Astec (ASTE) Rides on Solid Backlog Despite Recent Headwinds

On Mar 9, we issued an updated research report on Astec Industries, Inc. ASTE. The manufacturer of road building equipment is poised to gain from strong backlog, progress in product sales activity, improvement in the Energy group as well as the U.S. tax reform. However, uncertainty in government funding for federal highway projects, strong U.S. dollar and steel tariffs are expected to dent its performance in the near future.

Let’s illustrate the factors in detail.

Strong Backlog to Fuel Astec's Sales

Astec’s total backlog improved 13.7% year over year in 2017. Backlog improved across all its segments during fourth-quarter 2017. The company’s Infrastructure group won a number of orders during the quarter. The Energy group backlog also experienced increased quoting activity for oil and gas drilling products. Astec’s Brazil facility continues to record growth in quoting activity. For 2018, the company expects revenues to grow on this robust backlog.

Rising Orders to Assist Energy Group

Astec’s Energy group experienced strong sales activity during the recently-reported quarter for products targeted at infrastructure, oil, chemical and food industries. The company has built concrete plants in the Energy group and the quoting activity remains promising for these plants. Further, it witnessed huge number of customers in the World of Concrete Show held this January, as its RexCon and CEI subsidiaries displayed the latest innovative products. Both subsidiaries secured orders in the show. Being the second major supplier, RexCon and SEI teams are working together on Astec’s strategy to become the largest supplier concrete plant in the United States.

Tax Reform to Aid Earnings

Astec expects its annual effective tax rate to be in the range of 25-26% in 2018 compared to 41% recorded in the prior year. This reduced tax rate due to the tax reform will substantially benefit the company’s earnings.

Product Sales Activity Remains a Catalyst

Astec stated that 2017 was a year of transition as the company rolled out an extraordinary amount of products at the ConExpo show last March. The company also worked through installation and startup issues for customers. Thus, it will definitely win contracts from more consumers who were interested in innovative products at the ConExpo.

Adverse Impact of Strong U.S. dollar

From mid-2012 through 2017, the strong U.S. dollar has dampened pricing in certain foreign markets the company serves. Astec predicts the U.S. dollar to remain strong as compared to historical rates in the near term relative to most foreign currencies. Escalating domestic interest rates or weakening economic conditions abroad might cause the U.S. dollar to strengthen further, which will impact Astec's international sales.

Uncertain Government Funding Remains a Concern

Astec will be affected by uncertainty in the level of government funding for federal highway projects. The Fixing America's Surface Transportation Act (FAST Act), enacted in December 2015, approved funding for highways of approximately $205 billion and funding for transit projects of approximately $48 billion for the five-year period ending Sep 30, 2020. Although continued funding is anticipated under the FAST Act, it might be at lower levels than originally approved. This could lead to a slowdown in infrastructure equipment spending which will impact Astec's performance.

Steel Tariffs to Impede Near-Term Profit

Astec uses steel as a major raw material to manufacture products. Therefore, steel surcharges remain a concern. As a result, Trump's recent announcement to impose a 25% tariff on the imports of steel will thwart the company’s performance.

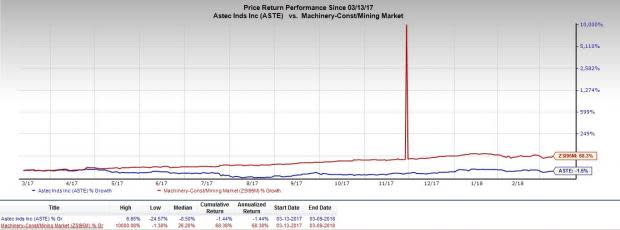

Share Price Performance

Astec’s shares have significantly underperformed the industry with respect to price performance over the past year. The stock has edged down 1.5%, as against 68.3% growth registered by the industry.

Zacks Rank & Stocks to Consider

Astec currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry are Komatsu Ltd. KMTUY, Caterpillar Inc. CAT and H&E Equipment Services, Inc. HEES. While Komatsu sports a Zacks Rank #1 (Strong Buy), Caterpillar and H&E Equipment carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Komatsu has a long-term earnings growth rate of 31.7%. Its shares have rallied 19.6%, over the past six months.

Caterpillar has a long-term earnings growth rate of 12%. The company’s shares have been up 32.3% during the same time frame.

H&E Equipment Services has a long-term earnings growth rate of 14.4%. The stock has gained 66.1% in six months’ time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Komatsu Ltd. (KMTUY) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance