zacks Rank #1 (Strong Buy) at present, J&J carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $4.49 to $4.70. During the same period, the earnings estimates per share for 2024 have risen from $5.29 to $5.51. Shares of Novo Nordisk are up 21.9% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 3.00%. In the last reported quarter, Novo Nordisk’searnings beat estimates by 2.47%.

In the past 30 days, estimates for J&J’s 2023 earnings per share have increased from $10.50 to $10.65. During the same period, the earnings estimates per share for 2024 have risen from $10.94 to $11.01. Shares of J&J are down 7.9% in the year-to-date period.

Earnings of J&J beat estimates in each of the last four quarters, witnessing an average earnings surprise of 3.96%. In the last reported quarter, J&J’s earnings beat estimates by 6.77%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance