Assurant (AIZ) Q3 Earnings Beat, Revenues Miss Estimates

Assurant, Inc. AIZ reported third-quarter 2022 net operating income of $1.01 per share, which beat the Zacks Consensus Estimate by 1% but missed our estimate of $2.36. The bottom line decreased 40.2% from the year-ago quarter.

The results reflected growth in specialty products and lender-placed, Global Automotive premium growth and higher net investment income, offset by higher catastrophe reinstatement premiums and expenses.

Total revenues increased 1.9% year over year to $2.6 billion due to higher net earned premiums and net investment income. The top line, however, missed the Zacks Consensus Estimate by 1.8%. The figure was lower than our estimate of $2.7 billion.

Net investment income was up 9.9% year over year to $83.5 million. The figure was higher than our estimate of $81.8 million.

Total benefits, loss and expenses increased 3.7% to $2.5 billion, mainly on account of an increase in policyholder benefits and underwriting and selling, general and administrative expenses.

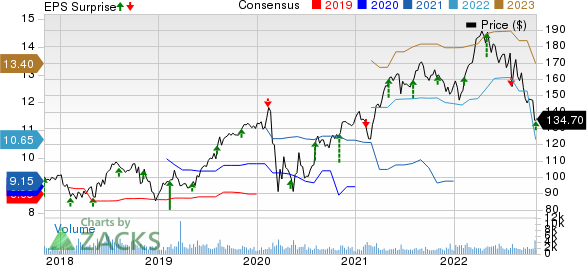

Assurant, Inc. Price, Consensus and EPS Surprise

Assurant, Inc. price-consensus-eps-surprise-chart | Assurant, Inc. Quote

Segmental Performance

Revenues at Global Housing increased 3% year over year to $484.1 million, owing to growth in specialty products and lender-placed, where higher average insured values and premium rates were partially offset by higher catastrophe reinstatement premiums. The figure was lower than our estimate of $531.1 million.

Adjusted EBITDA, excluding reportable catastrophes of $99.1 million, decreased 15% year over year. The decrease was due to nearly $38 million of higher non-catastrophe loss experience across all major products. In lender-placed, the elevated loss experience, as well as higher catastrophe reinsurance costs, was largely offset by higher average insured values and premium rates. The figure was higher than our estimate of $79.7 million.

Revenues at Global Lifestyle increased 1.5% year over year to $2 billion. The increase was primarily led by Global Automotive premium growth from strong prior period sales. Connected Living revenues decreased due to runoff mobile programs and the unfavorable impact of foreign exchange. The decrease was partially offset by device protection growth in North America. The figure was lower than our estimate of $2.1 billion.

Adjusted EBITDA of $165.9 million decreased 6% year over year due to the challenging macroeconomic environment.

Adjusted EBITDA loss at Corporate & Other was $24.9 million, wider than the year-ago quarter’s adjusted EBITDA loss of $23 million due to lower investment income.

Financial Position

Liquidity was $529 million as of Sep 30, 2022, about $304 million higher than the company’s current targeted minimum level of $225 million.

Total assets decreased 2% to $33.2 billion as of Sep 30, 2022 from 2021 end. The figure, however, was lower than our estimate of $33.5 billion.

Total shareholders’ equity came in at $4.1 billion, down 25% year over year. The figure, however, was lower than our estimate of $5.4 billion.

Share Repurchase and Dividend Update

In the third quarter of 2022, Assurant repurchased shares for $80 million. From Oct 1 through Oct 28, 2022, Assurant repurchased an additional share for nearly $12 million. It now has $275 million remaining under the current repurchase authorization.

Assurant’s total dividends amounted to $37 million in the third quarter of 2022.

2022 Guidance

Assurant expects adjusted EBITDA, excluding reportable catastrophes, to be modestly down to flat year over year, as growth in Global Lifestyle is expected to be offset by a decline in Global Housing.

Global Lifestyle adjusted EBITDA is projected to increase in high single-digits. This will be driven by mobile in Connected Living from expansion across device protection and trade-in and upgrade programs, partially offset by pressure in Asia Pacific and Europe from unfavorable foreign exchange and lower program volumes. Global Automotive is also expected to increase, owing to higher investment income and more favorable loss experience in select ancillary products.

Global Housing adjusted EBITDA, excluding reportable catastrophes, is expected to decline by low to mid-teens, due to higher non-catastrophe loss experience related to elevated inflationary trends, mainly in lender-placed, as well as higher catastrophe reinsurance costs. The decline will be partially offset by higher average insured values and premium rates in lender-placed and continuous expense initiatives.

Corporate and other adjusted EBITDA loss is expected to be around $105 million due to higher employee-related and technology expenses.

Adjusted earnings, excluding reportable catastrophes, per share are expected to increase by high single-digits, driven by share repurchases, including the return of net proceeds from the sale of Global Preneed.

Capital is projected to be deployed to support business growth by funding investments and M&A, as well as to return capital to shareholders via share repurchases and dividends, pending board approval and market conditions.

Zacks Rank

Assurant currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported third-quarter results so far, The Hartford Financial Services Group, Inc. HIG, Kinsale Capital Group, Inc. KNSL and Everest Re Group, Ltd. RE beat the respective Zacks Consensus Estimate for earnings.

The Hartford Financial Services reported third-quarter 2022 adjusted operating earnings of $1.44 per share, which outpaced the Zacks Consensus Estimate by 11.6%. The bottom line climbed 14% year over year. Operating revenues of HIG amounted to $3,830 million, which rose 3.6% year over year in the quarter under review.

The top line also beat the consensus mark by 1.8%. Total earned premiums improved 7.6% year over year to $4,910 million, which surpassed the Zacks Consensus Estimate of $4,811 million and our estimate of $4,808.2 million. Net investment income of $487 million dropped 25.1% year over year in the third quarter due to a decline in income from limited partnerships and other alternative investments (LPs).

Kinsale Capital delivered third-quarter 2022 net operating earnings of $1.64 per share, which outpaced the Zacks Consensus Estimate by 15.5%. The bottom line improved 3.1% year over year. Total revenues rose about 31.5% year over year to about $217 million. The top line, however, missed the Zacks Consensus Estimate by 1.4%.

Gross written premiums of $284.1 million rose 43.8% year over year, driven by strong submission flow from brokers and a favorable pricing environment. Net written premiums climbed 38.2% year over year to $235.9 million in the quarter. Net investment income increased 71.2% year over year to $13.9 million in the quarter.

Everest Re Group’s third-quarter 2022 operating loss per share of $5.28 was narrower than the Zacks Consensus Estimate of a loss of $5.89 but wider than the year-ago loss of $1.34. Everest Re’s total operating revenues of $3.2 billion increased 9.5% year over year on higher premiums earned. The top line, however, missed the consensus estimate by 2.2%.

Gross written premiums improved 6.3% year over year to $3.7 billion, largely driven by double-digit growth in the Insurance segment. However, it missed our estimate of $3.9 billion. Net investment income was $151 million, down 48.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance