Assurant (AIZ) Rallies 15% YTD: Can It Retain the Momentum?

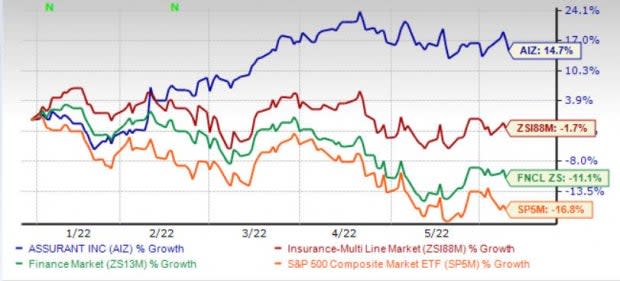

Shares of Assurant Inc. AIZ have rallied 14.7% year to date against the industry’s decrease of 1.7%. The Finance sector and the Zacks S&P 500 composite have declined 11.1% and 16.8%, respectively in the same time frame. With a market capitalization of $9.7 billion, the average volume of shares traded in the last three months was 0.4 million.

The well-performing Global Lifestyle business, growth in fee-based capital-light businesses and solid capital management continue to drive Assurant. The Zacks Consensus Estimate for 2022 and 2023 earnings has moved 6% and 3% north, respectively in the past 60 days, reflecting analysts’ optimism.

Assurant, carrying a Zacks Rank #3 (Hold), surpassed earnings expectations in the last five quarters.

Image Source: Zacks Investment Research

Can AIZ Retain the Momentum?

The Zacks Consensus Estimate for 2022 earnings is pegged at $12.86, indicating an increase of 37.4% on 5.1% higher revenues of $10.6 billion. The consensus estimate for 2023 earnings is pegged at $14.6, indicating an increase of 13.1% on 6.4% higher revenues of $11.2 billion.

The long-term earnings growth rate is currently pegged at 17.2%, better than the industry average of 12%.

Earnings at Global Lifestyle should benefit from the mobile business and will mainly come from new and expanded programs and the contribution from recent acquisitions. For 2022, Global Lifestyle adjusted EBITDA is expected to increase by low double digits, driven by mobile in Connected Living and global expansion in existing and new clients across device protection and trade-in and upgrade programs.

The strength of Global Automotive and Connected Living offerings continues to validate the company’s long-term strategy of focusing on higher growth fee-based and capital-light businesses. Management estimates the contribution to continue to grow in double digits over the longer term.

AIZ has a strong capital management policy in place. While it has been increasing dividends for the last 17 straight years, the company has $514 million remaining under its current share buyback authorization.

Upbeat Guidance

Assurant estimates adjusted EPS to grow 16-20% in 2022 and 12%+ average annual growth in 2023-2024. AIZ estimates about 10% average annual growth in 2023-2024.

Segment-wise, Global Lifestyle is expected to deliver 10% average annual growth in 2023-2024. Corporate and Other is expected to deliver adjusted EBITDA of about ($105 million) in 2022. Assurant estimates about $3 billion in segment cash generation over the next three years. For 2022, Assurant expects 8 to 10% growth in adjusted EBITDA, excluding reportable catastrophes, driven by profitable growth across Global Lifestyle and Global Housing.

In Global Housing, for 2022, Assurant expects adjusted EBITDA, excluding reportable catastrophes, to increase by mid-single-digits and in mid to high-single-digits in 2023 and 2024.

Stocks to Consider

Some better-ranked stocks from the insurance industry are MetLife, Inc. MET, MGIC Investment Corporation MTG and James River Group Holdings, Ltd. JRVR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MetLife’s earnings surpassed estimates in each of the last four quarters, the average beat being 42.9%.

The Zacks Consensus Estimate for MetLife’s 2022 and 2023 earnings has moved 0.5% and 0.4% north, respectively, in the past 30 days. In the past year, MET stock has gained 5.2%.

The Zacks Consensus Estimate for MGIC Investment’s 2022 and 2023 earnings has moved 1.8% and 3.2% north, respectively, in the past 30 days.

MTG’s earnings surpassed estimates in each of the last four quarters, the average beat being 10.94%. In the past year, MTG stock has lost 2.7%.

The Zacks Consensus Estimate for James River’s 2022 and 2023 earnings per share indicates year-over-year increases of 136% and 13.1%, respectively.

The Zacks Consensus Estimate for JRVR’s 2022 and 2023 earnings has moved 15.1% and 4.9% north, respectively, in the past 30 days. In the past year, JRVR stock has lost 28.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

James River Group Holdings, Ltd. (JRVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance